- Switzerland

- /

- Chemicals

- /

- SWX:GURN

June 2024 Spotlight On Growth Companies With High Insider Ownership At SIX Swiss Exchange

Reviewed by Simply Wall St

As the Switzerland market navigates through modest fluctuations and economic data releases, investors are closely monitoring the impact of monetary policies and inflation trends on market dynamics. In this context, companies with high insider ownership can offer a unique investment appeal, as they often reflect a commitment by those who know the business best to its long-term success.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

| Leonteq (SWX:LEON) | 12.7% | 26.4% |

| Sensirion Holding (SWX:SENS) | 20.7% | 78.3% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Arbonia (SWX:ARBN) | 28.8% | 104.5% |

Underneath we present a selection of stocks filtered out by our screen.

COLTENE Holding (SWX:CLTN)

Simply Wall St Growth Rating: ★★★★☆☆

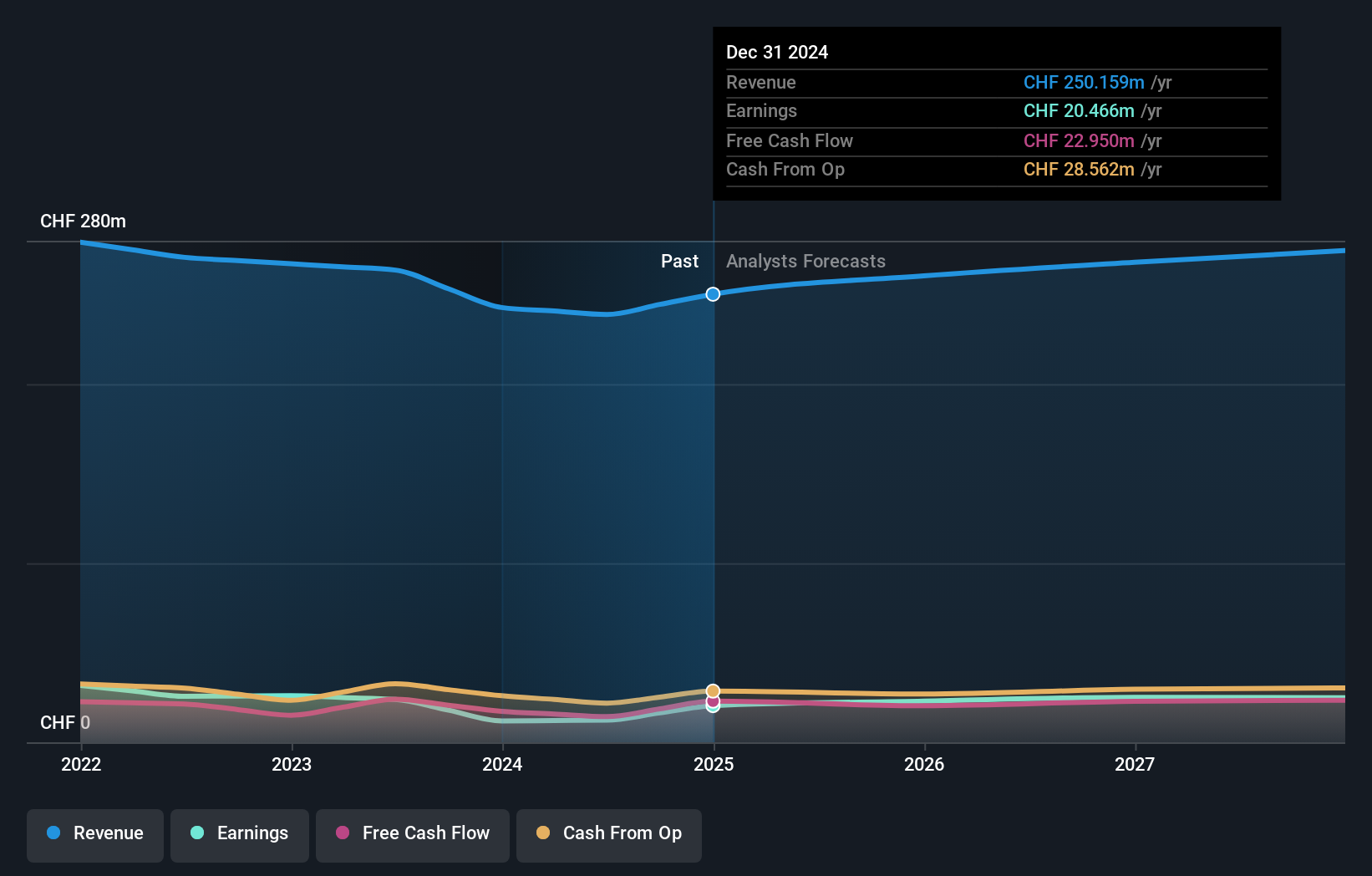

Overview: COLTENE Holding AG is a company that develops, manufactures, and sells disposables, tools, and equipment for dentists and dental laboratories across various global regions with a market capitalization of CHF 302.36 million.

Operations: The company generates CHF 242.73 million in revenue from the sale of disposables, tools, and equipment for dental professionals.

Insider Ownership: 22.2%

Return On Equity Forecast: 22% (2026 estimate)

COLTENE Holding, a Swiss-based company, reported a notable decline in sales and net income for the year ended December 31, 2023. Despite this downturn, the company's earnings are expected to grow significantly over the next three years. Insider ownership remains substantial, suggesting confidence from those closest to the company. However, its revenue growth is projected to lag behind market averages and its dividend coverage appears weak, indicating potential concerns about sustainability in payouts.

- Click here and access our complete growth analysis report to understand the dynamics of COLTENE Holding.

- The valuation report we've compiled suggests that COLTENE Holding's current price could be quite moderate.

Gurit Holding (SWX:GURN)

Simply Wall St Growth Rating: ★★★★☆☆

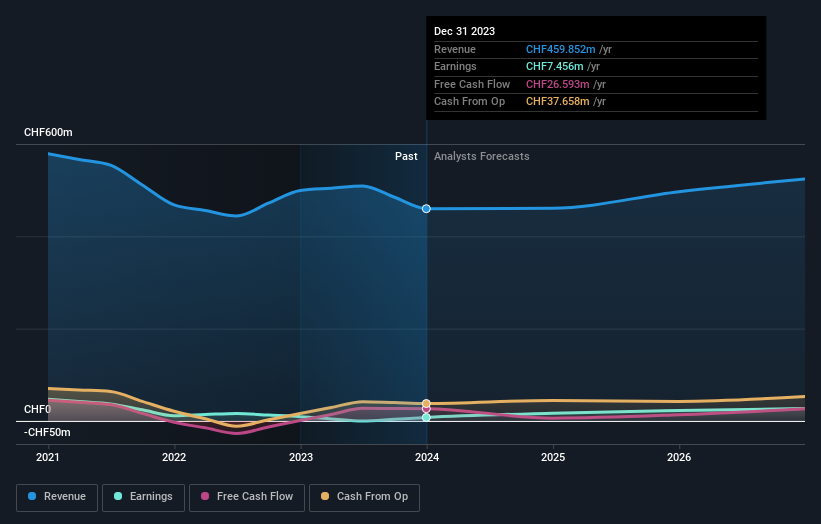

Overview: Gurit Holding AG specializes in developing, manufacturing, marketing, and selling advanced composite materials, composite tooling equipment, and kitting services globally, with a market capitalization of CHF 284.32 million.

Operations: The company generates revenue through three primary segments: Composite Materials (CHF 307.09 million), Marine and Industrial (CHF 101.63 million), and Manufacturing Solutions (CHF 51.29 million).

Insider Ownership: 30.2%

Return On Equity Forecast: 22% (2026 estimate)

Gurit Holding, a Swiss company, is trading at 53.5% below its estimated fair value, attracting attention for potential undervaluation. Despite a high debt level and revenue growth projections (4% per year) trailing the Swiss market average (4.4%), the firm's earnings are expected to surge by 35.1% annually over the next three years, outpacing the broader market's 8.3%. This forecasted robust earnings growth coupled with a significant anticipated increase in stock price (39.4%) highlights its growth potential amidst volatility and financial leverage concerns.

- Navigate through the intricacies of Gurit Holding with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Gurit Holding's shares may be trading at a discount.

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

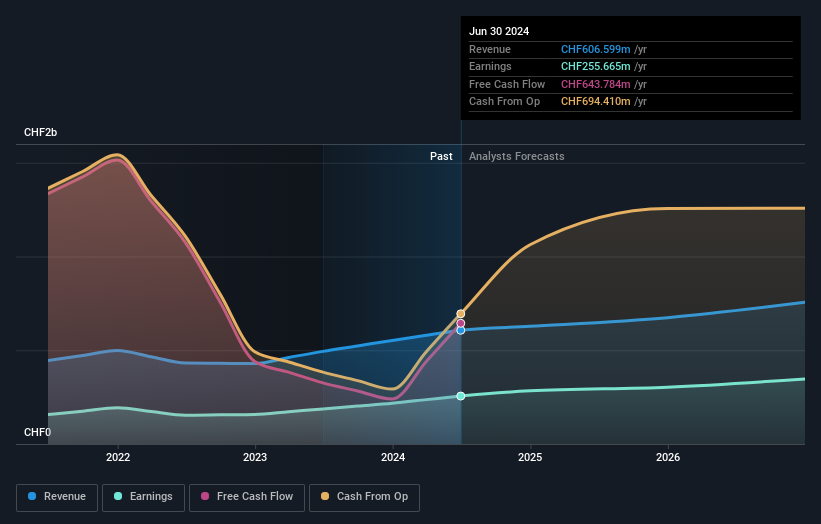

Overview: Swissquote Group Holding Ltd operates globally, offering a range of online financial services to retail, affluent, and institutional clients with a market capitalization of CHF 4.14 billion.

Operations: The company generates revenue primarily through leveraged Forex and securities trading, totaling CHF 101.09 million and CHF 429.78 million respectively.

Insider Ownership: 11.4%

Return On Equity Forecast: 23% (2026 estimate)

Swissquote Group Holding Ltd, a Swiss financial services company, reported a substantial increase in net income to CHF 217.63 million for the year ending December 31, 2023. The company's earnings are forecasted to grow by 14.3% annually, outpacing the Swiss market average of 8.3%. Despite slower revenue growth projections at 10.6% per year compared to higher market benchmarks, Swissquote trades at a significant discount of 22.6% below its estimated fair value and maintains a strong return on equity projected at 23.2%.

- Take a closer look at Swissquote Group Holding's potential here in our earnings growth report.

- Our valuation report here indicates Swissquote Group Holding may be overvalued.

Turning Ideas Into Actions

- Investigate our full lineup of 15 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GURN

Gurit Holding

Develops, manufactures, supplies, markets, and sells advanced composite materials, composite tooling equipment, and core kitting services in Switzerland and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives