- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

UBS (SWX:UBSG) Profit Margin Surge Reinforces Bullish Narratives Despite $4.2B One-Off Loss

Reviewed by Simply Wall St

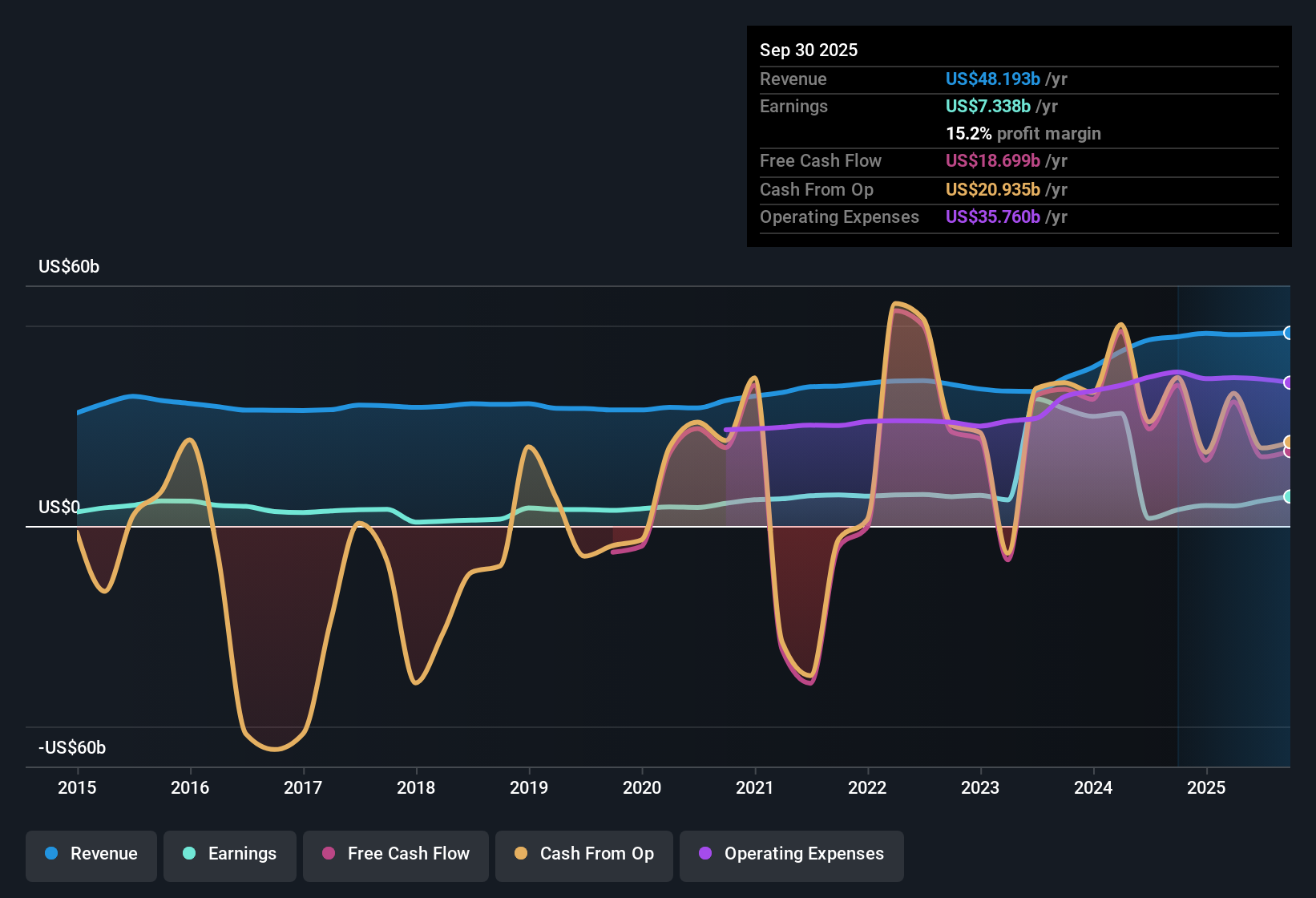

UBS Group (SWX:UBSG) reported net profit margins of 15.2%, a leap from 8.5% a year ago, and posted 81.8% earnings growth over the past year, substantially higher than its five-year average growth of 6.8% per year. Investors are weighing these strong results and an earnings growth forecast of 17.8% per year, which outpaces the Swiss market's 10.6% expectation, against the reality of a large, non-recurring $4.2 billion loss that affected recent results and ongoing concerns about dividend sustainability and earnings quality.

See our full analysis for UBS Group.Next up, we’ll put these headline numbers in context by comparing them with the prevailing narrative among Simply Wall St users, looking for both confirmation and surprises.

See what the community is saying about UBS Group

Credit Suisse Integration Delivers Cost Synergies

- Operational efficiency gains are materializing, with the ongoing integration of Credit Suisse tracking ahead of schedule and delivering meaningful cost savings that are set to boost margins in the coming years.

- According to the analysts' consensus view, platform migration and deeper operational streamlining are expected to increase net margins and enhance UBS's long-term earnings potential.

- This narrative is anchored by the expectation that profit margins will rise from 13.4% today to 24.3% over three years, signaling substantial upside.

- Consensus also highlights improving return on equity as UBS extracts cost synergies and scales its business globally.

- With global leadership in wealth management and strong asset flows in key regions, UBS is positioned for higher recurring revenues and diversified income streams as favorable demographic and market trends accelerate.

Consensus narrative points to long-term margin expansion as cost cuts and digital investments reshape UBS’s profitability. See how analysts weigh the risks in the full consensus narrative. 📊 Read the full UBS Group Consensus Narrative.

One-Off $4.2B Loss Clouds Earnings Quality

- The most recent twelve months include a significant non-recurring $4.2 billion loss, which undermined reported profits and highlights the potential volatility of headline results.

- Consensus narrative cautions that this event, together with ongoing restructuring charges from the Credit Suisse merger, raises key questions around the quality and sustainability of UBS’s improving net margins.

- Bearish voices within the consensus warn that further integration costs and regulatory risks could erode margin gains before they fully accrue to earnings.

- Persistent scrutiny around dividend sustainability and legal risk is flagged as a drag on shareholder returns until integration risks are resolved.

Valuation Trade-Off: Discount to Peers, Tight to Target

- UBS’s share price (CHF30.68) remains below DCF fair value (CHF34.39) and trades at a price-to-earnings ratio of 16.5x, lower than both the European Capital Markets industry average (16.6x) and nearest peers (21.5x).

- Consensus narrative notes the market is pricing UBS roughly in line with analyst targets. The CHF30.68 share price sits just 1% below the consensus target of CHF33.35, implying limited near-term upside given the current visibility and ongoing integration risks.

- Consensus also calls out conflicting analyst expectations, with targets ranging from CHF21.00 to CHF39.50, reflecting uncertainty around both future profitability and sector risk appetite.

- Analysts expect earnings to reach $12.8 billion by September 2028, but anticipate a decline in the PE ratio to 12.6x as growth is absorbed and sector multiples normalize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UBS Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Noticed something new in the results? Share your insights in just minutes and help shape how UBS’s story unfolds. Do it your way

A great starting point for your UBS Group research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite UBS’s robust margin gains, investors face continued uncertainty around dividend sustainability, earnings quality, and legal risks following the Credit Suisse merger.

If dependable dividend income is your priority, consider focusing on these 2002 dividend stocks with yields > 3% and find companies that offer consistent, attractive yields with fewer payout concerns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives