- China

- /

- Semiconductors

- /

- SZSE:300458

3 Global Growth Stocks With Insider Ownership Up To 37%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising consumer inflation and mixed economic signals, major indices like the S&P 500 and Nasdaq have achieved new highs, buoyed by strong corporate earnings. In such an environment, growth companies with significant insider ownership can be particularly appealing to investors seeking alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Pharma Mar (BME:PHM) | 11.8% | 43.3% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.6% |

| KebNi (OM:KEBNI B) | 38.3% | 94.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★☆☆

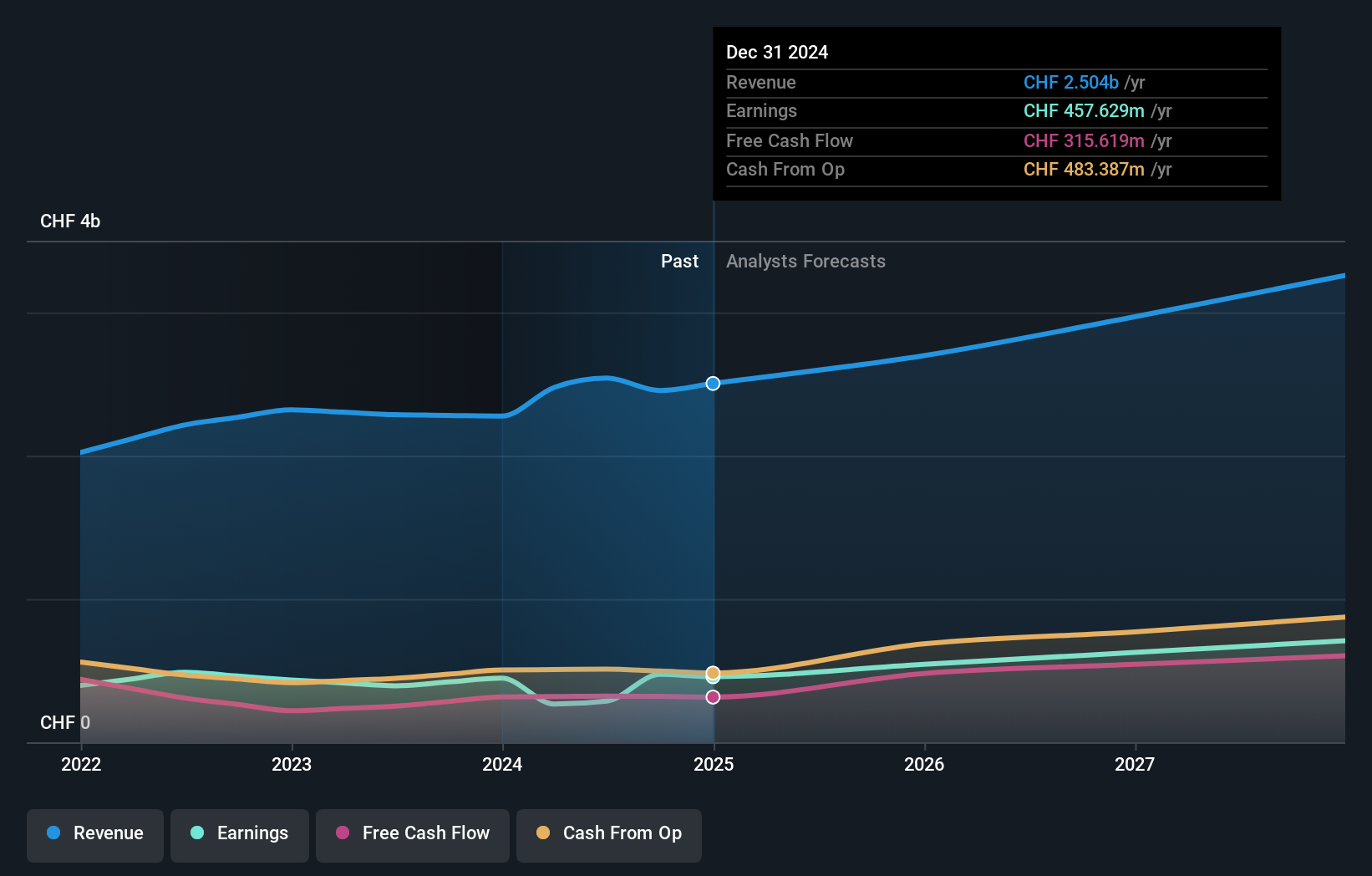

Overview: Straumann Holding AG is a global provider of tooth replacement and orthodontic solutions with a market cap of CHF16.86 billion.

Operations: Straumann's revenue is primarily derived from sales in Europe, the Middle East and Africa (CHF1.11 billion), North America (CHF791.79 million), Asia Pacific (CHF592.70 million), and Latin America (CHF290.28 million).

Insider Ownership: 32.3%

Straumann Holding demonstrates solid growth potential with earnings increasing 16.4% annually over the past five years and forecasted to grow at 13.17% per year, outpacing the Swiss market's 10.9%. The company's Return on Equity is expected to reach a high of 23.1%, indicating efficient management and profitability potential. Despite no substantial insider trading activity recently, Straumann remains slightly undervalued, trading just below its estimated fair value, while revenue growth surpasses market expectations at 9.4% annually.

- Dive into the specifics of Straumann Holding here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Straumann Holding's share price might be too optimistic.

Allwinner TechnologyLtd (SZSE:300458)

Simply Wall St Growth Rating: ★★★★★☆

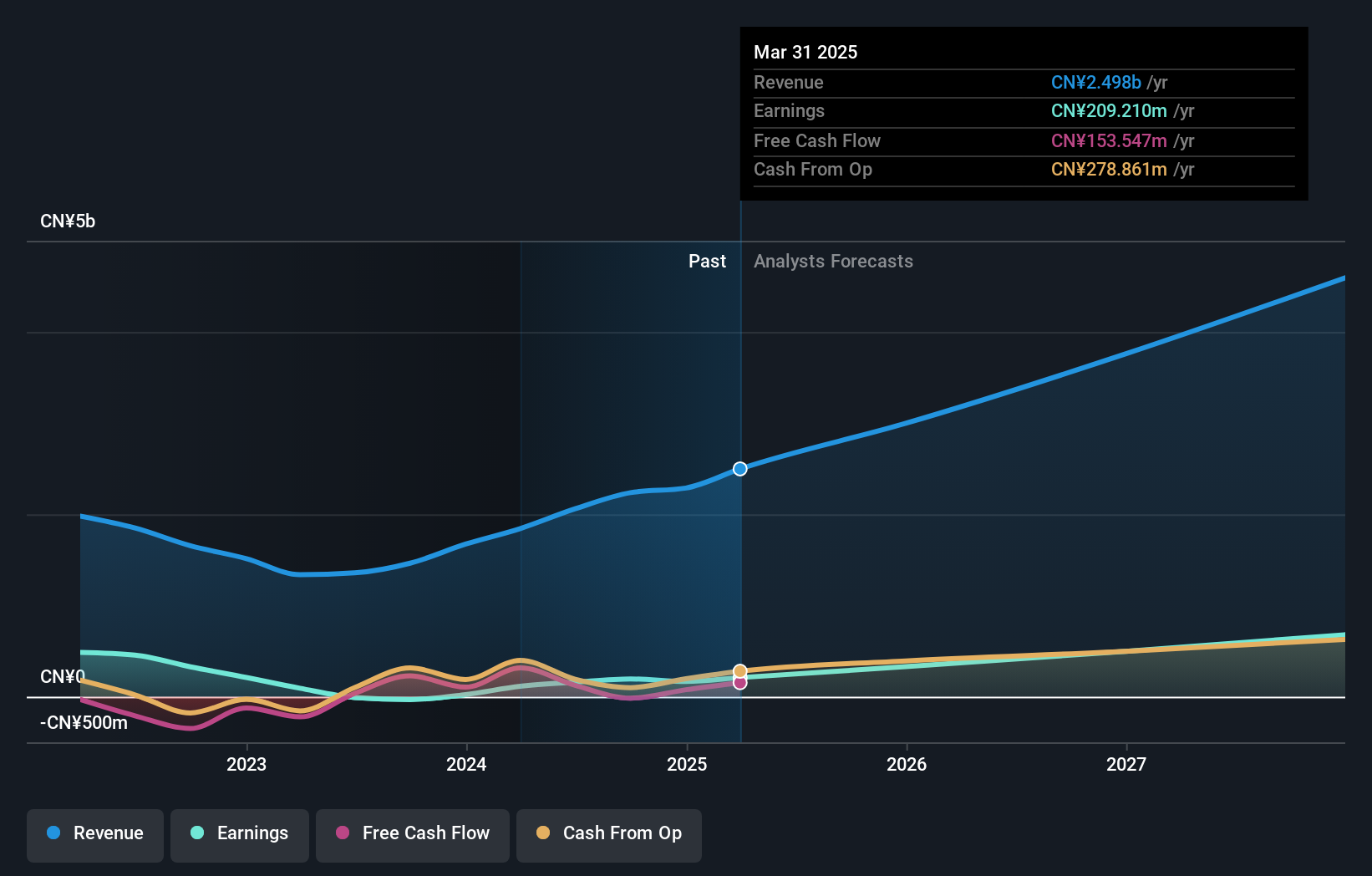

Overview: Allwinner Technology Co., Ltd. engages in the research, development, design, manufacture, and sale of intelligent application SoC, analog components, and wireless interconnect chips in China with a market cap of CN¥32.44 billion.

Operations: The company generates revenue from its Integrated Circuit Design segment, amounting to CN¥2.50 billion.

Insider Ownership: 37.4%

Allwinner Technology Ltd. showcases promising growth prospects with earnings expected to grow significantly at 39.9% annually, surpassing the CN market's 23.4%. The company's revenue is also forecasted to rise by 22.1% per year, outpacing the market's 12.5%. Recent earnings results for Q1 showed a substantial increase in net income to CNY 91.55 million from CNY 49.09 million last year, reflecting strong operational performance despite low projected Return on Equity of 15.2%.

- Navigate through the intricacies of Allwinner TechnologyLtd with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Allwinner TechnologyLtd is trading beyond its estimated value.

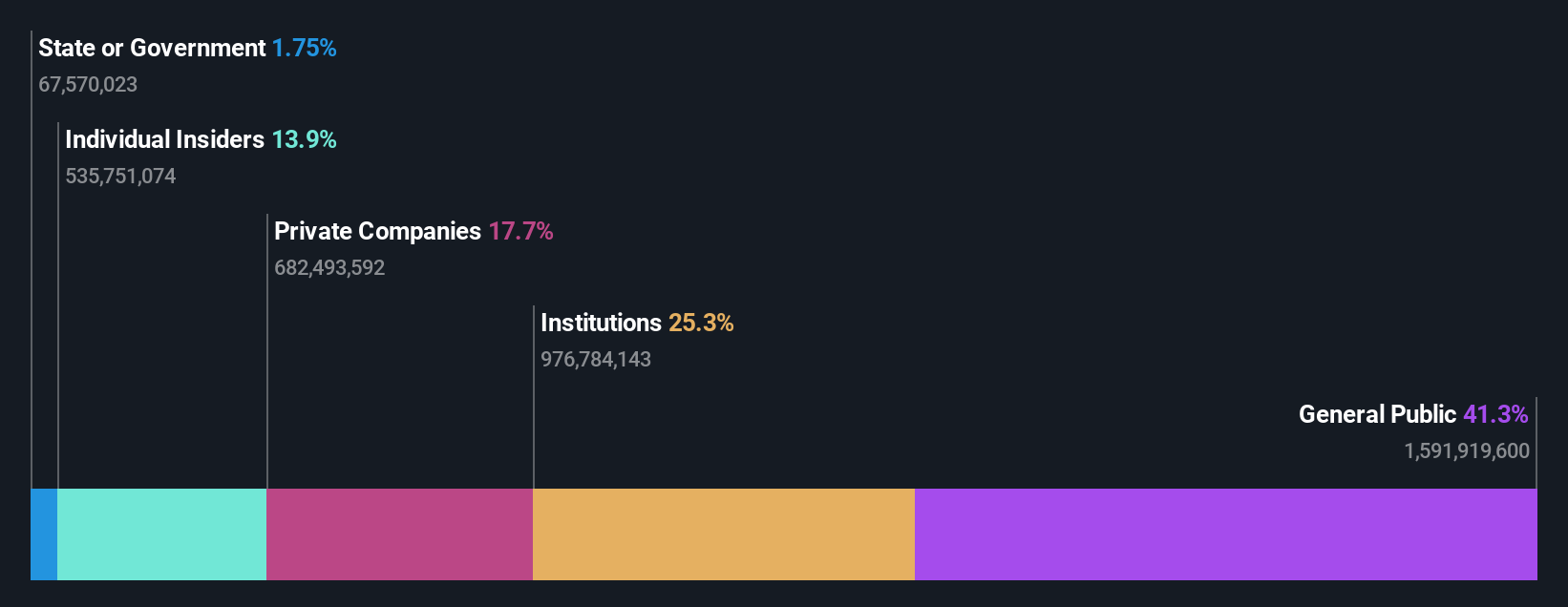

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of laptop computers and telecommunication products, with operations in the United States, Mainland China, the Netherlands, Japan, and other international markets; it has a market cap of NT$1.05 trillion.

Operations: The company's revenue primarily comes from the Electronics Sector, which generated NT$3.40 billion.

Insider Ownership: 13.9%

Quanta Computer's growth trajectory is supported by a robust partnership with Lumus, enhancing its AR market presence through dedicated production lines and automation. Despite earnings forecasted to grow at 11.18% annually, slower than the broader TW market, revenue expectations are strong at 23.9% per year. The stock trades significantly below its estimated fair value, offering good relative value compared to peers. Recent insider ownership changes reflect strategic governance shifts without substantial insider trading activity noted recently.

- Take a closer look at Quanta Computer's potential here in our earnings growth report.

- According our valuation report, there's an indication that Quanta Computer's share price might be on the cheaper side.

Key Takeaways

- Explore the 812 names from our Fast Growing Global Companies With High Insider Ownership screener here.

- Ready For A Different Approach? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300458

Allwinner TechnologyLtd

Researches, develops, designs, manufactures, and sells intelligent application SoC, analog components, and wireless interconnect chips in China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives