- Switzerland

- /

- Medical Equipment

- /

- SWX:ALC

Should Efficiency Gains From UNITY VCS Prompt Action From Alcon (SWX:ALC) Investors?

Reviewed by Simply Wall St

- Alcon recently announced results from time and motion studies showing that its UNITY® Vitreoretinal Cataract System (VCS) delivers measurable efficiency gains in vitreoretinal and cataract surgeries compared to established systems, with findings presented at major ophthalmology congresses in September 2025.

- The studies highlight Alcon’s commitment to addressing global challenges in eye care, particularly as the rising prevalence of conditions like age-related macular degeneration and diabetes puts pressure on surgical capacity and workflow efficiency.

- We'll explore how these efficiency gains from UNITY VCS might influence Alcon's longer-term market positioning and investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Alcon Investment Narrative Recap

To own Alcon stock, you need conviction in the company’s ability to out-innovate competitors and leverage global demographic shifts driving demand for eye care. While recent UNITY® VCS time and motion studies demonstrate clear gains in surgical efficiency, these results are not likely to transform near-term financial catalysts or offset the biggest challenge: persistent margin and competitive pressures in intraocular lenses and international markets.

Among the latest company news, Alcon’s FDA approval for TRYPTYR® represents an important milestone, targeting the expanding dry eye market. This is distinct from the UNITY VCS update, but together, these launches show that Alcon remains focused on pipeline growth to reinforce its existing product pillars as it faces slower core surgical market growth.

Yet, while new products impress, investors should be aware that international competitive pressures...

Read the full narrative on Alcon (it's free!)

Alcon's narrative projects $12.5 billion in revenue and $1.7 billion in earnings by 2028. This requires 7.5% yearly revenue growth and a $0.6 billion increase in earnings from the current $1.1 billion.

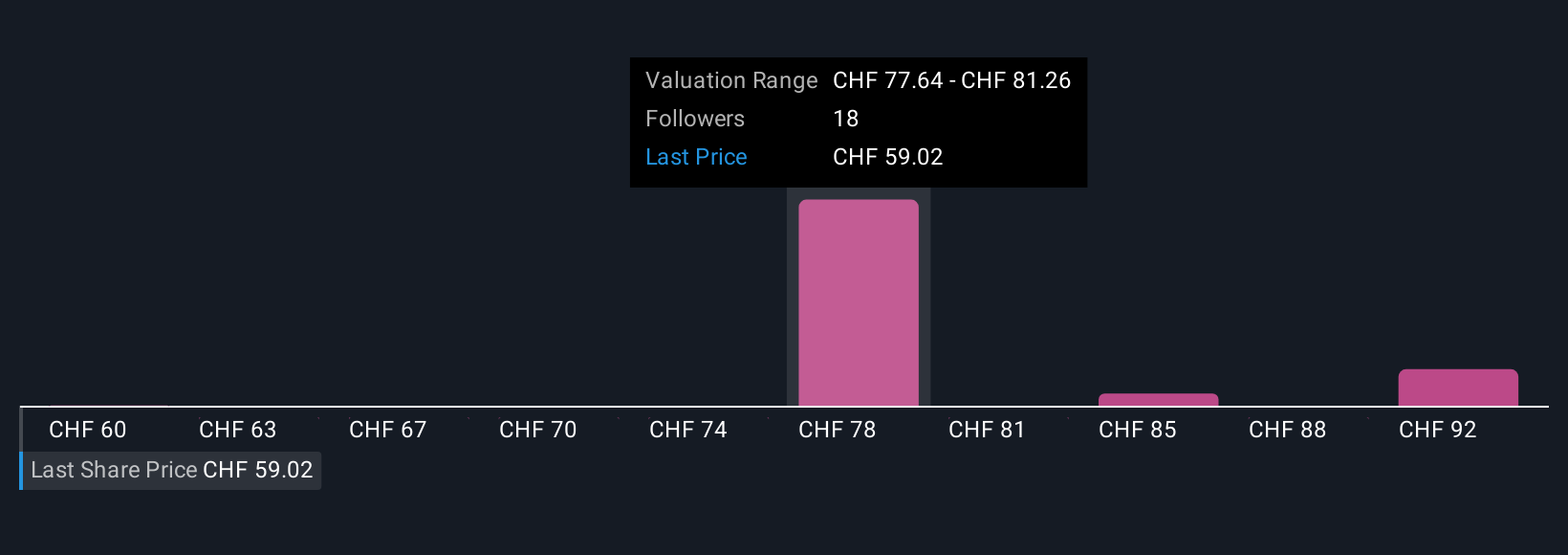

Uncover how Alcon's forecasts yield a CHF81.30 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Six different Simply Wall St Community fair value estimates for Alcon range from CHF59.56 to CHF93.87. Despite recent innovation, competition in key markets could still affect how future performance aligns with these varied investor outlooks.

Explore 6 other fair value estimates on Alcon - why the stock might be worth as much as 53% more than the current price!

Build Your Own Alcon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alcon research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Alcon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alcon's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALC

Alcon

Researches, develops, manufactures, distributes, and sells eye care products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives