- Switzerland

- /

- Chemicals

- /

- SWX:GIVN

Here's Why Shareholders May Want To Be Cautious With Increasing Givaudan SA's (VTX:GIVN) CEO Pay Packet

CEO Gilles Andrier has done a decent job of delivering relatively good performance at Givaudan SA (VTX:GIVN) recently. As shareholders go into the upcoming AGM on 24 March 2022, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for Givaudan

Comparing Givaudan SA's CEO Compensation With the industry

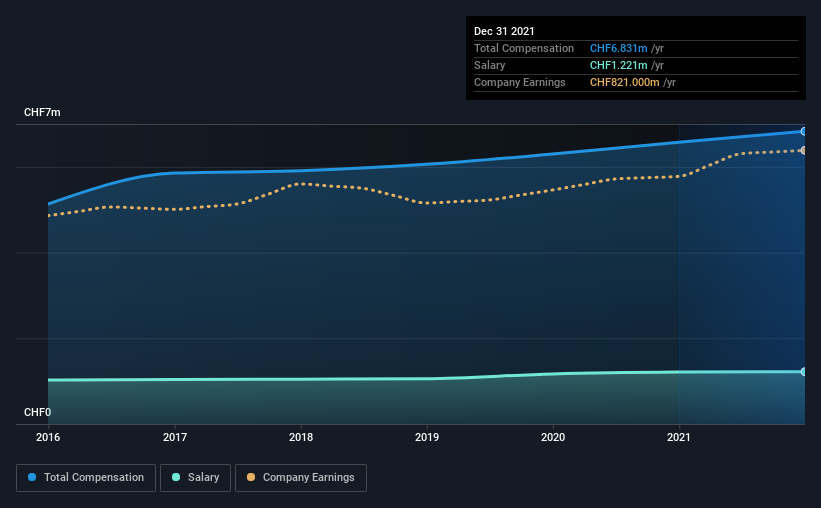

According to our data, Givaudan SA has a market capitalization of CHF35b, and paid its CEO total annual compensation worth CHF6.8m over the year to December 2021. That's a modest increase of 3.9% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at CHF1.2m.

On comparing similar companies in the industry with market capitalizations above CHF7.5b, we found that the median total CEO compensation was CHF3.5m. This suggests that Gilles Andrier is paid more than the median for the industry. Moreover, Gilles Andrier also holds CHF17m worth of Givaudan stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CHF1.2m | CHF1.2m | 18% |

| Other | CHF5.6m | CHF5.4m | 82% |

| Total Compensation | CHF6.8m | CHF6.6m | 100% |

On an industry level, around 51% of total compensation represents salary and 49% is other remuneration. Givaudan sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Givaudan SA's Growth

Over the past three years, Givaudan SA has seen its earnings per share (EPS) grow by 7.4% per year. In the last year, its revenue is up 5.7%.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but the modest improvement in EPS is good. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Givaudan SA Been A Good Investment?

Boasting a total shareholder return of 58% over three years, Givaudan SA has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for Givaudan that investors should be aware of in a dynamic business environment.

Switching gears from Givaudan, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:GIVN

Givaudan

Manufactures, supplies, and sells fragrance, beauty, taste, and wellbeing products to the consumer goods industry.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives