- Switzerland

- /

- Pharma

- /

- SWX:NOVN

Does Novartis Still Offer Value After 19% YTD Jump and Sandoz Spinoff?

Reviewed by Bailey Pemberton

If you’ve been eyeing Novartis and thinking, “Is now the right moment to buy, hold, or sell?” you’re definitely not alone. After a strong run, with Novartis up 6.8% over just the last week and nearly 19% year-to-date, it’s tough not to notice the momentum behind this major player. While some investors were caught off guard by how quickly sentiment has become more optimistic, much of the crowd seems to be reassessing Novartis’ risk profile as the company strengthens its focus on high-growth pharmaceutical segments.

Of course, it’s not just about price moves for the sake of excitement. Longer-term numbers are just as compelling, with Novartis delivering solid growth at over 65% in three years and above 68% over five. It’s fuel for the debate between those who think the company is only just now being recognized for its strengths, and those who wonder if the market’s optimism might be overdone.

But where does value fit in? Here’s where things get interesting. When measured against six key valuation checks, Novartis passes five, giving it a robust value score of 5 out of 6. There aren’t many large pharmaceutical names out there showing results like that.

Let’s dig into the major valuation approaches analysts use to size up Novartis today. Stick around, though, as we also uncover an even deeper perspective on the company’s worth that too many investors overlook.

Why Novartis is lagging behind its peers

Approach 1: Novartis Discounted Cash Flow (DCF) Analysis

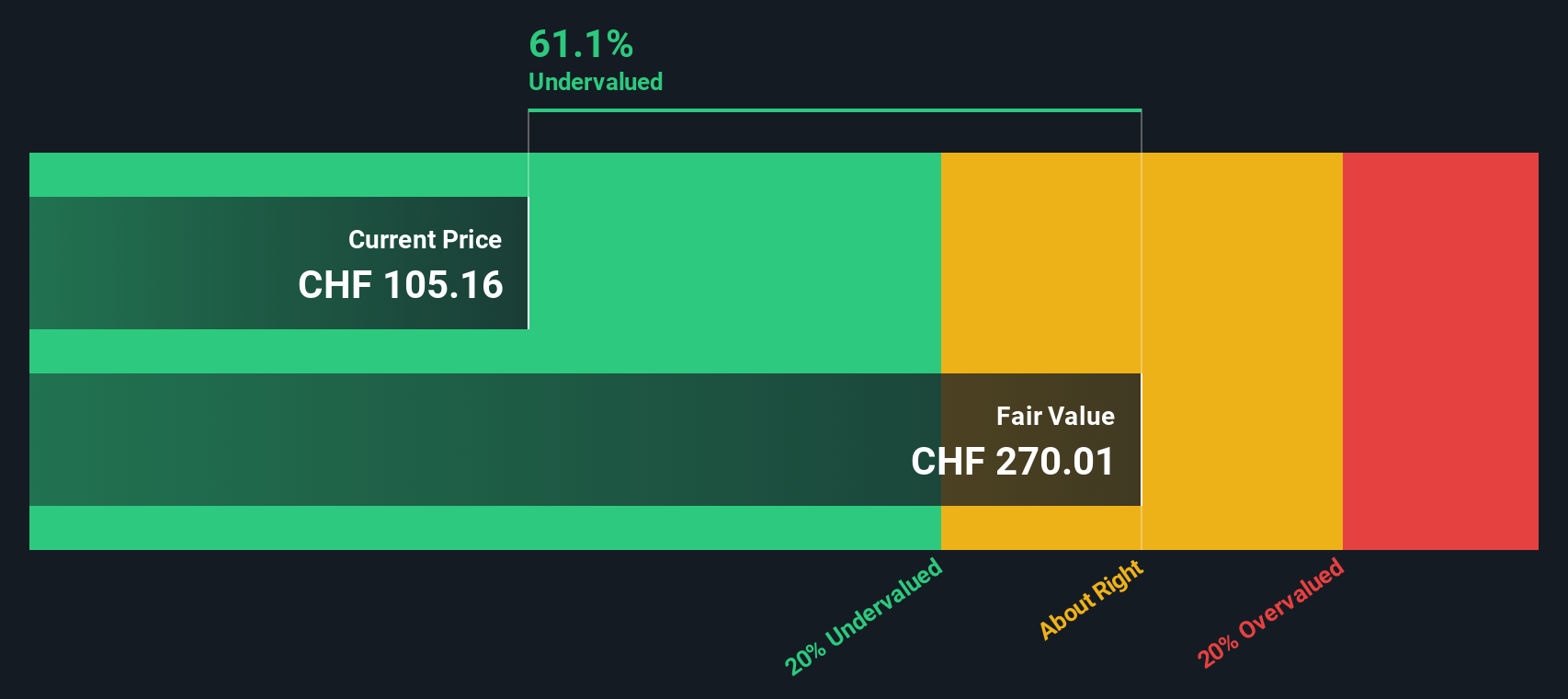

The Discounted Cash Flow (DCF) model is a popular valuation method that estimates a company’s intrinsic value by extrapolating its future cash flows and discounting them back to today’s dollars. For Novartis, this approach looks at how much cash the business can generate in the future by using analyst forecasts for the first five years, then projecting further growth beyond that period.

Novartis reported last-twelve-month Free Cash Flow (FCF) of $17.98 billion. Analyst projections see this rising steadily, with estimated FCF reaching $20.88 billion by 2029. After the analyst forecast window, projections rely on conservative growth estimates, resulting in a ten-year forecast that remains robust and is well supported by the company’s current trajectory.

Using this methodology, Novartis’ intrinsic value is calculated at $269.28 per share. With the stock currently trading at a DCF-implied discount of 60.7%, this indicates that the shares are priced materially below their estimated worth based on cash flow fundamentals. The DCF model therefore points to a significant undervaluation at today’s levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novartis is undervalued by 60.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Novartis Price vs Earnings

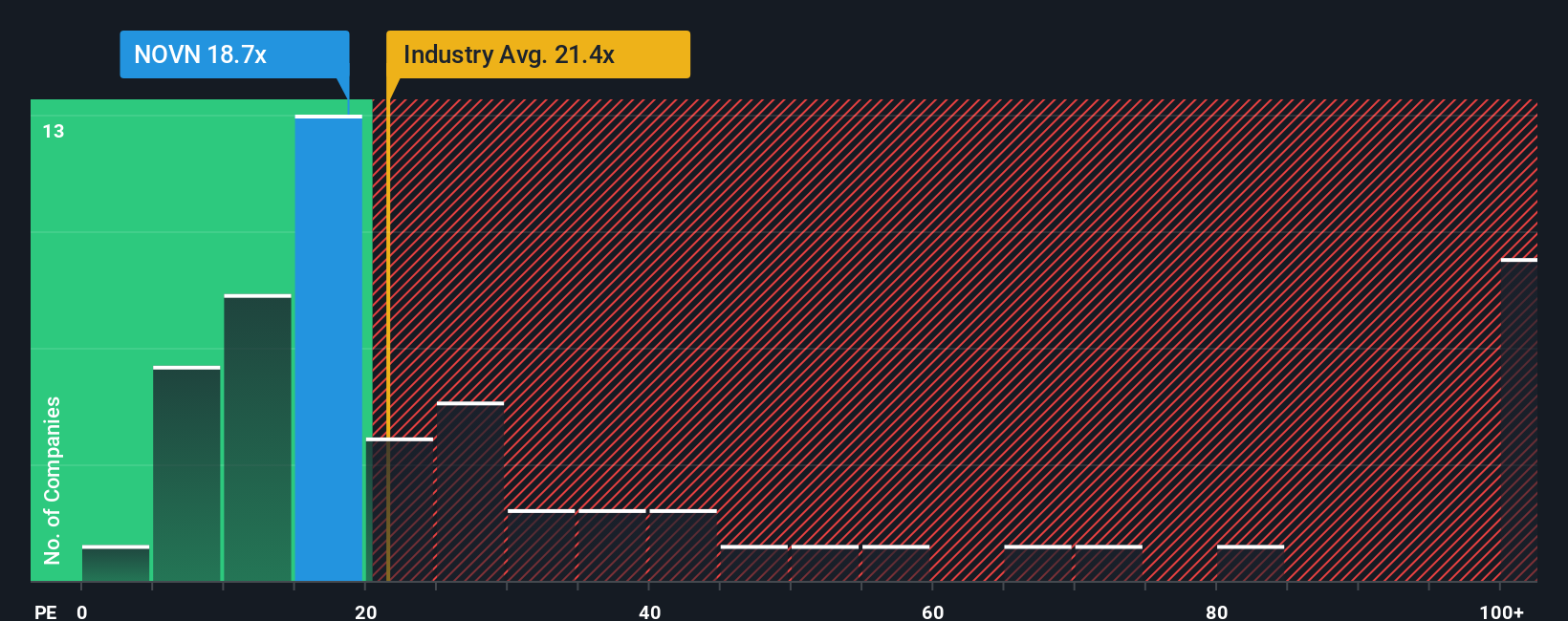

The Price-to-Earnings (PE) ratio is a key valuation metric when analyzing profitable companies like Novartis, as it lets investors quickly gauge how much they are paying for each franc of current earnings. Generally, higher expected growth or lower risk justifies a higher PE ratio, while lower growth or greater uncertainty would push the fair multiple down.

Novartis currently trades at a PE ratio of 18.9x. To put this in context, the average pharmaceutical industry PE is higher at 24.6x, and the peer group average stands at 73.8x. At first glance, this makes Novartis look attractively priced compared to both its sector and direct competitors.

However, digging deeper with Simply Wall St’s proprietary Fair Ratio tells a more tailored story. The Fair Ratio for Novartis is 29.4x, factoring in the company’s specific earnings growth, risk profile, profit margins, industry type, and market size. This approach goes beyond surface-level comparison. Industry averages and peer multiples can miss the nuances that actually drive long-term value. The Fair Ratio adjusts for what truly matters about Novartis.

Since the current PE multiple is well below the Fair Ratio, Novartis appears undervalued by this metric, not just inexpensive compared to industry norms.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novartis Narrative

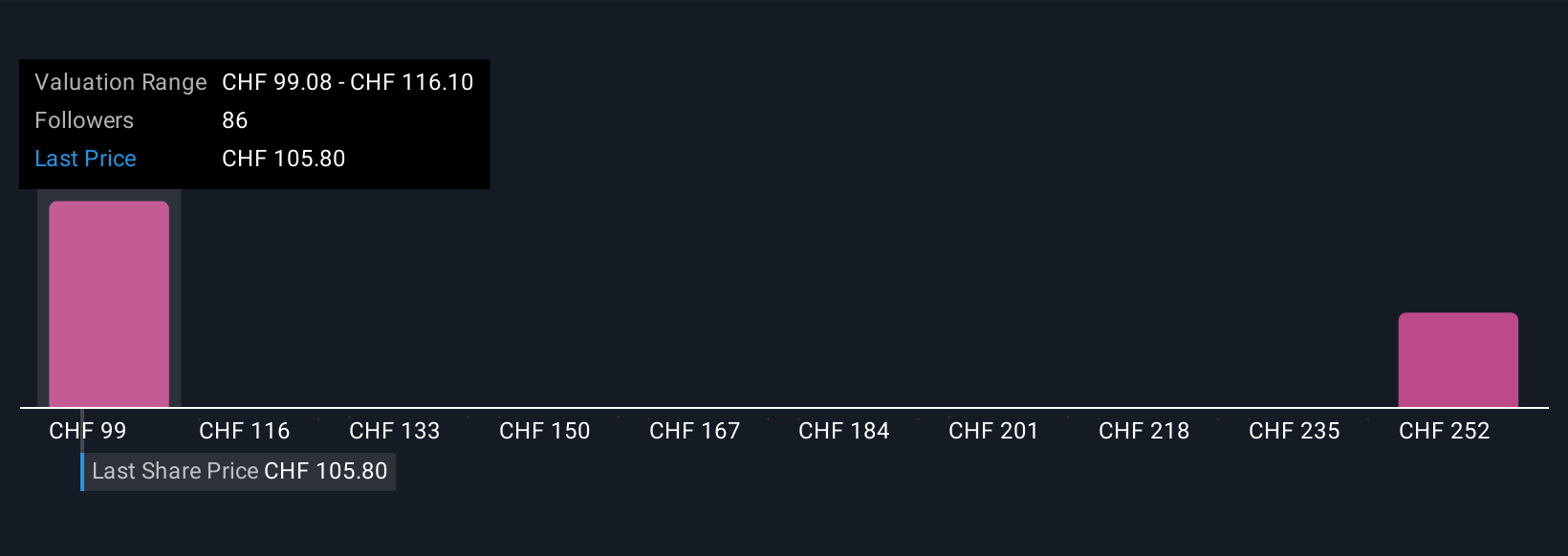

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal take on a company, linking what you believe about its story—such as where you see Novartis’ future growth, margins, and risks—to your own financial forecasts and a resulting fair value.

On Simply Wall St’s Community page, Narratives give you an easy and accessible way to express your outlook, instantly see your implied fair value, and compare it to the actual share price. It is a tool millions of investors use to make smarter buy or sell decisions by turning market news and financial numbers into actionable insight.

What is powerful is that Narratives are dynamic and update automatically when new information comes in, whether that is the latest clinical results or significant changes in management. For Novartis, some investors may have a bullish Narrative based on expansion in China and next-generation therapies leading to fair value targets as high as CHF120.06. Others may be more cautious, viewing pricing pressures as justification for a fair value as low as CHF79.67.

This personalized approach lets you test your own thesis, compare it with others, and stay responsive as the story evolves. This can make complex investment decisions both simpler and smarter.

Do you think there's more to the story for Novartis? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives