- Switzerland

- /

- Pharma

- /

- SWX:COPN

Market Participants Recognise Cosmo Pharmaceuticals N.V.'s (VTX:COPN) Revenues

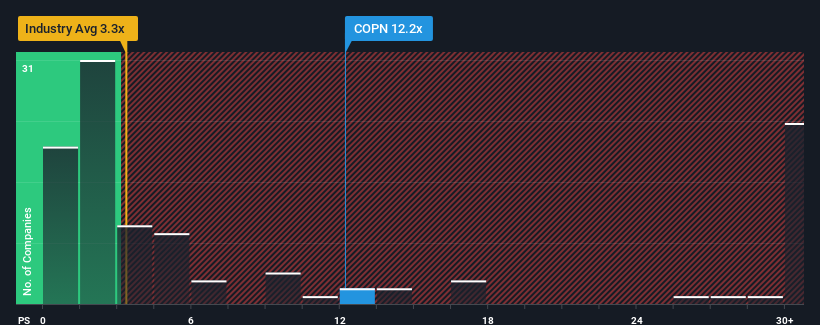

With a price-to-sales (or "P/S") ratio of 12.2x Cosmo Pharmaceuticals N.V. (VTX:COPN) may be sending very bearish signals at the moment, given that almost half of all the Pharmaceuticals companies in Switzerland have P/S ratios under 4.1x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Cosmo Pharmaceuticals

How Has Cosmo Pharmaceuticals Performed Recently?

Cosmo Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Cosmo Pharmaceuticals will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Cosmo Pharmaceuticals?

Cosmo Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.3%. Even so, admirably revenue has lifted 59% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 40% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 11% per annum, which is noticeably less attractive.

In light of this, it's understandable that Cosmo Pharmaceuticals' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Cosmo Pharmaceuticals' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Cosmo Pharmaceuticals' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Cosmo Pharmaceuticals is showing 3 warning signs in our investment analysis, and 1 of those is potentially serious.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:COPN

Cosmo Pharmaceuticals

Focuses on the development and commercialization products for gastroenterology, dermatology, and healthtech worldwide.

Flawless balance sheet, undervalued and pays a dividend.