- South Korea

- /

- Entertainment

- /

- KOSE:A352820

February 2025's High Insider Ownership Growth Companies To Consider

Reviewed by Simply Wall St

As global markets continue to react to rising inflation and the anticipation of prolonged restrictive monetary policies, U.S. stock indexes are nearing record highs, with growth stocks outperforming value shares. In this environment, companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's uncover some gems from our specialized screener.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩10.33 trillion.

Operations: The company generates revenue from several segments, including Label (₩1.29 trillion), Platform (₩337.18 million), and Solution (₩1.21 trillion).

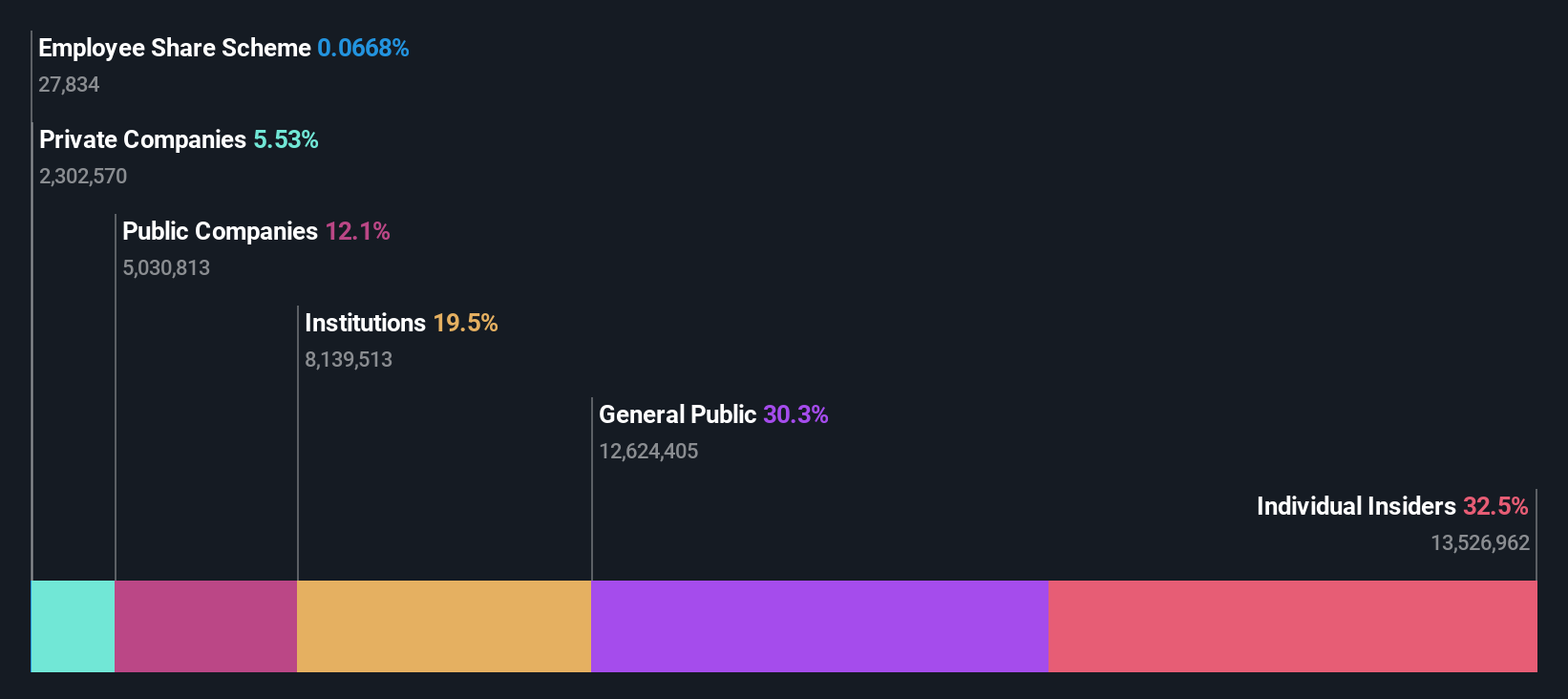

Insider Ownership: 32.5%

Earnings Growth Forecast: 50.8% p.a.

HYBE's revenue is forecast to grow at 17.1% annually, outpacing the Korean market's 8.9%, with earnings expected to rise by 50.83% per year, becoming profitable within three years. Despite trading slightly below fair value and a forecasted low return on equity of 10.8%, insider ownership remains significant, with no recent substantial insider trading activity. Leadership changes aim to bolster sustainable growth and competitiveness in the global music market under Shin Seon-jeong’s new leadership role.

- Click here and access our complete growth analysis report to understand the dynamics of HYBE.

- Our expertly prepared valuation report HYBE implies its share price may be too high.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Straumann Holding AG is a global provider of tooth replacement and orthodontic solutions, with a market cap of CHF20.29 billion.

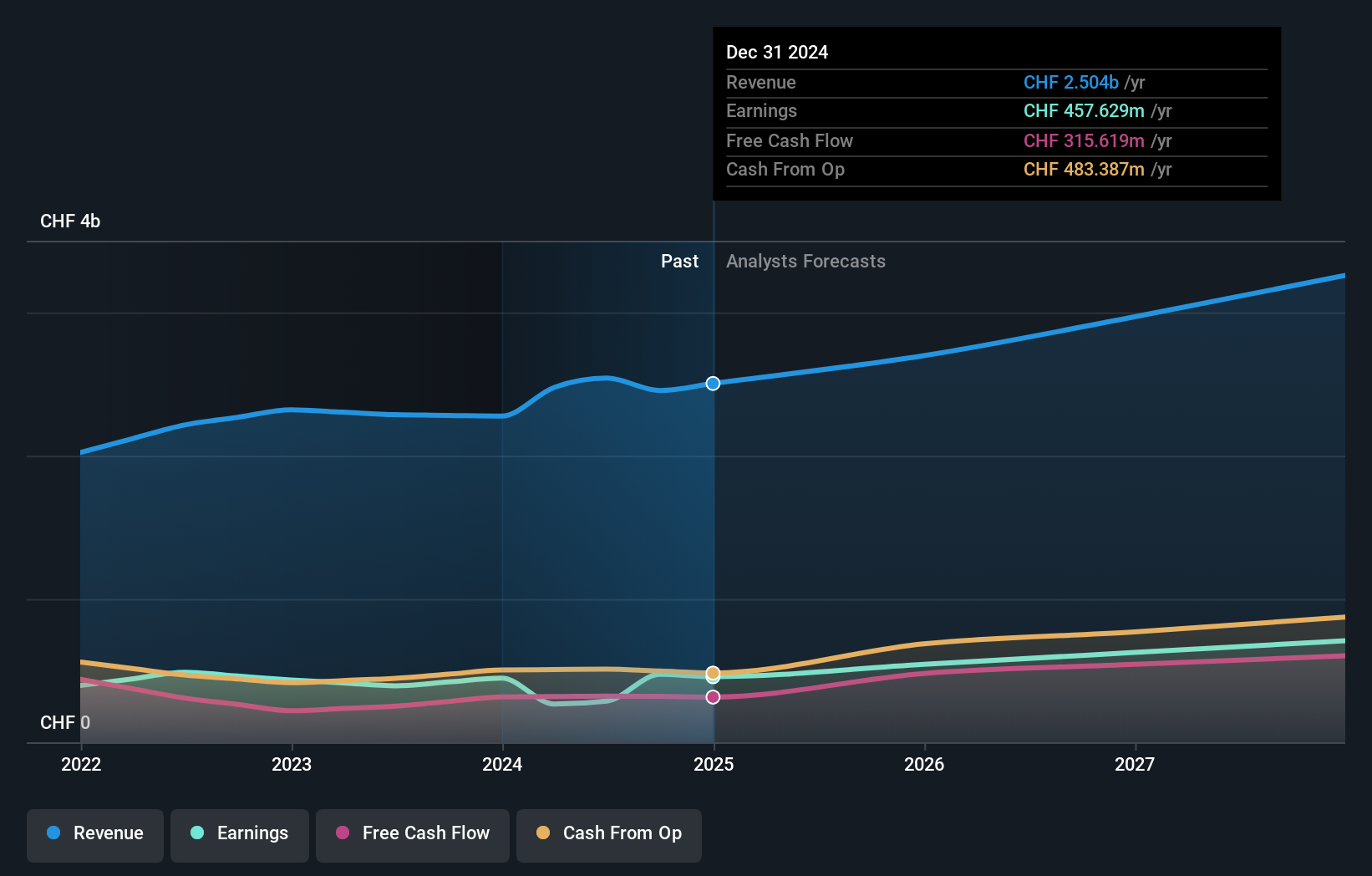

Operations: The company's revenue is derived from several segments, including Sales NAM at CHF800.14 million, Operations contributing CHF1.26 billion, Sales APAC at CHF540.74 million, Sales EMEA with CHF1.20 billion, and Sales LATAM amounting to CHF282.34 million.

Insider Ownership: 32.7%

Earnings Growth Forecast: 19.9% p.a.

Straumann Holding's revenue is projected to grow at 8.9% annually, surpassing the Swiss market's 4.4%, with earnings expected to increase by 19.87% per year, outperforming the market's 11.8%. Although profit margins have decreased from last year, the company maintains high-quality earnings and forecasts a strong return on equity of 22.9% in three years. There has been no substantial insider trading activity recently, indicating stable insider confidence in its growth trajectory.

- Unlock comprehensive insights into our analysis of Straumann Holding stock in this growth report.

- According our valuation report, there's an indication that Straumann Holding's share price might be on the expensive side.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Winning Health Technology Group Co., Ltd. (SZSE:300253) operates in the healthcare technology sector, providing digital solutions and services, with a market cap of CN¥27.08 billion.

Operations: Winning Health Technology Group Co., Ltd. (SZSE:300253) does not have specific revenue segments listed in the provided text.

Insider Ownership: 22.5%

Earnings Growth Forecast: 34.9% p.a.

Winning Health Technology Group's earnings are projected to grow at 34.9% annually, outpacing the Chinese market's 25.1%, while revenue growth is expected at 19.2% per year, slightly below the significant growth threshold. Despite a volatile share price and low future return on equity forecast of 10.2%, its price-to-earnings ratio of 75.2x remains attractive compared to industry peers. The recent completion of a CNY 79.99 million share buyback underscores management's confidence in long-term value creation despite no substantial insider trading activity recently.

- Click here to discover the nuances of Winning Health Technology Group with our detailed analytical future growth report.

- Our valuation report here indicates Winning Health Technology Group may be overvalued.

Key Takeaways

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1459 more companies for you to explore.Click here to unveil our expertly curated list of 1462 Fast Growing Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives