- Switzerland

- /

- Pharma

- /

- SWX:GALD

3 Stocks That Could Be Undervalued By Up To 49.5%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by declining major stock indexes and mixed economic signals, investors are increasingly focused on the Federal Reserve's anticipated rate cut and its potential impact on market dynamics. Amidst this environment, identifying undervalued stocks becomes crucial as they may present opportunities for growth when broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | US$26.67 | US$53.13 | 49.8% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.59 | CN¥19.09 | 49.8% |

| Musashi Seimitsu Industry (TSE:7220) | ¥4020.00 | ¥8038.95 | 50% |

| Xiamen Bank (SHSE:601187) | CN¥5.68 | CN¥11.35 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.18 | HK$18.27 | 49.8% |

| BYD Electronic (International) (SEHK:285) | HK$39.85 | HK$79.36 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP291.30 | CLP579.37 | 49.7% |

| Constellium (NYSE:CSTM) | US$10.91 | US$21.69 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

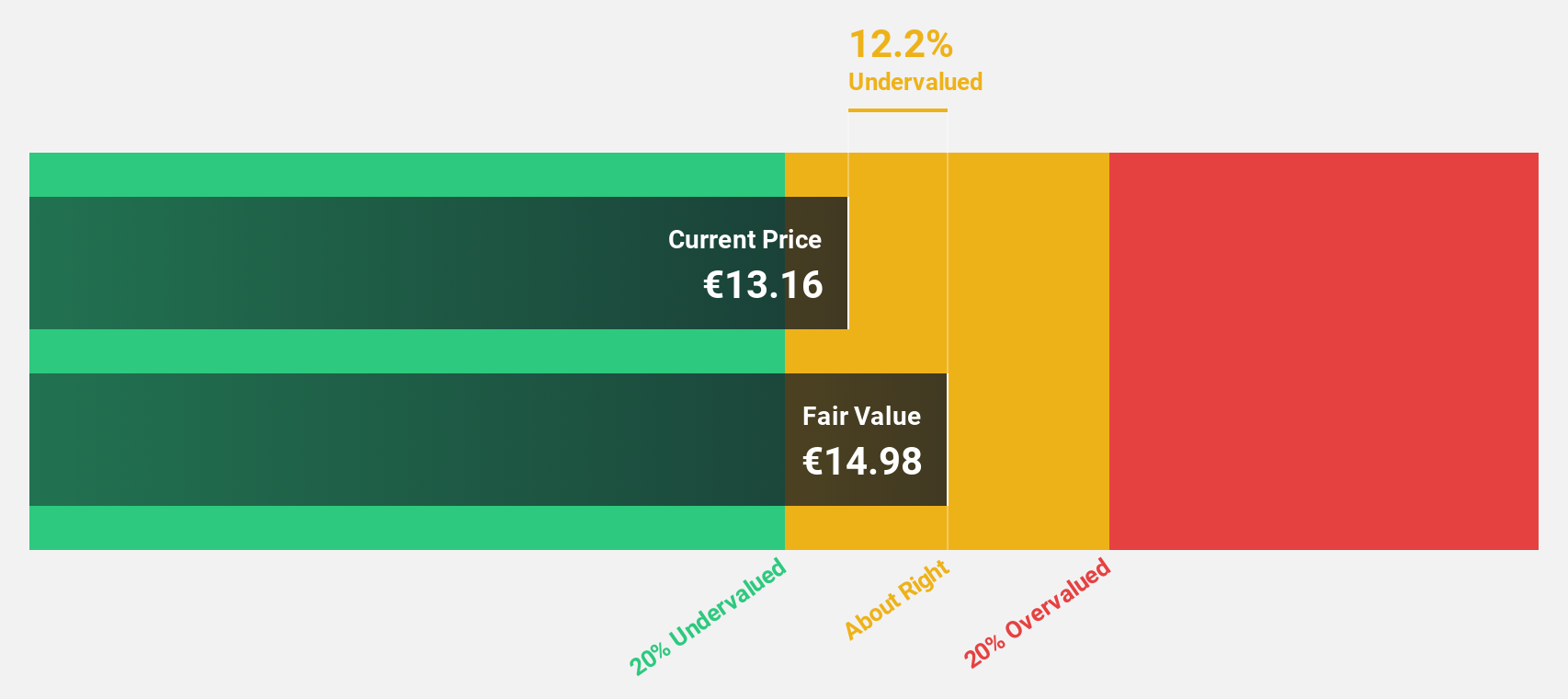

Puuilo Oyj (HLSE:PUUILO)

Overview: Puuilo Oyj operates a discount retail chain in Finland and has a market cap of €879.28 million.

Operations: The company's revenue primarily comes from its retail department stores segment, which generated €364.50 million.

Estimated Discount To Fair Value: 24.2%

Puuilo Oyj is trading at €10.44, significantly below its estimated fair value of €13.78, highlighting potential undervaluation based on discounted cash flow analysis. Despite a moderate earnings growth forecast of 14.6% annually, which slightly surpasses the Finnish market's average growth rate, Puuilo's revenue is expected to grow at 11.5% per year—outpacing the market. The company's return on equity is projected to be very high in three years, enhancing its investment appeal.

- Our comprehensive growth report raises the possibility that Puuilo Oyj is poised for substantial financial growth.

- Dive into the specifics of Puuilo Oyj here with our thorough financial health report.

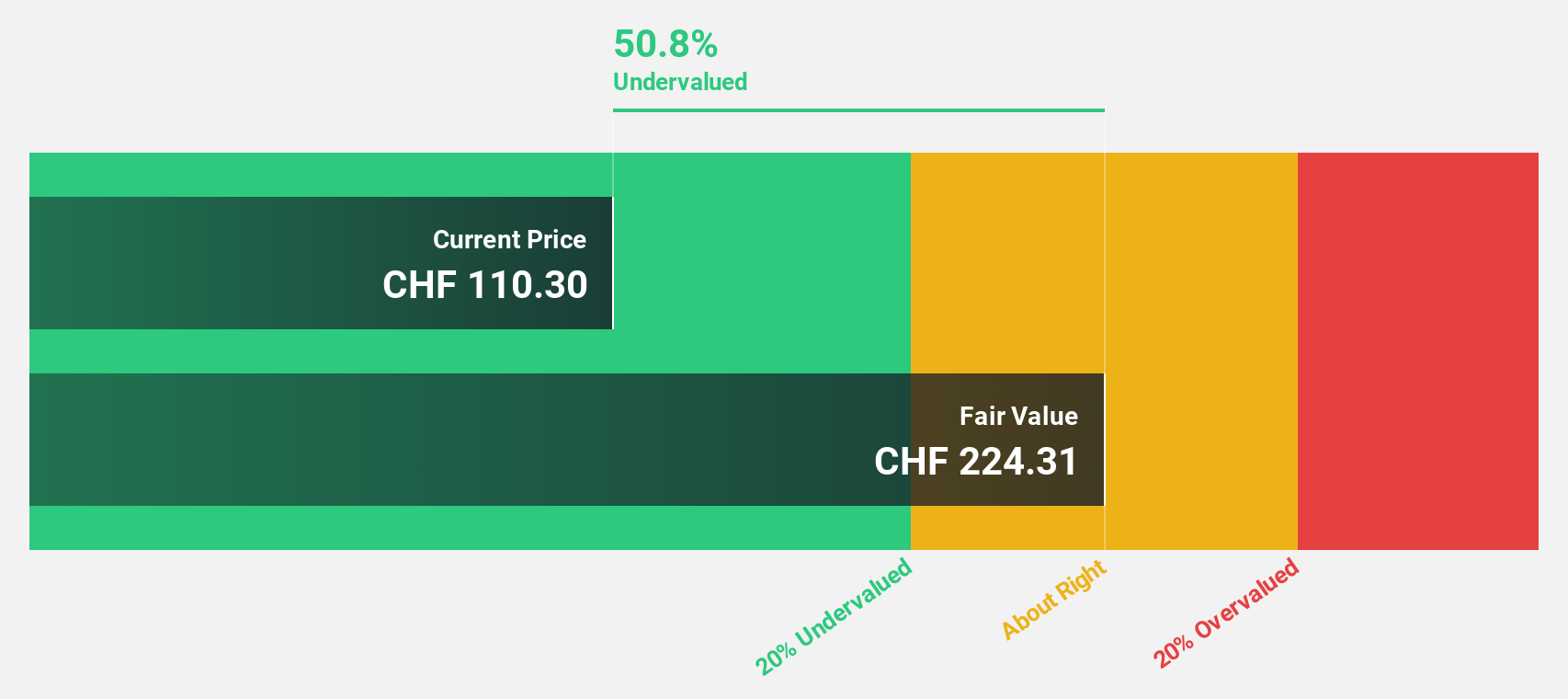

Galderma Group (SWX:GALD)

Overview: Galderma Group AG is a global dermatology company with a market capitalization of CHF22.55 billion.

Operations: The company generates revenue from its dermatology segment, totaling $4.32 billion.

Estimated Discount To Fair Value: 49.5%

Galderma Group is currently trading at CHF94.94, significantly below its estimated fair value of CHF188.04, suggesting potential undervaluation based on discounted cash flow analysis. The company's earnings are forecast to grow by 44.64% annually as it becomes profitable over the next three years, exceeding average market growth expectations. Recent FDA approvals for Nemluvio® could boost revenue growth, which is projected at 11.5% annually—faster than the Swiss market's rate.

- Upon reviewing our latest growth report, Galderma Group's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Galderma Group's balance sheet health report.

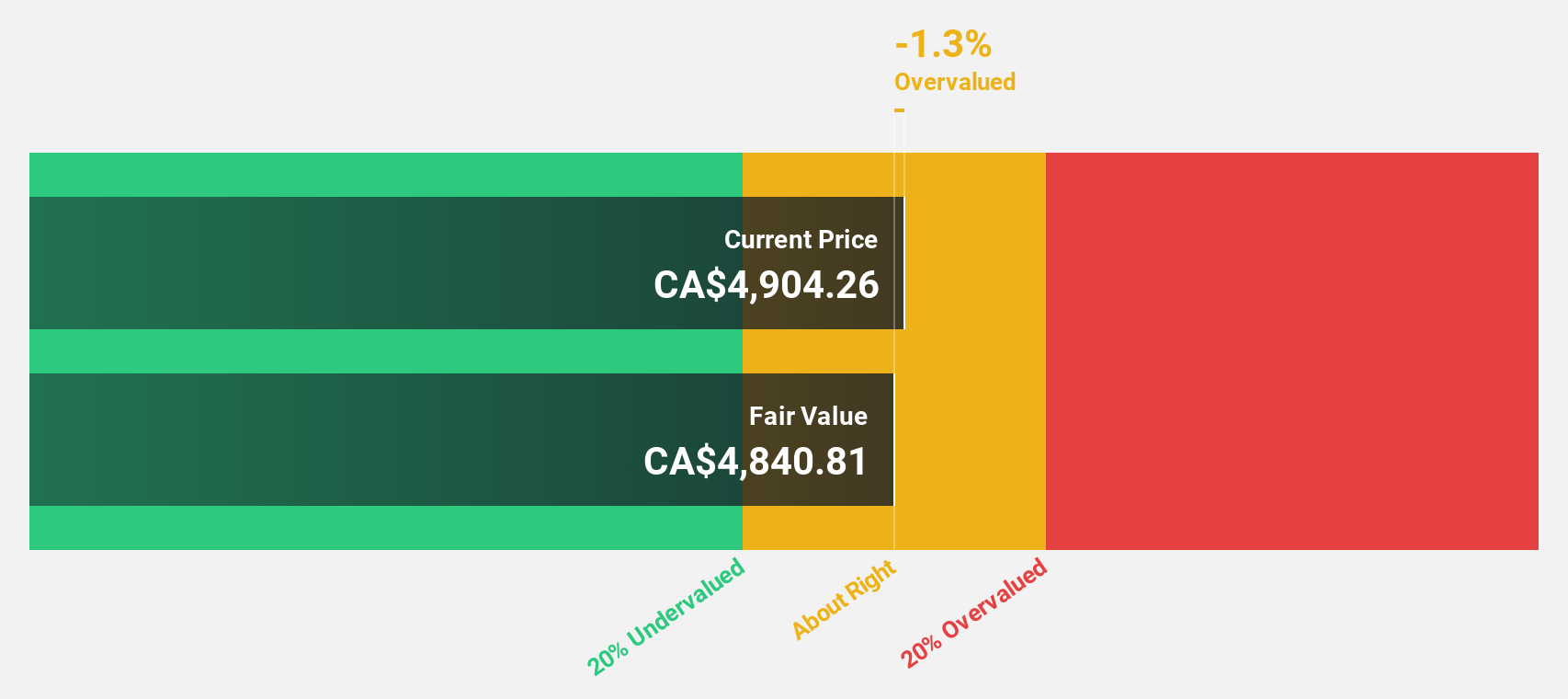

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$97.94 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating $9.68 billion.

Estimated Discount To Fair Value: 13.7%

Constellation Software, trading at CA$4,656.93, is undervalued relative to its fair value estimate of CA$5,397.70 based on discounted cash flow analysis. Despite high debt levels, its earnings are expected to grow significantly at 27.9% annually over the next three years—outpacing the Canadian market's growth rate of 15.5%. Recent earnings show a revenue increase to US$7.36 billion for nine months ended September 2024, though net income slightly decreased year-over-year in Q3.

- The growth report we've compiled suggests that Constellation Software's future prospects could be on the up.

- Click here to discover the nuances of Constellation Software with our detailed financial health report.

Taking Advantage

- Investigate our full lineup of 874 Undervalued Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GALD

Reasonable growth potential with adequate balance sheet.