European Stock Opportunities That Might Be Undervalued In April 2025

Reviewed by Simply Wall St

As European markets show signs of recovery, with the STOXX Europe 600 Index and major national indexes rebounding from earlier losses, investor sentiment is buoyed by the European Central Bank's recent rate cuts and delayed tariff hikes. In this environment of cautious optimism, identifying stocks that are potentially undervalued can offer opportunities for investors looking to capitalize on market shifts; such stocks often exhibit strong fundamentals or growth potential that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Andritz (WBAG:ANDR) | €56.50 | €112.96 | 50% |

| Qt Group Oyj (HLSE:QTCOM) | €57.20 | €114.25 | 49.9% |

| LPP (WSE:LPP) | PLN15600.00 | PLN30559.23 | 49% |

| Pharma Mar (BME:PHM) | €81.10 | €157.48 | 48.5% |

| TF Bank (OM:TFBANK) | SEK351.50 | SEK682.95 | 48.5% |

| Etteplan Oyj (HLSE:ETTE) | €11.55 | €22.94 | 49.7% |

| Jerónimo Martins SGPS (ENXTLS:JMT) | €21.40 | €42.23 | 49.3% |

| Nordic Semiconductor (OB:NOD) | NOK118.40 | NOK235.37 | 49.7% |

| Longino & Cardenal (BIT:LON) | €1.35 | €2.69 | 49.8% |

| Galderma Group (SWX:GALD) | CHF90.00 | CHF175.74 | 48.8% |

We're going to check out a few of the best picks from our screener tool.

DSV (CPSE:DSV)

Overview: DSV A/S provides transport and logistics services across various regions including Europe, the Middle East, Africa, North America, South America, Asia, Australia, and the Pacific with a market cap of DKK301.80 billion.

Operations: The company's revenue segments comprise DKK40.51 billion from Road, DKK25.62 billion from Solutions, DKK55.17 billion from Air Freight, and DKK49.33 billion from Sea Freight.

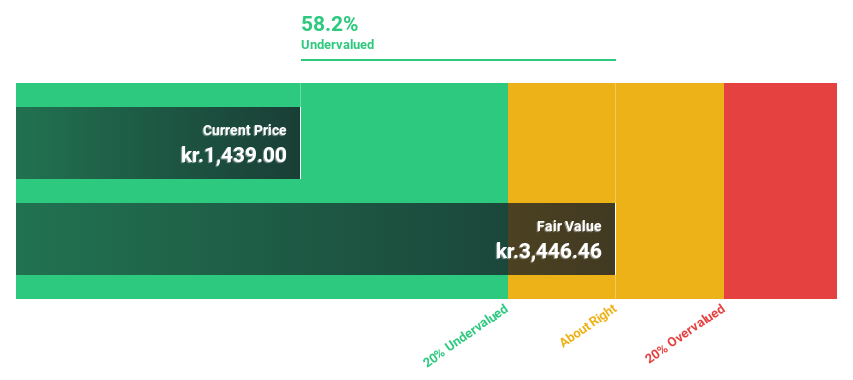

Estimated Discount To Fair Value: 48.2%

DSV is trading at DKK1278.5, significantly below its estimated fair value of DKK2468.15, indicating it may be undervalued based on cash flows. Analysts forecast earnings growth of 20% annually, outpacing the Danish market's 8.4%. Despite a dip in net income for 2024 to DKK10.11 billion from DKK12.32 billion the previous year, recent guidance suggests robust volume increases and stable margins across divisions, with anticipated EBIT between DKK15.5-17.5 billion for 2025 excluding acquisitions.

- The analysis detailed in our DSV growth report hints at robust future financial performance.

- Take a closer look at DSV's balance sheet health here in our report.

Galderma Group (SWX:GALD)

Overview: Galderma Group AG is a global dermatology company with a market cap of CHF21.37 billion.

Operations: The company generates revenue of $4.44 billion from its dermatology segment worldwide.

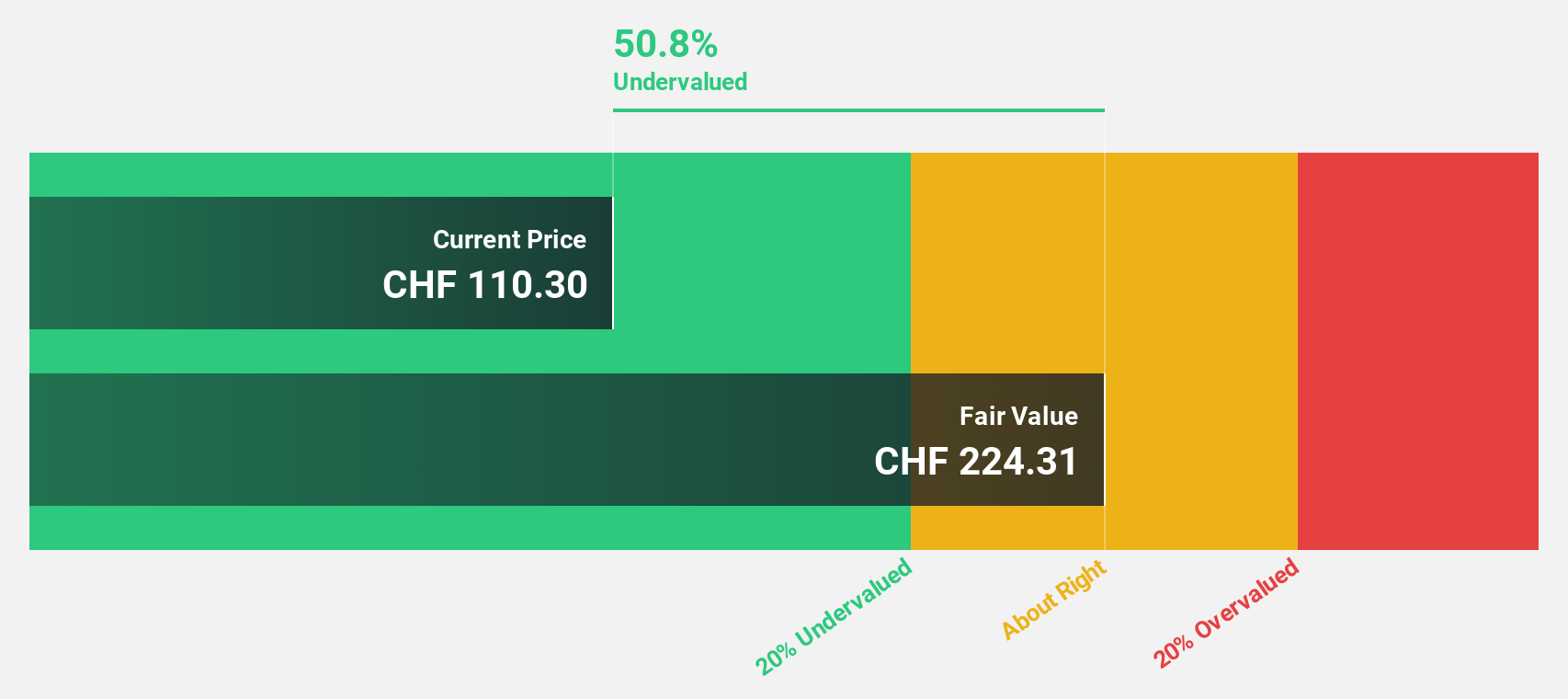

Estimated Discount To Fair Value: 48.8%

Galderma Group, trading at CHF90, is significantly undervalued with an estimated fair value of CHF175.74. Despite recent share price volatility, the company's earnings are projected to grow 30.4% annually, surpassing the Swiss market average of 10.8%. Galderma's strategic expansion into China with Sculptra highlights its commitment to capturing growth in high-demand markets. However, its forecasted return on equity remains modest at 12.2%, suggesting potential limitations in profitability enhancement despite robust cash flow valuation metrics.

- Our expertly prepared growth report on Galderma Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Galderma Group.

adidas (XTRA:ADS)

Overview: adidas AG, along with its subsidiaries, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America with a market cap of approximately €38.50 billion.

Operations: The company's revenue segments include €7.55 billion from Europe, €3.46 billion from Greater China, €2.77 billion from Latin America, €5.13 billion from North America, €3.31 billion from Emerging Markets, and €1.34 billion from Japan/South Korea.

Estimated Discount To Fair Value: 44.2%

adidas, currently priced at €215.6, is significantly undervalued with an estimated fair value of €386.62 based on discounted cash flow analysis. The company's earnings are forecasted to grow 25.21% annually, outpacing the German market's growth rate of 15.5%. Recent partnerships and strategic initiatives like the collaboration with New Era Cap LLC and Fastbreak AI indicate a focus on expanding brand presence and community impact, potentially enhancing future cash flows despite recent losses turning into profitability this year.

- Upon reviewing our latest growth report, adidas' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of adidas stock in this financial health report.

Key Takeaways

- Investigate our full lineup of 169 Undervalued European Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DSV

DSV

Offers transport and logistics services in Europe, the Middle East, Africa, North America, South America, Asia, Australia, and the Pacific.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives