- Switzerland

- /

- Medical Equipment

- /

- SWX:STMN

Straumann Holding (SWX:STMN) Eyes Growth with AI Investments and Asian Market Expansion Initiatives

Reviewed by Simply Wall St

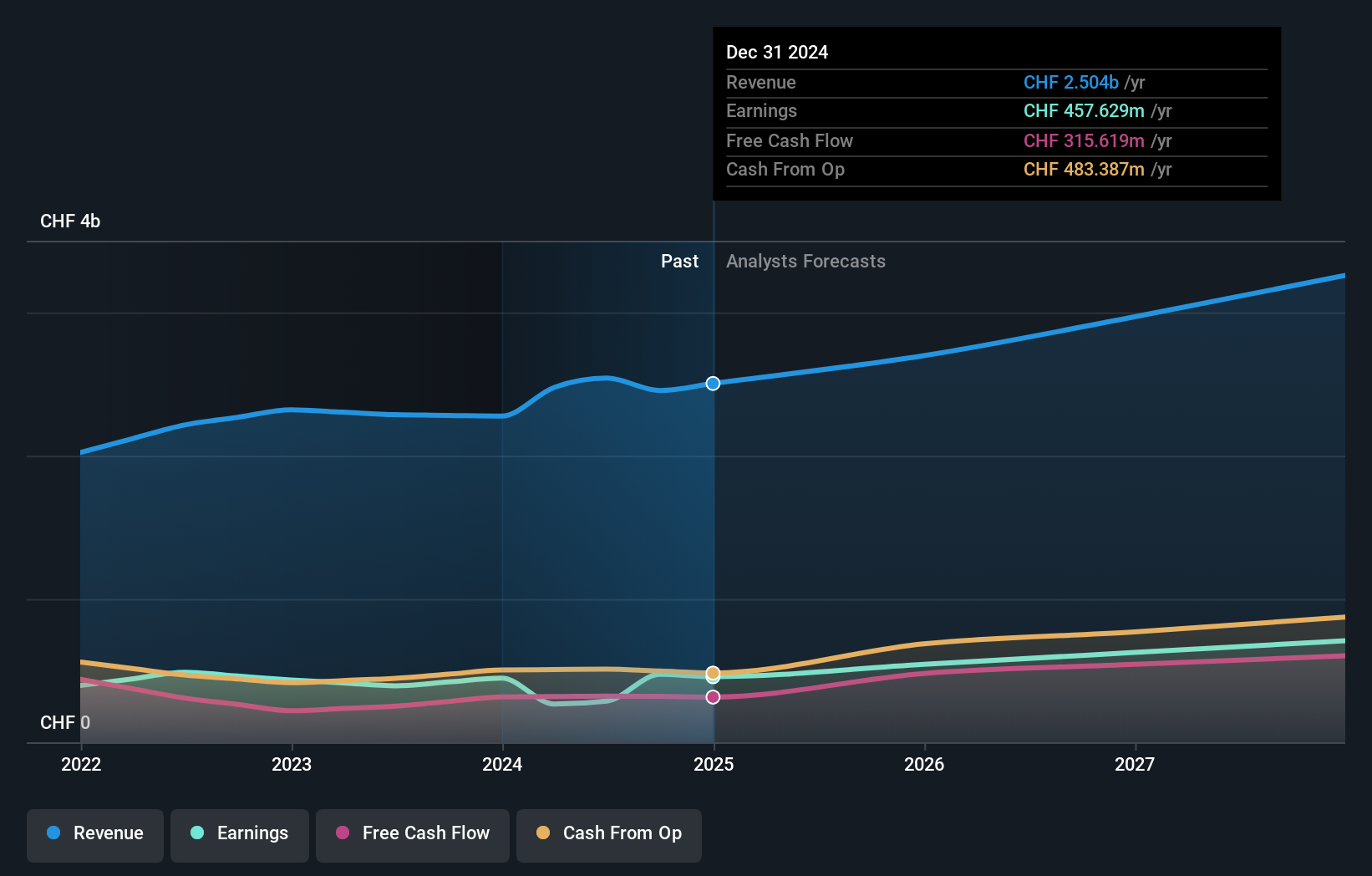

Straumann Holding (SWX:STMN) is positioned for substantial growth, with earnings projected to rise by 20.89% annually and revenue expected to grow by 8.6% per year, outpacing the Swiss market. Despite challenges such as a decline in net profit margin and a significant one-off loss, the company is leveraging opportunities in new markets and investing in AI technology to enhance efficiency. The following report explores Straumann's competitive advantages, critical issues affecting performance, potential growth strategies, and external factors impacting the company.

Click to explore a detailed breakdown of our findings on Straumann Holding.

Competitive Advantages That Elevate Straumann Holding

The company is poised for significant growth, with earnings projected to increase by 20.89% annually. This is complemented by an expected revenue growth of 8.6% per year, surpassing the Swiss market average. Financial health is further underscored by a forecasted Return on Equity of 23% within three years. Additionally, the company maintains a strong balance sheet with more cash than total debt, ensuring that interest payments are comfortably covered by profits. The current share price trades below its estimated fair value, suggesting it may be undervalued despite a high Price-To-Earnings Ratio compared to industry averages.

Critical Issues Affecting the Performance of Straumann Holding and Areas for Growth

Challenges persist, particularly with the net profit margin, which has decreased from 17.3% to 11.3%. The company also experienced a 27% earnings decline over the past year, complicating industry comparisons. Return on Equity, currently at 14.7%, falls short of the 20% threshold, highlighting areas for improvement. A significant one-off loss has also impacted financial results, necessitating strategic adjustments to enhance profitability.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities abound with anticipated earnings growth over the next three years and the potential for revenue to outpace the broader market. The company's strategic exploration of new markets, particularly in Asia, is promising. Investments in AI technology are expected to bolster operational efficiency and customer engagement. The launch of new product lines is designed to capture a larger market segment, diversifying revenue streams and meeting evolving consumer demands.

External Factors Threatening Straumann Holding

Economic uncertainties pose a risk to consumer spending, requiring proactive measures to safeguard sales. Regulatory changes could introduce additional costs and operational complexities, emphasizing the need for strong compliance frameworks. Supply chain vulnerabilities remain a concern, although steps are being taken to enhance resilience against potential disruptions.

Conclusion

Straumann Holding is positioned for substantial growth, with projected annual earnings increases of 20.89% and revenue growth surpassing the Swiss market average. Challenges such as a reduced net profit margin and a recent earnings decline are present, but strategic initiatives like market expansion in Asia and AI investments are set to drive future performance. The company's strong balance sheet and cash reserves ensure financial stability, while the current share price, trading below its estimated fair value, indicates potential for upward movement. This undervaluation, coupled with a high Price-To-Earnings Ratio, suggests that the market may not fully recognize Straumann's growth prospects and financial health, presenting a significant opportunity for investors.

Next Steps

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SWX:STMN

Straumann Holding

Provides tooth replacement and orthodontic solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives