- Switzerland

- /

- Chemicals

- /

- SWX:EMSN

EMS-CHEMIE HOLDING (SWX:EMSN): Evaluating Valuation After Recent Share Price Weakness

Reviewed by Kshitija Bhandaru

EMS-CHEMIE HOLDING (SWX:EMSN) shares have softened in recent trading, with the stock down 1% over the past day and 3% for the week. Looking at longer horizons, it has slipped 9% month-to-date and 14% in the past 3 months.

See our latest analysis for EMS-CHEMIE HOLDING.

The recent slip in EMS-CHEMIE HOLDING's share price caps off a year where sentiment has clearly faded, with a 1-year total shareholder return of -16.45% and losses accumulating over both short and long-term timeframes. Ongoing weakness suggests investors have grown cautious, possibly factoring in shifts in growth or risk outlook, even as fundamentals continue to evolve.

If you want to see which other companies show strong momentum and fresh growth prospects, this is a great moment to explore fast growing stocks with high insider ownership.

With the share price now well below analysts’ consensus and fundamentals still posting modest growth, is EMS-CHEMIE HOLDING an overlooked bargain, or has the market fully accounted for its future prospects?

Price-to-Earnings of 28.2x: Is it justified?

EMS-CHEMIE HOLDING’s shares are currently trading at a price-to-earnings (P/E) multiple of 28.2x, which stands well above both its industry peers and what many would consider average for the sector. At a last close of CHF556, the stock commands a premium valuation despite recent weakness in its share price.

The price-to-earnings ratio measures how much investors are willing to pay for each franc of earnings generated. For EMS-CHEMIE HOLDING, this high P/E means the market is placing a significant premium on future profit growth or quality. This is typically justified only by consistent growth, high returns, or market-leading positions.

However, EMS-CHEMIE HOLDING’s current P/E of 28.2x is materially higher than both the European Chemicals industry average of 17.4x and the peer group average of 23.3x. Additionally, when compared to its estimated fair price-to-earnings ratio of 15.1x, the current valuation looks stretched. If the market reverts to the fair ratio, there could be considerable downside from present levels.

Explore the SWS fair ratio for EMS-CHEMIE HOLDING

Result: Price-to-Earnings of 28.2x (OVERVALUED)

However, weaker earnings momentum or unexpected shifts in industry demand could quickly challenge the current outlook for EMS-CHEMIE HOLDING’s shares.

Find out about the key risks to this EMS-CHEMIE HOLDING narrative.

Another View: What Does Our DCF Model Suggest?

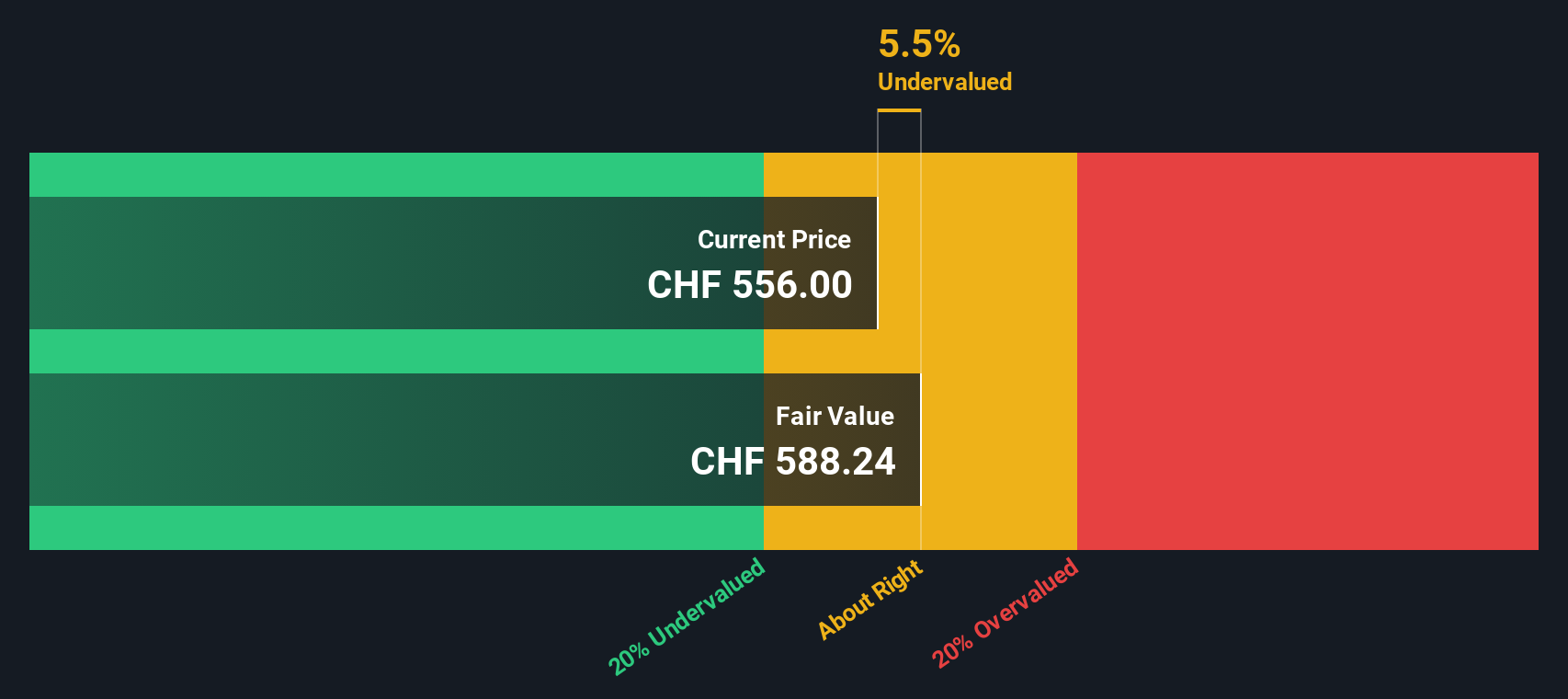

While the current price-to-earnings ratio hints at EMS-CHEMIE HOLDING being overvalued compared to peers, our SWS DCF model suggests a different perspective. Based on our estimates, the shares are trading about 5.5% below their calculated fair value. This signals potential upside, even as traditional multiples indicate otherwise.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EMS-CHEMIE HOLDING for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EMS-CHEMIE HOLDING Narrative

If you have a different take on EMS-CHEMIE HOLDING or want to examine the numbers firsthand, creating your personal analysis is quick and straightforward. Do it your way

A great starting point for your EMS-CHEMIE HOLDING research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities. Use the power of Simply Wall Street’s screener to reveal dynamic stocks in sectors you might have overlooked and stay ahead of the market.

- Fortify your portfolio with stable cash flow plays by checking out these 897 undervalued stocks based on cash flows, featuring companies trading below their intrinsic value.

- Capture growth from the next big medical breakthroughs by taking a look at these 32 healthcare AI stocks, including companies at the forefront of healthcare and artificial intelligence innovation.

- Spot high-yield potential and consistent returns when you tap into these 18 dividend stocks with yields > 3%, listing stocks with strong dividend payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMS-CHEMIE HOLDING might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:EMSN

EMS-CHEMIE HOLDING

Engages in the polymers and specialty chemicals businesses in the Americas, Europe, Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives