- Switzerland

- /

- Medical Equipment

- /

- SWX:YPSN

How Ypsomed’s First U.S. Plant Launch (SWX:YPSN) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Swiss medical technology firm Ypsomed Holding AG recently announced plans to open its first U.S. production site in Holly Springs, North Carolina, investing around CHF 200 million in the initial phase and aiming to start U.S. market production by the end of 2027.

- This move marks an important step in Ypsomed's international expansion and positions the company to offer more localized solutions within the significant American medtech market.

- We'll explore how Ypsomed's commitment to building U.S. manufacturing capacity could influence its longer-term growth and operational outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ypsomed Holding Investment Narrative Recap

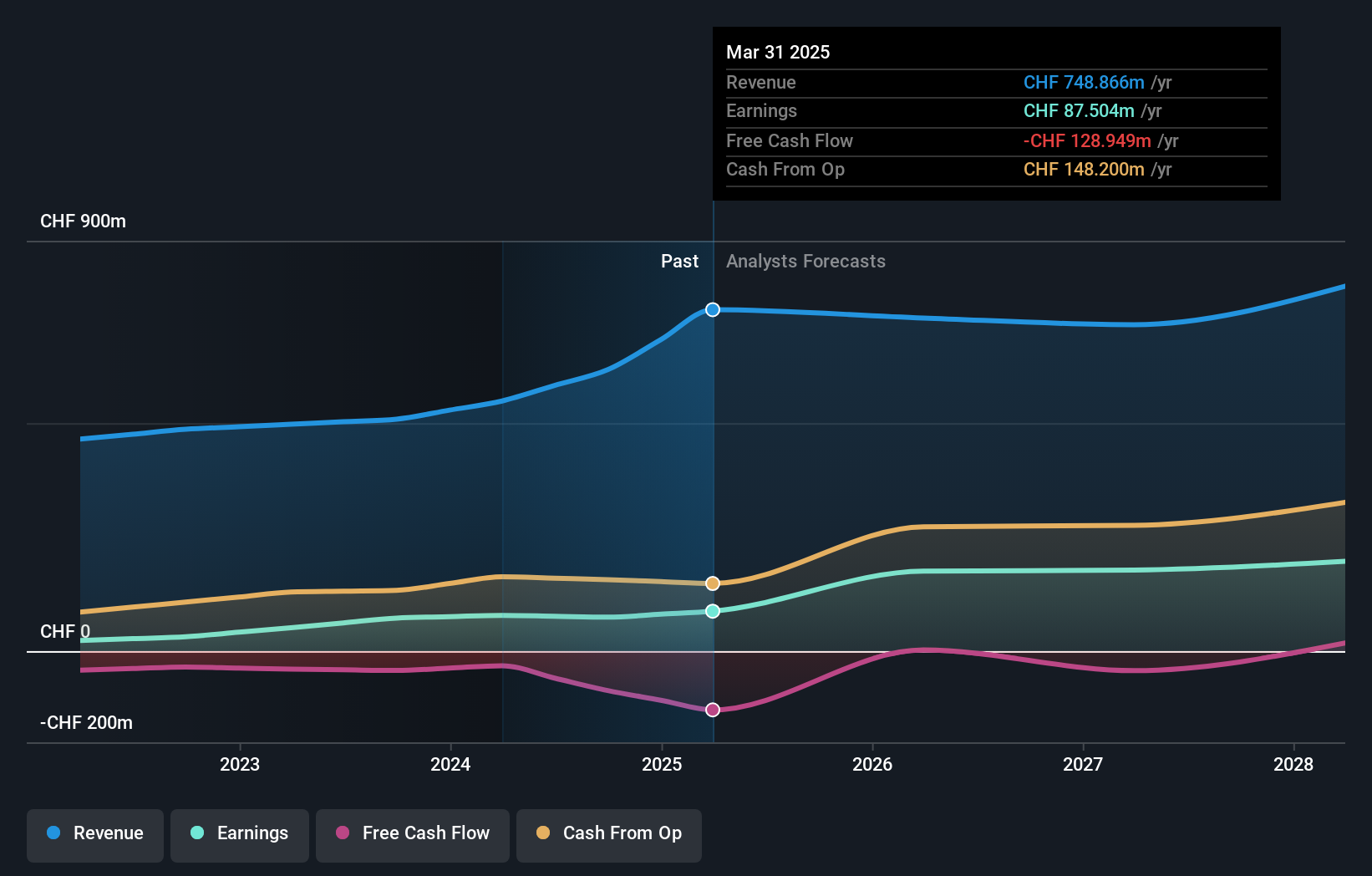

To own Ypsomed Holding stock, you need confidence in its transition to a focused B2B medical technology provider, capable of executing operationally while expanding internationally. The announcement of a major U.S. production facility signals meaningful progress on its expansion catalyst, but does not immediately resolve the key short-term risk: the operational challenge and earnings variability that comes with investing heavily in new capacity while executing a business shift. Overall, the news may support revenue and margin growth longer term, but near-term risks remain substantial. Among recent developments, Ypsomed’s full-year 2025 earnings release is most relevant, showing net income rose to CHF87.5 million from CHF78.37 million the previous year. While healthy profit growth offers reassurance, it also places a spotlight on whether management can sustain this financial momentum as large-scale capital projects and business realignment get underway, all while keeping liquidity and margins in check. In contrast, investors should be aware of how the capacity expansion’s potential to strain cash flows and impact...

Read the full narrative on Ypsomed Holding (it's free!)

Ypsomed Holding's outlook anticipates CHF912.9 million in revenue and CHF248.2 million in earnings by 2028. This scenario is based on annual revenue growth of 6.8% and an earnings increase of CHF160.7 million from the current CHF87.5 million.

Uncover how Ypsomed Holding's forecasts yield a CHF429.92 fair value, a 31% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community has produced two independent fair value estimates for Ypsomed Holding ranging from CHF429.92 to CHF547.93. With the U.S. expansion project raising the stakes on future earnings and operational execution, you can see how perspectives may diverge and why it helps to consider several different viewpoints.

Explore 2 other fair value estimates on Ypsomed Holding - why the stock might be worth as much as 67% more than the current price!

Build Your Own Ypsomed Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ypsomed Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ypsomed Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ypsomed Holding's overall financial health at a glance.

No Opportunity In Ypsomed Holding?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:YPSN

Ypsomed Holding

Develops, manufactures, and sells injection and infusion systems for safe and simple self-medication companies.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives