- Switzerland

- /

- Food

- /

- SWX:NESN

The Bull Case For Nestlé (SWX:NESN) Could Change Following Chocolate Price Hikes Driven by Cocoa Cost Surge

Reviewed by Sasha Jovanovic

- In the past week, Nestlé and other major chocolate producers raised consumer prices in response to higher cocoa input costs stemming from supply disruptions in West Africa, crop diseases, and new US tariffs, as reported by Wells Fargo.

- This widespread price adjustment underscores how global supply chain challenges and shifting commodity markets are directly shaping pricing strategies for leading brands like Nestlé.

- We'll explore how Nestlé’s recent chocolate price hikes amid rising cocoa costs could influence its earnings outlook and profit margins.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nestlé Investment Narrative Recap

To be a Nestlé shareholder, you need to believe in long-term consumer demand for trusted food brands and the company’s ability to balance cost inflation against its global scale and brand portfolio. The recent chocolate price hikes, triggered by surging cocoa costs and supply shocks, directly address the most important short-term catalyst, margin recovery, but also re-emphasize the biggest risk: whether further cost pressures can be offset if input volatility persists. The net impact is material in the current context.

Among recent announcements, the July 24 earnings reaffirmation stands out: Nestlé maintained its organic sales growth guidance for 2025 despite higher input costs. This steady outlook, following swift price actions in confectionery, shows how proactive pricing is central to its earnings resilience, though margin headwinds from commodity swings remain in sharp focus for investors.

By contrast, investors should also be aware that persistent margin pressure from ongoing commodity spikes and currency movements could...

Read the full narrative on Nestlé (it's free!)

Nestlé's outlook anticipates CHF96.0 billion in revenue and CHF12.0 billion in earnings by 2028. This implies a 1.8% annual revenue growth rate and an earnings increase of CHF1.7 billion from the current CHF10.3 billion.

Uncover how Nestlé's forecasts yield a CHF86.23 fair value, a 14% upside to its current price.

Exploring Other Perspectives

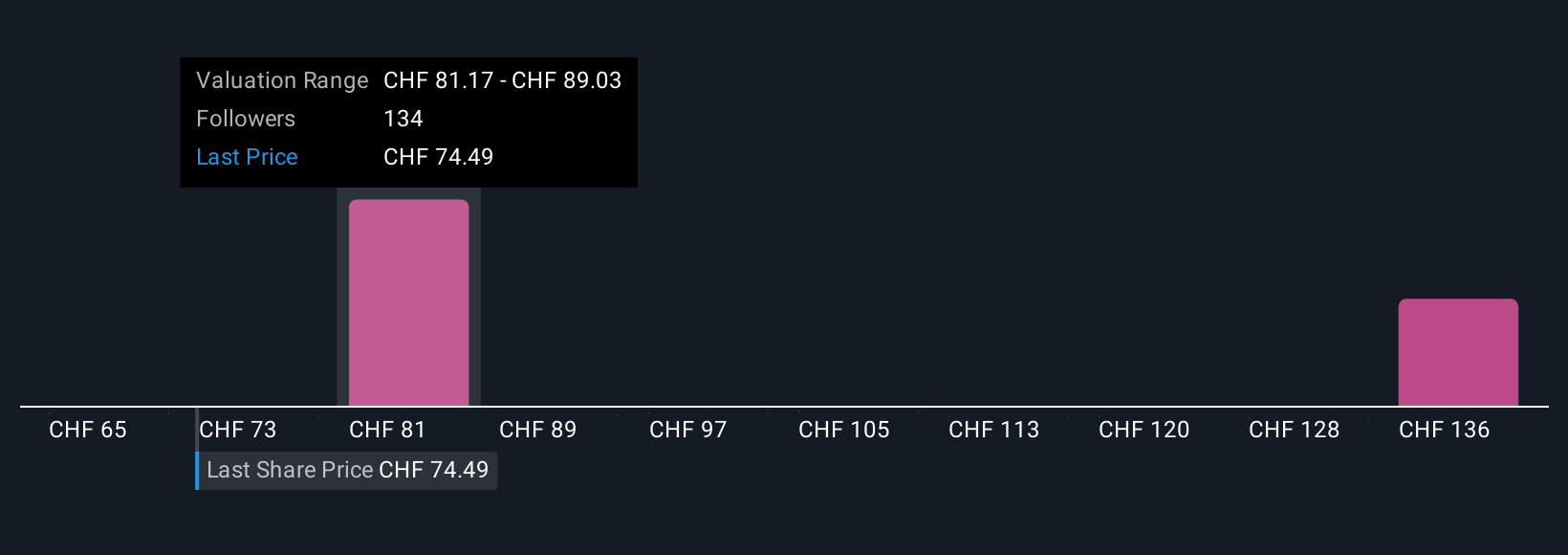

Nineteen community valuations for Nestlé range from CHF65.45 to CHF144.03, showcasing significant disagreement on fair value. While many see upside, ongoing margin pressure from higher cocoa and input costs may weigh on operating results, see how others assess these risks and opportunities.

Explore 19 other fair value estimates on Nestlé - why the stock might be worth as much as 90% more than the current price!

Build Your Own Nestlé Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nestlé research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nestlé research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nestlé's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nestlé might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NESN

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives