- Switzerland

- /

- Life Sciences

- /

- SWX:TECN

Tecan Group AG (VTX:TECN) Pays A CHF03.00 Dividend In Just Four Days

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Tecan Group AG (VTX:TECN) is about to trade ex-dividend in the next four days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. In other words, investors can purchase Tecan Group's shares before the 14th of April in order to be eligible for the dividend, which will be paid on the 16th of April.

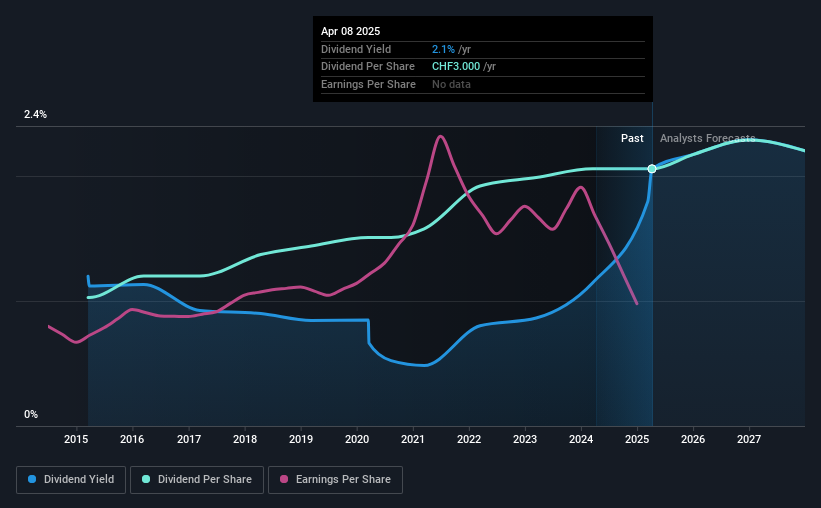

The company's next dividend payment will be CHF03.00 per share, and in the last 12 months, the company paid a total of CHF3.00 per share. Based on the last year's worth of payments, Tecan Group stock has a trailing yield of around 2.1% on the current share price of CHF0145.80. If you buy this business for its dividend, you should have an idea of whether Tecan Group's dividend is reliable and sustainable. As a result, readers should always check whether Tecan Group has been able to grow its dividends, or if the dividend might be cut.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Tecan Group is paying out an acceptable 57% of its profit, a common payout level among most companies. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Fortunately, it paid out only 33% of its free cash flow in the past year.

It's positive to see that Tecan Group's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Check out our latest analysis for Tecan Group

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's not ideal to see Tecan Group's earnings per share have been shrinking at 3.0% a year over the previous five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Tecan Group has delivered 7.2% dividend growth per year on average over the past 10 years. That's interesting, but the combination of a growing dividend despite declining earnings can typically only be achieved by paying out more of the company's profits. This can be valuable for shareholders, but it can't go on forever.

Final Takeaway

Is Tecan Group worth buying for its dividend? We're not enthused by the declining earnings per share, although at least the company's payout ratio is within a reasonable range, meaning it may not be at imminent risk of a dividend cut. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

With that being said, if dividends aren't your biggest concern with Tecan Group, you should know about the other risks facing this business. In terms of investment risks, we've identified 1 warning sign with Tecan Group and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tecan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:TECN

Tecan Group

Provides laboratory instruments and solutions in biopharmaceuticals, forensics, and clinical diagnostics in Europe, North America, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)