- Switzerland

- /

- Healthcare Services

- /

- SWX:SHLTN

3 European Penny Stocks With Market Caps Over €20M To Watch

Reviewed by Simply Wall St

Amid cautious optimism in Europe, the pan-European STOXX Europe 600 Index edged higher as investors weighed developments in U.S. trade policy and efforts to resolve the Russia-Ukraine conflict. In this context, penny stocks—often smaller or newer companies—remain a relevant investment area for those seeking opportunities beyond traditional equities. These stocks can offer affordability and growth potential, especially when backed by strong financials, making them worth watching for those interested in discovering hidden value within the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.85 | SEK288.69M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.255 | €312.08M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.952 | €31.88M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.70 | €53.03M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.85 | SEK288.5M | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.06 | SEK1.97B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.43 | €24.77M | ★★★★★☆ |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.10 | €88.61M | ★★★★★☆ |

| Scana (OB:SCANA) | NOK2.30 | NOK1.06B | ★★★★★★ |

Click here to see the full list of 431 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Alpcot Holding (OM:ALPCOT B)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alpcot Holding AB (publ) operates a digital platform for personal finance in Sweden's financial industry, with a market cap of SEK160 million.

Operations: Alpcot Holding AB (publ) does not report any specific revenue segments.

Market Cap: SEK160M

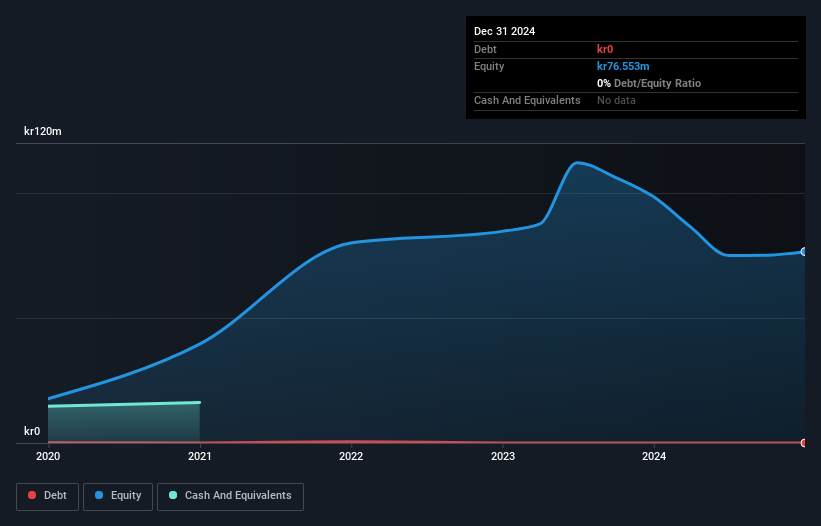

Alpcot Holding AB, a digital platform operator in Sweden's financial industry, remains pre-revenue with a market cap of SEK160 million. Despite being unprofitable and having experienced increased losses for the full year 2024, the company reported a modest net income of SEK 0.608 million in Q4 compared to a significant loss previously. The firm is debt-free and its short-term assets comfortably cover both short- and long-term liabilities. However, it faces challenges such as high share price volatility and an inexperienced management team with an average tenure of just over one year.

- Jump into the full analysis health report here for a deeper understanding of Alpcot Holding.

- Understand Alpcot Holding's track record by examining our performance history report.

SHL Telemedicine (SWX:SHLTN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SHL Telemedicine Ltd. develops and markets personal telemedicine solutions across Israel, Europe, and internationally, with a market cap of CHF36.06 million.

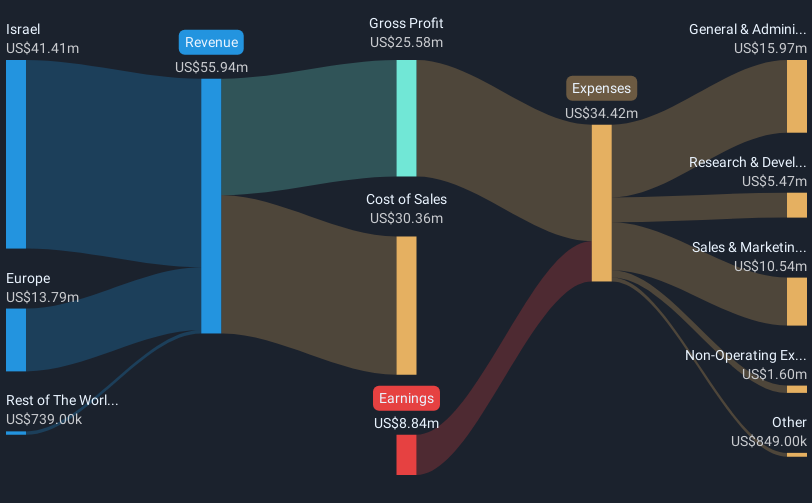

Operations: The company's revenue is derived entirely from its Telemedicine Services segment, totaling $55.94 million.

Market Cap: CHF36.06M

SHL Telemedicine Ltd., with a market cap of CHF36.06 million, is navigating challenges typical for penny stocks, including high share price volatility and unprofitability. The company has seen its losses increase by 42.8% annually over the past five years, but it maintains financial stability with short-term assets exceeding liabilities and more cash than debt. Recent strategic moves include an expanded partnership with DocGo Inc., enhancing its SmartHeart ECG device's reach in underserved U.S. markets, and appointing seasoned CFO Lior Haalman to strengthen financial operations amidst an inexperienced management team averaging 1.8 years in tenure.

- Dive into the specifics of SHL Telemedicine here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into SHL Telemedicine's track record.

Francotyp-Postalia Holding (XTRA:FPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Francotyp-Postalia Holding AG offers business mail and digital solutions for businesses and authorities both in Germany and internationally, with a market cap of €37.81 million.

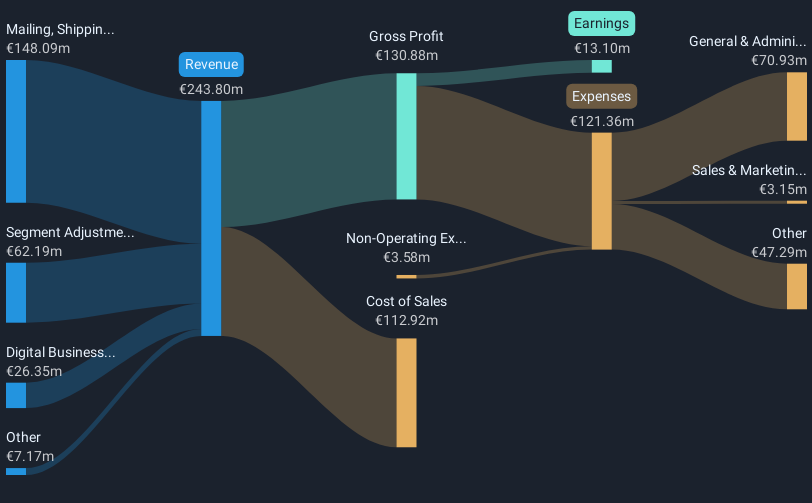

Operations: The company's revenue is derived from its Digital Business Solutions segment, which generated €26.35 million, and its Mailing, Shipping & Office Solutions segment, which contributed €148.09 million.

Market Cap: €37.81M

Francotyp-Postalia Holding AG, with a market cap of €37.81 million, demonstrates characteristics common in penny stocks. Its short-term assets of €89.5 million comfortably cover both short and long-term liabilities, indicating financial stability despite the volatile nature of such investments. The company has achieved significant earnings growth over the past year at 424.2%, surpassing its five-year average growth rate and outperforming industry benchmarks. However, future earnings are expected to decline by an average of 29.8% annually over the next three years, posing a potential risk for investors seeking sustained growth in this segment.

- Get an in-depth perspective on Francotyp-Postalia Holding's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Francotyp-Postalia Holding's future.

Seize The Opportunity

- Jump into our full catalog of 431 European Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SHLTN

SHL Telemedicine

Develops and markets personal telemedicine solutions in Israel, Europe, and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives