- Switzerland

- /

- Medical Equipment

- /

- SWX:YPSN

Ypsomed Holding (SWX:YPSN) Valuation in Focus as Company Unveils First US Manufacturing Expansion

Reviewed by Kshitija Bhandaru

Ypsomed Holding (SWX:YPSN) has announced plans to set up its first manufacturing facility in the United States, choosing Holly Springs, North Carolina as the site. This move highlights a meaningful step in the company’s strategy for US market expansion.

See our latest analysis for Ypsomed Holding.

Ypsomed Holding’s announcement comes after a challenging period for the stock, with a 1-year total shareholder return of -20.15% and a recent 30-day share price return of -21.34%, reflecting pressure on sentiment even as the company’s longer-term performance remains robust. Its 3-year total shareholder return stands at 108.27%, highlighting significant value creation for patient investors.

If the US expansion has you thinking about markets with strong growth stories, now’s the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

Yet with shares still trading at a sizable discount to analyst price targets, investors are left to ponder whether Ypsomed is undervalued at current levels or if the market has already priced in its future growth prospects.

Most Popular Narrative: 25% Undervalued

Ahead of the last close at CHF 322.50, the most widely tracked narrative calculates fair value at CHF 429.92 for Ypsomed Holding. The numbers suggest notable upside relative to today’s price, grounded in a blend of ambitious growth projections and evolving profit margins. See what’s underpinning this bold forecast below.

The company's expanded manufacturing capacity, including investment in new assembly lines and doubling its tool shop, positions Ypsomed to meet future demand, especially in fast-growing segments like auto-injectors, potentially boosting revenues (expected impact on revenue). Ypsomed's strategic shift to establish local manufacturing in China for the China market and plans for an American production facility by 2027 may reduce geopolitical risks and improve supply chain efficiencies, potentially enhancing earnings through cost savings and increased market penetration (expected impact on earnings).

Curious what makes this valuation so compelling? Discover how a blend of ramped-up manufacturing, new market strategies, and bold earnings targets fuel this forecast. The hidden drivers could surprise you. Find out what future assumptions analysts are betting on.

Result: Fair Value of $429.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or weaker-than-expected revenue growth could quickly challenge the bullish thesis and limit potential upside from this point.

Find out about the key risks to this Ypsomed Holding narrative.

Another View: Market Multiples Tell a Different Story

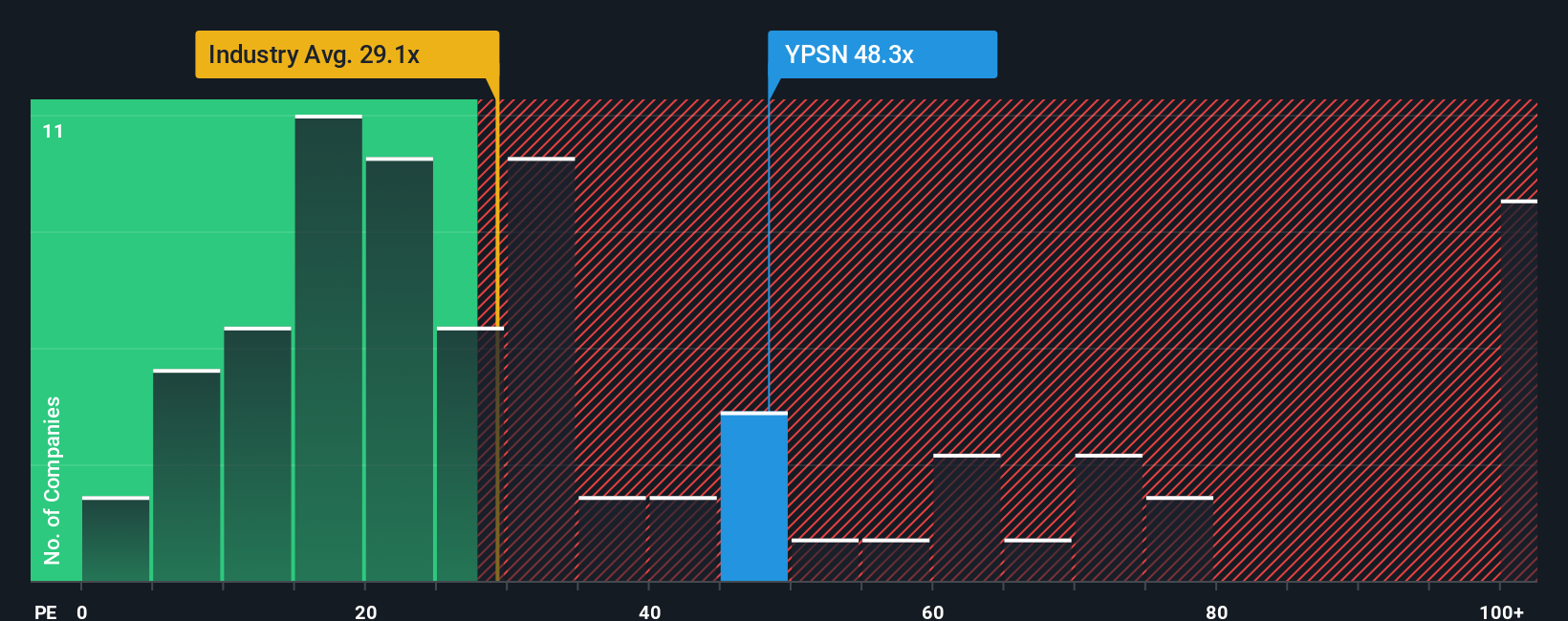

Looking at how the company is priced compared to others, Ypsomed's price-to-earnings ratio stands at 50.3 times, significantly higher than both the European Medical Equipment industry average of 29.1 times and the peer average of 25.5 times. Even when compared with the fair ratio of 34 times, shares appear expensive. This kind of gap could signal valuation risk, but does it mean caution is needed, or is the price justified by future prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ypsomed Holding Narrative

If you see the story shaping up differently, or want to dive deeper into the details, you can build your own narrative from the data in just a few minutes. Do it your way

A great starting point for your Ypsomed Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your opportunities to one company when so much innovation is happening across the market. Check out these dynamic stock ideas before the next big move:

- Tap into robust cash flows and attractive entry points by reviewing these 891 undervalued stocks based on cash flows on the market right now.

- Capitalize on tomorrow’s tech breakthroughs by researching these 24 AI penny stocks fueling rapid change in artificial intelligence.

- Unlock long-term payouts and stability by seeking out these 19 dividend stocks with yields > 3% with consistently strong yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:YPSN

Ypsomed Holding

Develops, manufactures, and sells injection and infusion systems for safe and simple self-medication companies.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives