- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

Why You Might Be Interested In UBS Group AG (VTX:UBSG) For Its Upcoming Dividend

UBS Group AG (VTX:UBSG) is about to trade ex-dividend in the next 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Thus, you can purchase UBS Group's shares before the 30th of April in order to receive the dividend, which the company will pay on the 3rd of May.

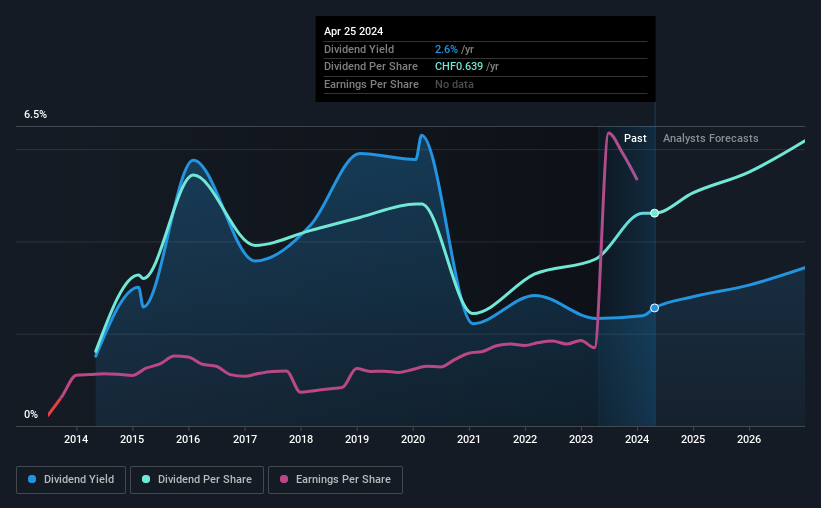

The company's next dividend payment will be US$0.70 per share, and in the last 12 months, the company paid a total of US$0.70 per share. Based on the last year's worth of payments, UBS Group stock has a trailing yield of around 2.6% on the current share price of CHF024.96. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for UBS Group

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. UBS Group is paying out just 7.9% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see UBS Group has grown its earnings rapidly, up 48% a year for the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, UBS Group has increased its dividend at approximately 11% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

Final Takeaway

Has UBS Group got what it takes to maintain its dividend payments? Typically, companies that are growing rapidly and paying out a low fraction of earnings are keeping the profits for reinvestment in the business. This strategy can add significant value to shareholders over the long term - as long as it's done without issuing too many new shares. We think this is a pretty attractive combination, and would be interested in investigating UBS Group more closely.

In light of that, while UBS Group has an appealing dividend, it's worth knowing the risks involved with this stock. To that end, you should learn about the 4 warning signs we've spotted with UBS Group (including 1 which doesn't sit too well with us).

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion