- Switzerland

- /

- Pharma

- /

- SWX:ROG

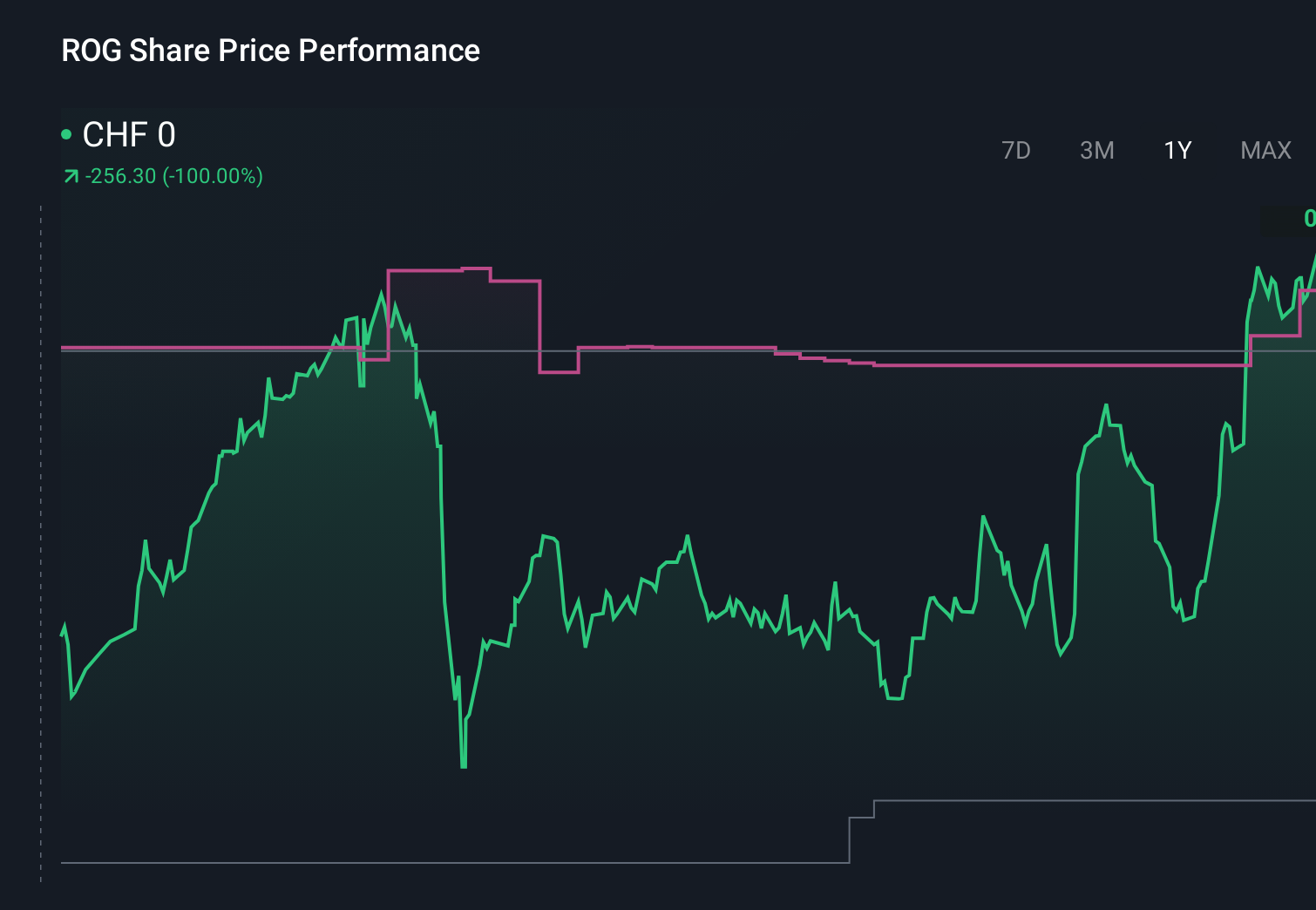

The Bull Case For Roche Holding (SWX:ROG) Could Change Following Breakthrough Giredestrant Breast Cancer Data

Reviewed by Sasha Jovanovic

- Genentech, part of Roche, recently reported that its experimental breast cancer pill giredestrant cut the risk of invasive disease recurrence or death by 30% versus standard endocrine therapy in a large Phase III trial in early-stage ER-positive disease.

- This is the first time in more than 20 years that an oral endocrine therapy has outperformed the long-standing standard in this setting, highlighting Roche’s ongoing strength in developing practice-changing oncology medicines.

- We’ll now examine how this first-in-decades advance in endocrine therapy could reshape Roche’s investment narrative and future growth mix.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Roche Holding Investment Narrative Recap

To own Roche today, you need to believe in its ability to replace aging blockbusters with high‑value medicines across oncology, immunology and diagnostics, while managing China pricing pressure and biosimilar erosion from 2026. The giredestrant data strengthens the near term oncology pipeline narrative, but does not materially change the biggest current swing factor, which remains execution on multiple late stage programs and avoiding further high profile trial or regulatory setbacks.

Among the latest updates, the European approval of Gazyva for lupus nephritis stands out as especially relevant, because it shows Roche converting immunology pipeline assets into new autoimmune indications beyond cancer. Together with giredestrant’s Phase III success, it underlines how the company is trying to rebalance away from legacy oncology franchises toward a broader mix of autoimmune and targeted therapies that can help offset future biosimilar headwinds.

Yet, in contrast to the excitement around giredestrant, investors should still be aware that future earnings are exposed to accelerating biosimilar pressure and...

Read the full narrative on Roche Holding (it's free!)

Roche Holding's narrative projects CHF67.3 billion revenue and CHF16.8 billion earnings by 2028. This requires 1.9% yearly revenue growth and an earnings increase of about CHF7.4 billion from CHF9.4 billion today.

Uncover how Roche Holding's forecasts yield a CHF311.78 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community range from CHF 302.06 to CHF 734.60, showing how far views on Roche can diverge. Against that backdrop, the latest giredestrant success reinforces the importance of Roche’s late stage pipeline to counter looming biosimilar risks and could shape how you think about its long term earnings power.

Explore 7 other fair value estimates on Roche Holding - why the stock might be worth 6% less than the current price!

Build Your Own Roche Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roche Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Roche Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roche Holding's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026