3 Swiss Companies Possibly Trading Below Their Intrinsic Value By Up To 35.6% On SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland market opened weak Friday morning and kept drifting lower as the day progressed, closing with a more than 1% loss. Investors moved past the Fed's rate hike and awaited the Swiss National Bank's monetary policy announcement next Thursday, where a rate cut is widely expected. In this environment of cautious sentiment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential market inefficiencies. Here are three Swiss companies possibly trading below their intrinsic value by up to 35.6% on SIX Swiss Exchange.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Swissquote Group Holding (SWX:SQN) | CHF303.20 | CHF567.73 | 46.6% |

| ALSO Holding (SWX:ALSN) | CHF270.50 | CHF416.85 | 35.1% |

| Georg Fischer (SWX:GF) | CHF63.80 | CHF112.56 | 43.3% |

| lastminute.com (SWX:LMN) | CHF19.90 | CHF29.71 | 33% |

| Clariant (SWX:CLN) | CHF11.97 | CHF21.33 | 43.9% |

| Comet Holding (SWX:COTN) | CHF313.00 | CHF529.16 | 40.8% |

| Barry Callebaut (SWX:BARN) | CHF1526.00 | CHF2370.57 | 35.6% |

| VAT Group (SWX:VACN) | CHF397.20 | CHF556.80 | 28.7% |

| SGS (SWX:SGSN) | CHF95.56 | CHF144.63 | 33.9% |

| Dätwyler Holding (SWX:DAE) | CHF170.20 | CHF250.30 | 32% |

Underneath we present a selection of stocks filtered out by our screen.

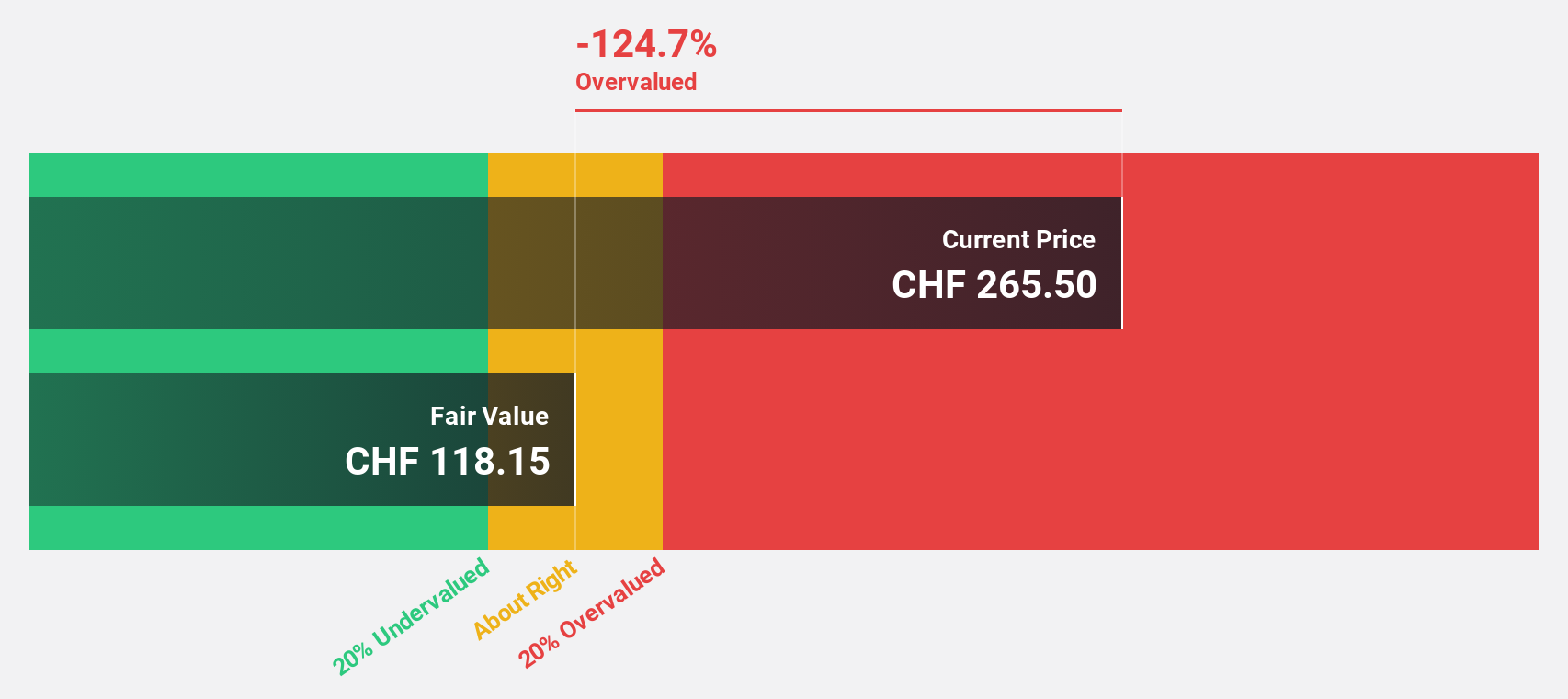

ALSO Holding (SWX:ALSN)

Overview: ALSO Holding AG is a technology services provider for the ICT industry operating in Switzerland, Germany, the Netherlands, Poland, and internationally, with a market cap of CHF3.31 billion.

Operations: ALSO Holding AG generates revenue from Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion).

Estimated Discount To Fair Value: 35.1%

ALSO Holding is trading at CHF270.5, 35.1% below its estimated fair value of CHF416.85, indicating it may be undervalued based on cash flows. Despite a highly volatile share price over the past three months, earnings are forecast to grow significantly at 24% annually, outpacing the Swiss market's growth rate of 11.7%. However, revenue growth is slower than desired at 12% per year and recent earnings reports show a decline in net income to EUR41.66 million from EUR52.53 million last year.

- According our earnings growth report, there's an indication that ALSO Holding might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of ALSO Holding.

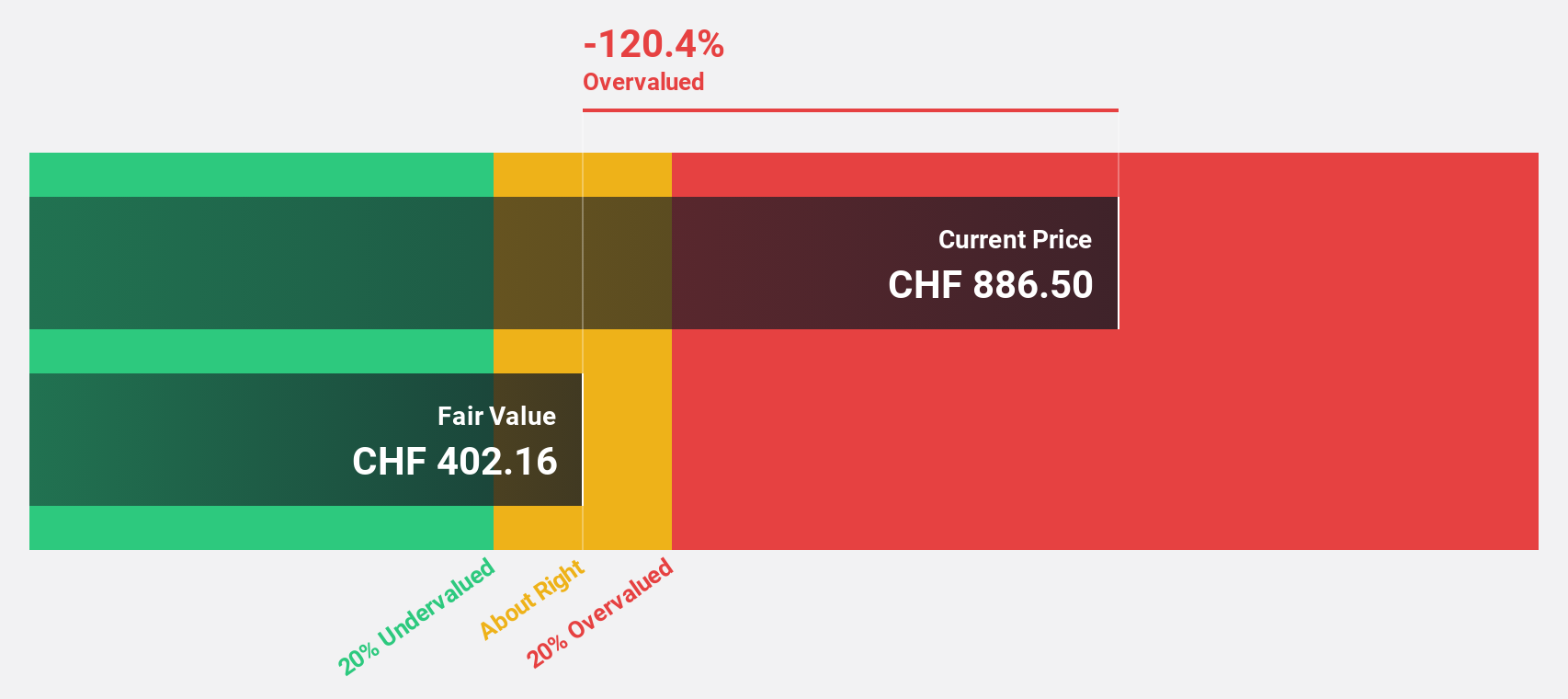

Barry Callebaut (SWX:BARN)

Overview: Barry Callebaut AG, with a market cap of CHF8.35 billion, manufactures and sells chocolate and cocoa products through its subsidiaries.

Operations: The company's revenue segments include Global Cocoa, which generated CHF5.31 billion, and Segment Adjustment amounting to CHF6.76 billion.

Estimated Discount To Fair Value: 35.6%

Barry Callebaut is trading at CHF1526, significantly below its estimated fair value of CHF2370.57, making it highly undervalued based on discounted cash flow analysis. Earnings are forecast to grow 25.27% annually, outpacing the Swiss market's 11.7%. However, the company faces challenges with debt coverage by operating cash flow and a low projected return on equity of 14.8% in three years. Recent presentations at the Baader Investment Conference highlight strategic initiatives aligning with EUDR objectives.

- The growth report we've compiled suggests that Barry Callebaut's future prospects could be on the up.

- Click here to discover the nuances of Barry Callebaut with our detailed financial health report.

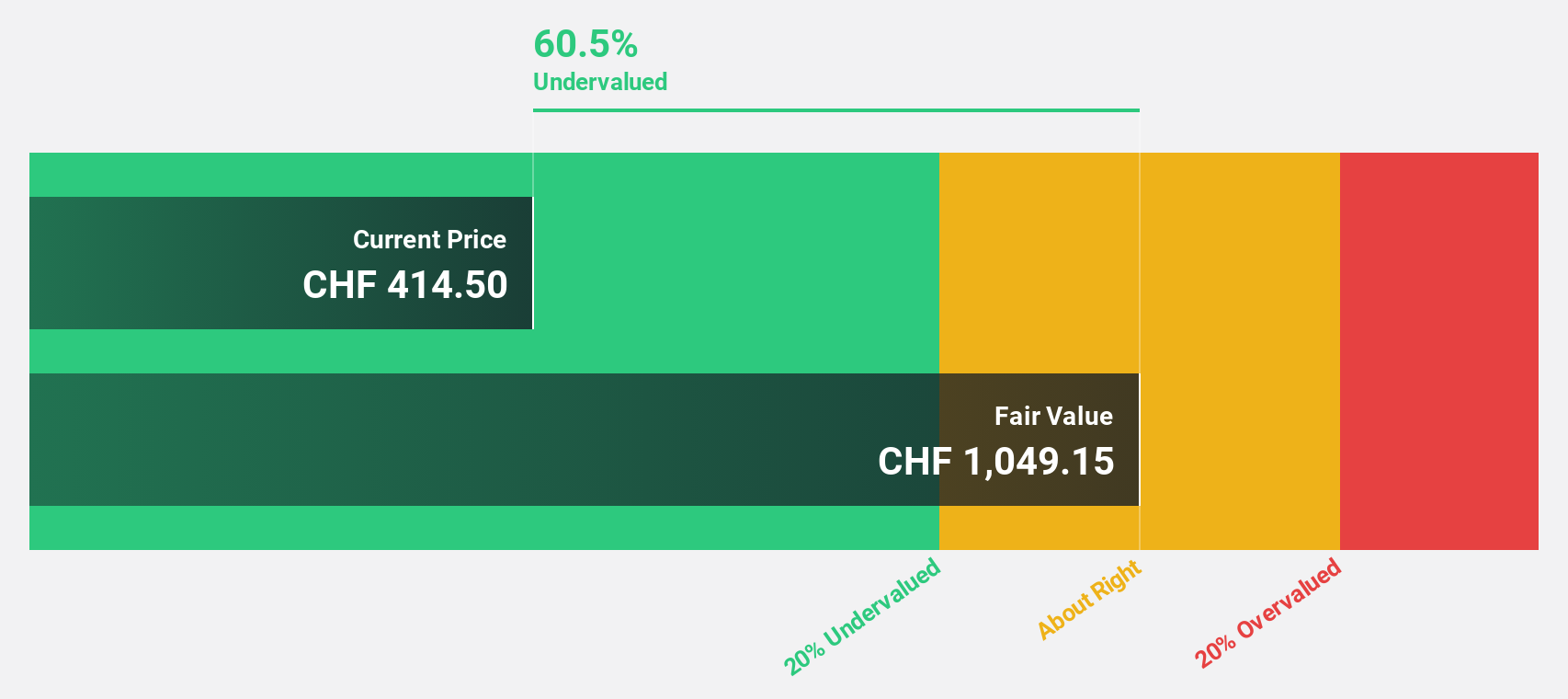

Ypsomed Holding (SWX:YPSN)

Overview: Ypsomed Holding AG, with a market cap of CHF 5.75 billion, develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies through its subsidiaries.

Operations: Revenue Segments: Ypsomed generates revenue primarily from Ypsomed Diabetes Care (CHF 151.05 million) and Ypsomed Delivery Systems (CHF 385.15 million).

Estimated Discount To Fair Value: 21.1%

Ypsomed Holding, trading at CHF421.5, is undervalued by 21.1% based on a fair value estimate of CHF533.91 from discounted cash flow analysis. The company's earnings grew by 52.8% over the past year and are forecast to grow significantly at 33.3% annually, surpassing the Swiss market's 11.7%. Recent news includes a partnership with Astria Therapeutics for an autoinjector development, potentially boosting future revenue streams despite a lower projected return on equity of 17.8%.

- Our comprehensive growth report raises the possibility that Ypsomed Holding is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Ypsomed Holding.

Seize The Opportunity

- Navigate through the entire inventory of 15 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALSN

ALSO Holding

Operates as a technology services provider for the ICT industry in Switzerland, Germany, the Netherlands, Poland, and internationally.

Flawless balance sheet, undervalued and pays a dividend.