- Switzerland

- /

- Medical Equipment

- /

- SWX:MEDX

Shareholders 41% loss in medmix (VTX:MEDX) partly attributable to the company's decline in earnings over past year

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the medmix AG (VTX:MEDX) share price is down 42% in the last year. That falls noticeably short of the market decline of around 6.4%. We wouldn't rush to judgement on medmix because we don't have a long term history to look at.

The recent uptick of 7.3% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for medmix

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

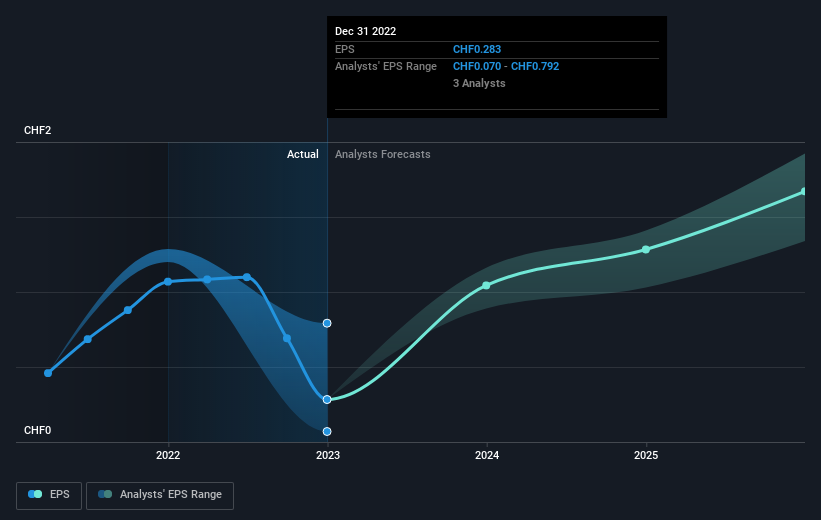

Unfortunately medmix reported an EPS drop of 74% for the last year. This fall in the EPS is significantly worse than the 42% the share price fall. It may have been that the weak EPS was not as bad as some had feared. Indeed, with a P/E ratio of 67.30 there is obviously some real optimism that earnings will bounce back.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into medmix's key metrics by checking this interactive graph of medmix's earnings, revenue and cash flow.

A Different Perspective

medmix shareholders are down 41% for the year (even including dividends), even worse than the market loss of 6.4%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 8.4% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand medmix better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with medmix (including 1 which shouldn't be ignored) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MEDX

medmix

Designs, produces, and sells high-precision devices and services in Switzerland and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives