- Switzerland

- /

- Food

- /

- SWX:LISN

Pinning Down Chocoladefabriken Lindt & Sprüngli AG's (VTX:LISN) P/E Is Difficult Right Now

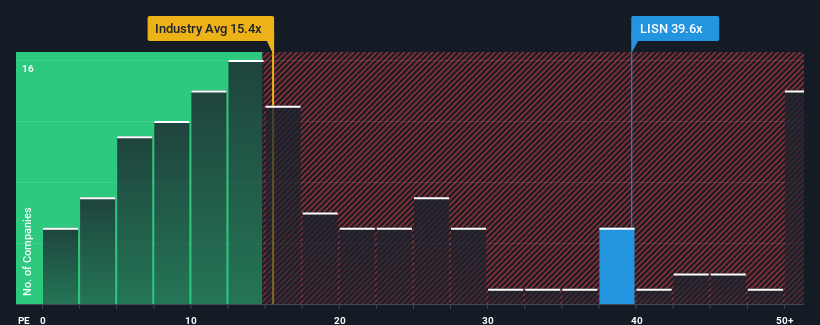

When close to half the companies in Switzerland have price-to-earnings ratios (or "P/E's") below 18x, you may consider Chocoladefabriken Lindt & Sprüngli AG (VTX:LISN) as a stock to avoid entirely with its 39.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Chocoladefabriken Lindt & Sprüngli certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Chocoladefabriken Lindt & Sprüngli

Is There Enough Growth For Chocoladefabriken Lindt & Sprüngli?

In order to justify its P/E ratio, Chocoladefabriken Lindt & Sprüngli would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 46% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 5.3% per annum over the next three years. With the market predicted to deliver 8.7% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's alarming that Chocoladefabriken Lindt & Sprüngli's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Chocoladefabriken Lindt & Sprüngli's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chocoladefabriken Lindt & Sprüngli currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Chocoladefabriken Lindt & Sprüngli with six simple checks.

If you're unsure about the strength of Chocoladefabriken Lindt & Sprüngli's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Chocoladefabriken Lindt & Sprüngli, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:LISN

Chocoladefabriken Lindt & Sprüngli

Engages in the manufacture and sale of chocolate products worldwide.

Excellent balance sheet with acceptable track record.