While it may not be enough for some shareholders, we think it is good to see the Evolva Holding SA (VTX:EVE) share price up 23% in a single quarter. But that doesn't change the fact that the returns over the last half decade have been disappointing. Indeed, the share price is down 70% in the period. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

View our latest analysis for Evolva Holding

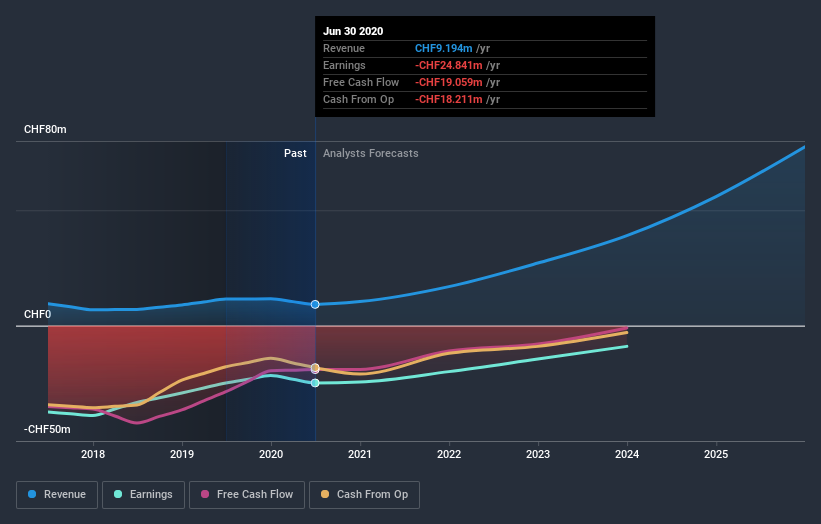

Evolva Holding isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Evolva Holding reduced its trailing twelve month revenue by 4.2% for each year. That's not what investors generally want to see. If a business loses money, you want it to grow, so no surprises that the share price has dropped 11% each year in that time. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Evolva Holding's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Evolva Holding's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Evolva Holding hasn't been paying dividends, but its TSR of -64% exceeds its share price return of -70%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in Evolva Holding had a tough year, with a total loss of 9.3%, against a market gain of about 1.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Evolva Holding better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Evolva Holding you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

When trading Evolva Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Evolva Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:EVE

Evolva Holding

Evolva Holding SA discovers, researches, develops, and commercializes nature-based ingredients for use in flavor and fragrances, health ingredients, health protection, and other sectors in Switzerland, the United States, and internationally.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives