- Switzerland

- /

- Food

- /

- SWX:ORON

Here's Why We Think ORIOR AG's (VTX:ORON) CEO Compensation Looks Fair for the time being

Key Insights

- ORIOR to hold its Annual General Meeting on 19th of April

- Total pay for CEO Daniel Lutz includes CHF408.4k salary

- Total compensation is similar to the industry average

- Over the past three years, ORIOR's EPS fell by 1.6% and over the past three years, the total shareholder return was 13%

The share price of ORIOR AG (VTX:ORON) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. The upcoming AGM on 19th of April may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

View our latest analysis for ORIOR

Comparing ORIOR AG's CEO Compensation With The Industry

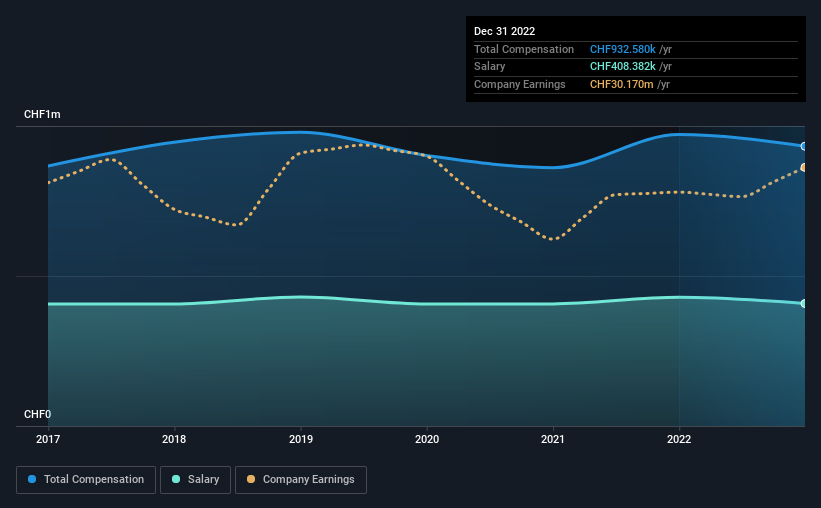

Our data indicates that ORIOR AG has a market capitalization of CHF543m, and total annual CEO compensation was reported as CHF933k for the year to December 2022. That's slightly lower by 4.0% over the previous year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CHF408k.

On examining similar-sized companies in the Swiss Food industry with market capitalizations between CHF359m and CHF1.4b, we discovered that the median CEO total compensation of that group was CHF826k. From this we gather that Daniel Lutz is paid around the median for CEOs in the industry. Moreover, Daniel Lutz also holds CHF510k worth of ORIOR stock directly under their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CHF408k | CHF429k | 44% |

| Other | CHF524k | CHF542k | 56% |

| Total Compensation | CHF933k | CHF971k | 100% |

On an industry level, around 44% of total compensation represents salary and 56% is other remuneration. ORIOR is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

ORIOR AG's Growth

Over the last three years, ORIOR AG has shrunk its earnings per share by 1.6% per year. Its revenue is up 3.7% over the last year.

The lack of EPS growth is certainly uninspiring. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has ORIOR AG Been A Good Investment?

ORIOR AG has generated a total shareholder return of 13% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for ORIOR that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:ORON

ORIOR

Operates as a food and beverage company in Switzerland and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives