- Switzerland

- /

- Media

- /

- SWX:MCHN

We Think Some Shareholders May Hesitate To Increase MCH Group AG's (VTX:MCHN) CEO Compensation

Key Insights

- MCH Group will host its Annual General Meeting on 27th of May

- Salary of CHF468.5k is part of CEO Florian Faber's total remuneration

- The total compensation is 200% higher than the average for the industry

- Over the past three years, MCH Group's EPS grew by 46% and over the past three years, the total loss to shareholders 51%

Shareholders of MCH Group AG (VTX:MCHN) will have been dismayed by the negative share price return over the last three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 27th of May. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

View our latest analysis for MCH Group

Comparing MCH Group AG's CEO Compensation With The Industry

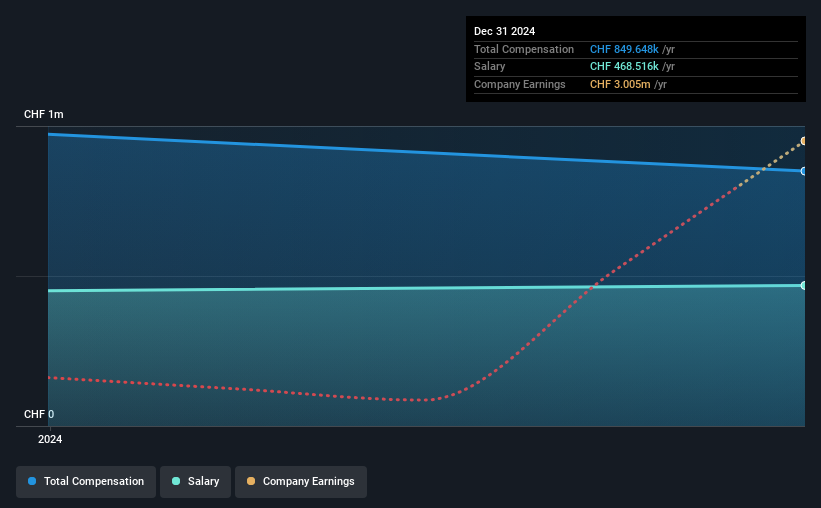

At the time of writing, our data shows that MCH Group AG has a market capitalization of CHF108m, and reported total annual CEO compensation of CHF850k for the year to December 2024. We note that's a decrease of 13% compared to last year. In particular, the salary of CHF468.5k, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the Switzerland Media industry with market capitalizations below CHF166m, reported a median total CEO compensation of CHF283k. Accordingly, our analysis reveals that MCH Group AG pays Florian Faber north of the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CHF469k | CHF451k | 55% |

| Other | CHF381k | CHF521k | 45% |

| Total Compensation | CHF850k | CHF972k | 100% |

On an industry level, total compensation is equally proportioned between salary and other compensation, that is, they each represent approximately 50% of the total compensation. It's interesting to note that MCH Group pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at MCH Group AG's Growth Numbers

Over the past three years, MCH Group AG has seen its earnings per share (EPS) grow by 46% per year. In the last year, its revenue is up 12%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has MCH Group AG Been A Good Investment?

Few MCH Group AG shareholders would feel satisfied with the return of -51% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for MCH Group that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MCHN

MCH Group

Operates as a live marketing company that provides a network of services in the exhibition and event market worldwide.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.