- Switzerland

- /

- Pharma

- /

- SWX:ROG

Roche (SWX:ROG): Revisiting Valuation After a Strong 30-Day Share Price Rally

Reviewed by Simply Wall St

Roche Holding (SWX:ROG) has quietly outperformed the broader market over the past month, and that steady climb is catching investor attention as they reassess what they are paying for its earnings power.

See our latest analysis for Roche Holding.

That steady run has pushed Roche Holding to a share price of $310.1, with a 30 day share price return of 17.46 percent and a 1 year total shareholder return of 24.99 percent. This suggests that momentum is building as investors grow more comfortable with its earnings outlook.

If Roche’s recent move has you rethinking your healthcare exposure, it could be a good moment to explore other quality names using our healthcare stocks.

Yet with Roche trading almost exactly in line with analyst targets despite solid profit growth, investors now face a key question: is this a still-underappreciated compounder, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 50% Undervalued

Compared with Roche Holding’s last close of CHF 310.1, the most followed narrative points to a fair value near CHF 312, implying meaningful upside from long term compounding rather than short term speculation.

Investment in automation, AI, and operational efficiencies (such as restructuring R and D processes, optimizing CRO usage, and reallocating CHF 3 billion in cost savings by 2030) is set to lower cost structures, improve R and D productivity, and enable sustained reinvestment in high impact innovation supporting both margin expansion and improved earnings growth.

Curious how modest revenue growth, expanding margins, and a lower future earnings multiple still add up to a robust upside story for Roche? The narrative leans on disciplined execution, a richer pipeline mix, and a surprisingly conservative discount rate to justify that gap. Want to see exactly which assumptions turn a steady pharma giant into a deep value case on paper? Read on to unpack the full narrative behind this valuation call.

Result: Fair Value of $311.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant biosimilar erosion after 2026 and ongoing China pricing pressure could easily derail the upbeat earnings and valuation narrative for Roche.

Find out about the key risks to this Roche Holding narrative.

Another Angle on Valuation

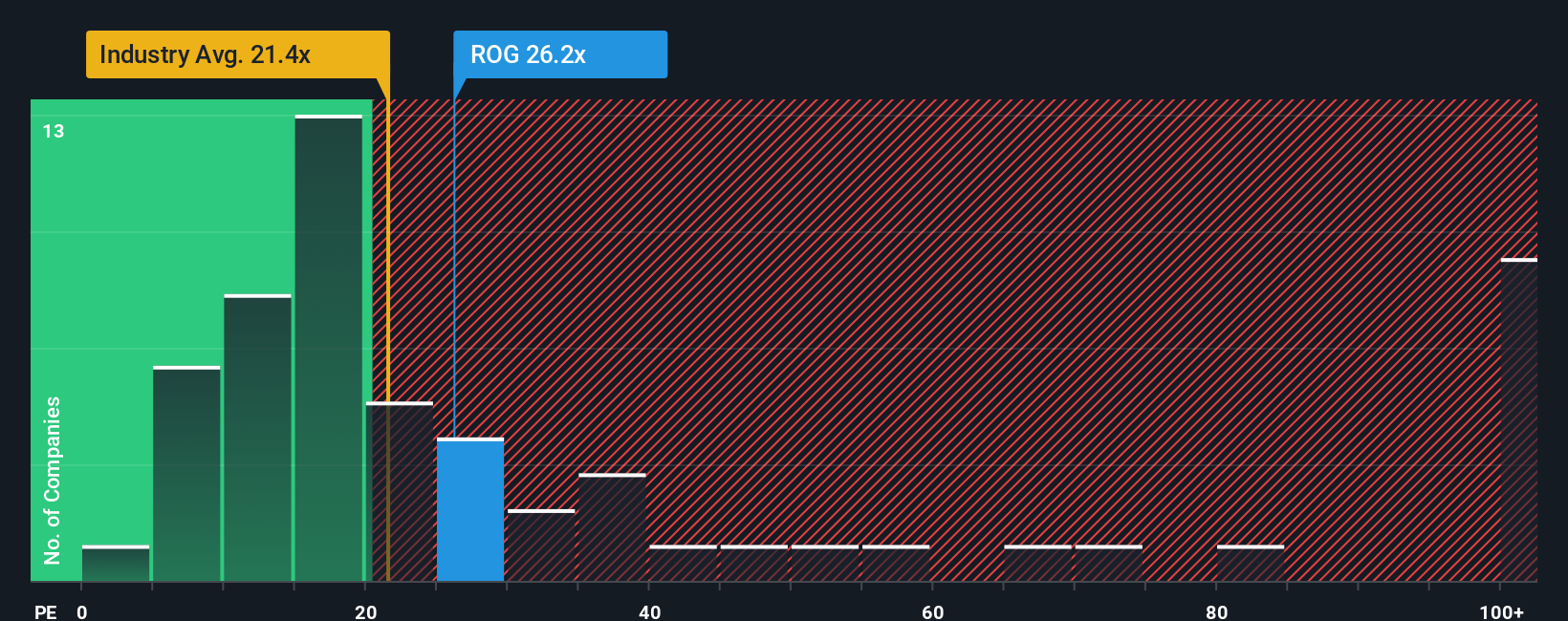

Roche looks cheap against our fair ratio on earnings, with its 28x price to earnings multiple sitting well below an implied 36.5x fair ratio, yet still above the European pharmaceuticals average of 23.3x. That mix of cushion and premium leaves investors weighing potential upside against the risk of sentiment turning.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roche Holding Narrative

If you see things differently or want to dig into the numbers yourself, you can build a fully personalized view in just a few minutes: Do it your way.

A great starting point for your Roche Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Roche might fit your strategy, but you will stack the odds even further in your favor by actively hunting for other mispriced opportunities before the market catches on.

- Capitalize on resilient income potential by targeting steady payers through these 15 dividend stocks with yields > 3% that can support returns even when markets turn choppy.

- Position yourself ahead of transformative innovation by scanning these 27 quantum computing stocks and uncovering companies pushing the boundaries of computing power.

- Amplify your long term return prospects by zeroing in on these 907 undervalued stocks based on cash flows that the market has not fully appreciated yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026