- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

3 Value Stock Picks On The SIX Swiss Exchange For Potential Capital Growth

Reviewed by Simply Wall St

The Switzerland market ended modestly higher on Friday after a somewhat choppy session, with investors largely reacting to earnings updates and improved consumer sentiment. In this context of cautious optimism, identifying undervalued stocks can offer potential capital growth opportunities for discerning investors.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1148.00 | CHF1821.71 | 37% |

| Georg Fischer (SWX:GF) | CHF62.20 | CHF111.91 | 44.4% |

| Swissquote Group Holding (SWX:SQN) | CHF278.60 | CHF412.07 | 32.4% |

| Clariant (SWX:CLN) | CHF12.20 | CHF21.52 | 43.3% |

| Temenos (SWX:TEMN) | CHF55.75 | CHF79.95 | 30.3% |

| lastminute.com (SWX:LMN) | CHF17.80 | CHF29.85 | 40.4% |

| Gurit Holding (SWX:GURN) | CHF42.85 | CHF73.08 | 41.4% |

| SGS (SWX:SGSN) | CHF91.78 | CHF144.37 | 36.4% |

| VAT Group (SWX:VACN) | CHF408.00 | CHF557.16 | 26.8% |

| Dätwyler Holding (SWX:DAE) | CHF177.40 | CHF251.54 | 29.5% |

We'll examine a selection from our screener results.

Partners Group Holding (SWX:PGHN)

Overview: Partners Group Holding AG is a private equity firm specializing in direct, secondary, and primary investments across private equity, real estate, infrastructure, and debt with a market cap of CHF29.20 billion.

Operations: Revenue segments include CHF1.17 billion from Private Equity, CHF379.20 million from Infrastructure, CHF211.30 million from Private Credit, and CHF186.90 million from Real Estate.

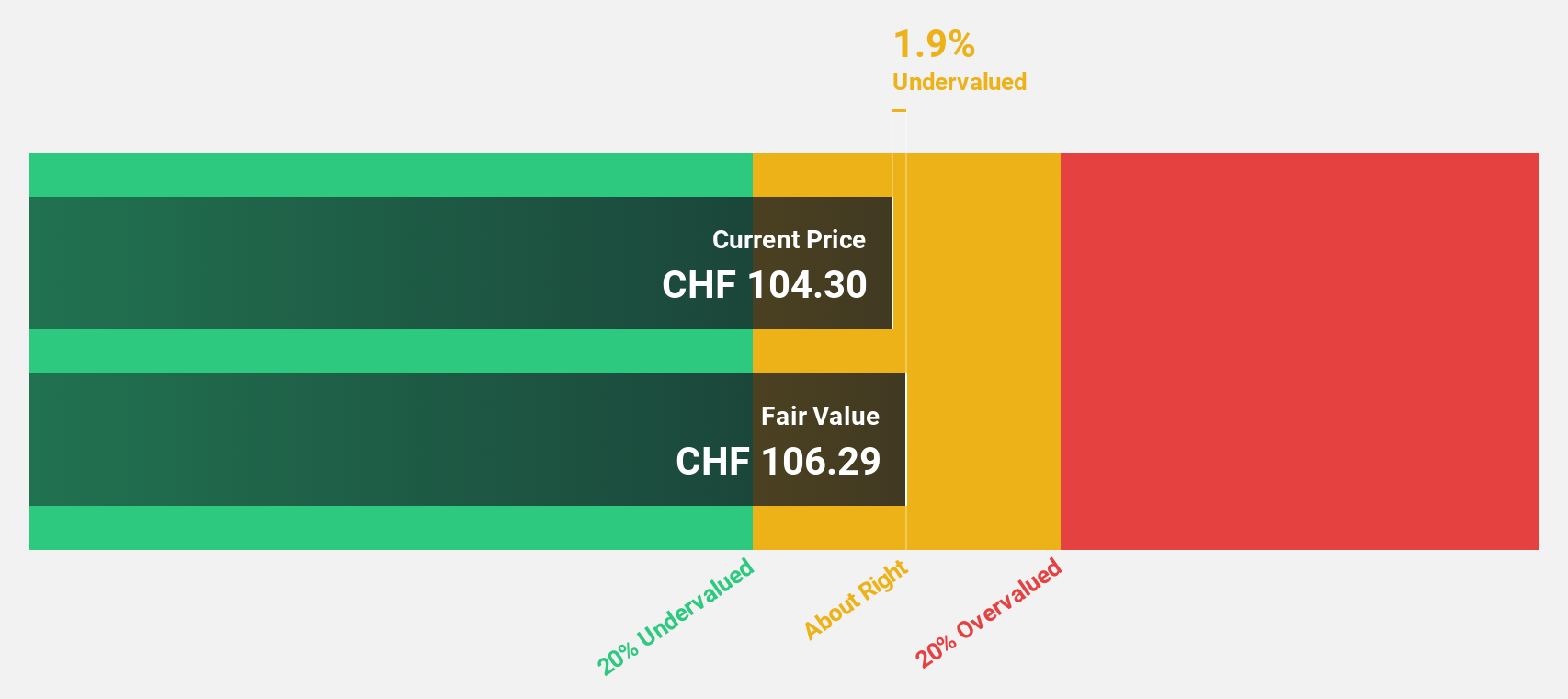

Estimated Discount To Fair Value: 14.2%

Partners Group Holding AG (PGHN) is trading at CHF1124, which is 14.1% below its estimated fair value of CHF1309.09 based on discounted cash flow analysis. The company's earnings are forecast to grow at 13.5% per year, outpacing the Swiss market's average growth rate of 9.1%. Despite high debt levels and a dividend yield of 3.47% that isn't well-covered by earnings or free cash flows, PGHN's strong revenue growth and robust return on equity projections make it an attractive candidate for undervalued stocks based on cash flows in Switzerland.

- The growth report we've compiled suggests that Partners Group Holding's future prospects could be on the up.

- Dive into the specifics of Partners Group Holding here with our thorough financial health report.

Straumann Holding (SWX:STMN)

Overview: Straumann Holding AG, with a market cap of CHF17.78 billion, provides tooth replacement and orthodontic solutions worldwide.

Operations: Straumann Holding AG's revenue segments include CHF1.17 billion from Sales Europe, Middle East and Africa (EMEA), CHF1.20 billion from Operations, CHF793.05 million from Sales North America (NAM), CHF451.27 million from Sales Asia Pacific (APAC), and CHF265.82 million from Sales Latin America (LATAM).

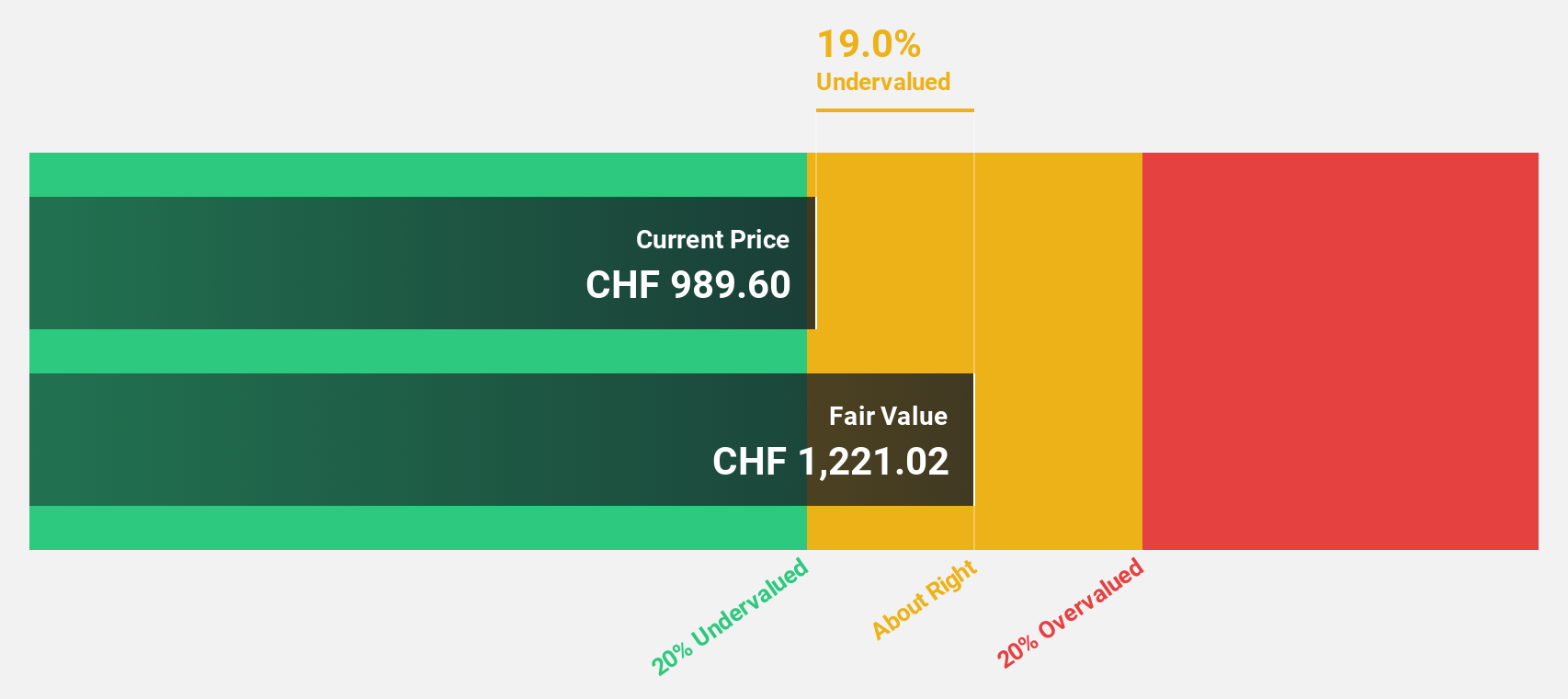

Estimated Discount To Fair Value: 20.6%

Straumann Holding (CHF111.5) is trading 20.6% below its estimated fair value of CHF140.38, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 20.84% per year, outpacing the Swiss market's average growth rate of 9.1%. However, profit margins have decreased from 18.7% to 10.2%, and large one-off items have impacted financial results, which investors should consider when evaluating the stock's potential.

- Our earnings growth report unveils the potential for significant increases in Straumann Holding's future results.

- Unlock comprehensive insights into our analysis of Straumann Holding stock in this financial health report.

Temenos (SWX:TEMN)

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally and has a market cap of CHF4.04 billion.

Operations: Temenos AG's revenue segments include software licensing ($383.54 million), maintenance ($437.46 million), and services ($293.10 million).

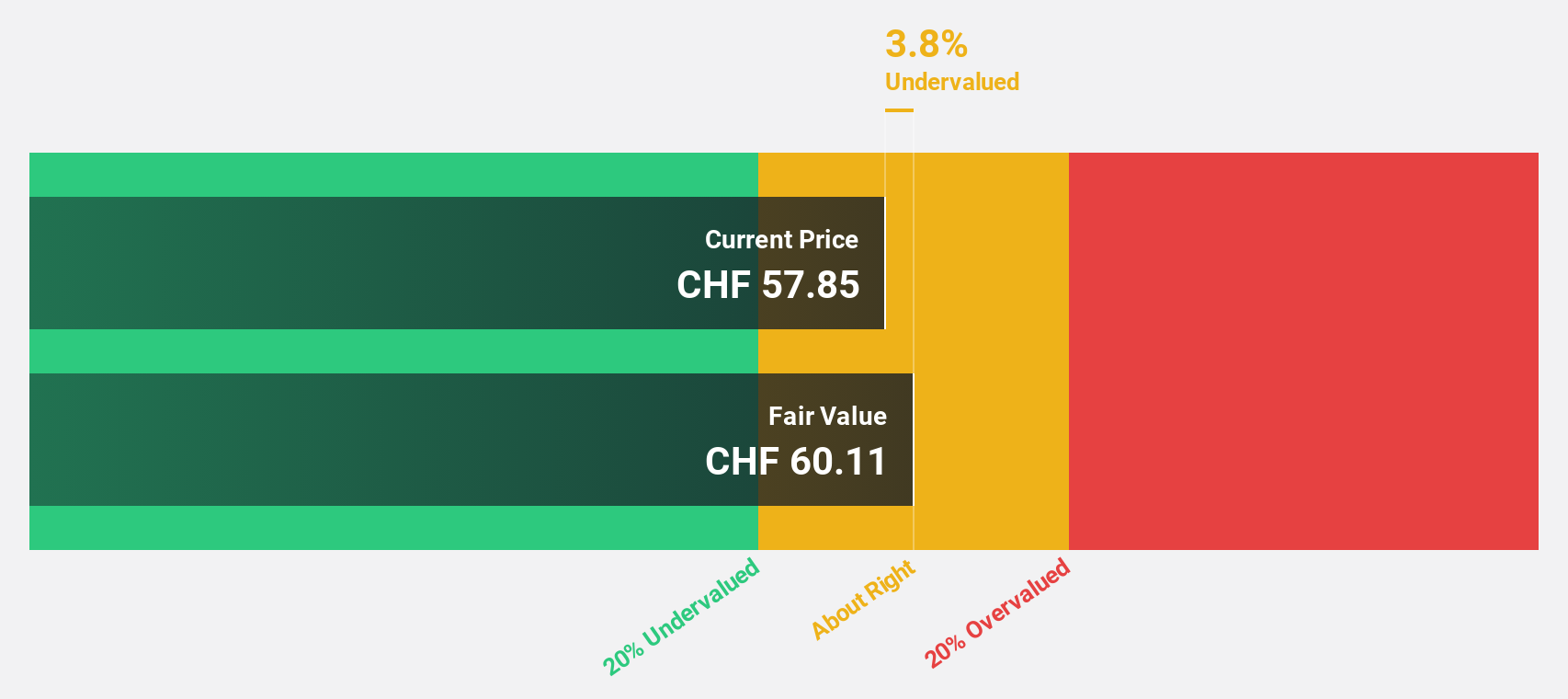

Estimated Discount To Fair Value: 30.3%

Temenos (CHF55.75) is trading 30.3% below its estimated fair value of CHF79.95, making it potentially undervalued based on cash flows. Recent executive appointments aim to drive growth in SaaS and the US market, while the company considers selling its fund management unit for EUR 600 million to bolster finances. Despite a slight dip in Q2 net income, earnings are forecast to grow at 14.32% per year, faster than the Swiss market's average of 9.1%.

- Our expertly prepared growth report on Temenos implies its future financial outlook may be stronger than recent results.

- Take a closer look at Temenos' balance sheet health here in our report.

Key Takeaways

- Unlock more gems! Our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener has unearthed 15 more companies for you to explore.Click here to unveil our expertly curated list of 18 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Solid track record with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives