- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

Executive Reshuffle and AI Focus Could Be a Game Changer for UBS Group (SWX:UBSG)

Reviewed by Sasha Jovanovic

- UBS Group AG recently announced a significant executive reshuffle, including the appointment of its first Chief Artificial Intelligence Officer and key leadership changes, as part of its ongoing integration of Credit Suisse.

- This leadership transition signals a deepened focus on technology and risk management, reflecting UBS’s commitment to transformation as it completes one of the industry’s largest mergers.

- We'll examine how leadership changes and a heightened emphasis on artificial intelligence may influence UBS Group's long-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

UBS Group Investment Narrative Recap

To be a UBS Group AG shareholder, you need to believe in the long-term benefits of the Credit Suisse integration and UBS's push to lead in digital and AI-driven wealth management. Recent executive changes, including appointments to technology and compliance leadership, support this narrative but do not materially change the biggest near-term catalyst: realizing cost savings from the merger. The main risk, prolonged integration challenges and potential disruptions in client retention, remains unchanged by these news developments.

Among recent announcements, the appointment of Daniele Magazzeni as Chief Artificial Intelligence Officer stands out. This move underscores UBS's priority to scale AI across its operations, which could be important for competitive differentiation and operational efficiency as the integration with Credit Suisse continues.

In contrast, investors should not lose sight of the persistent execution risk in merger integrations, especially as UBS enters a critical phase in consolidating Credit Suisse’s...

Read the full narrative on UBS Group (it's free!)

UBS Group's outlook projects $52.8 billion in revenue and $12.8 billion in earnings by 2028. This is based on a 4.0% annual revenue growth rate and a $6.5 billion increase in earnings from the current $6.3 billion.

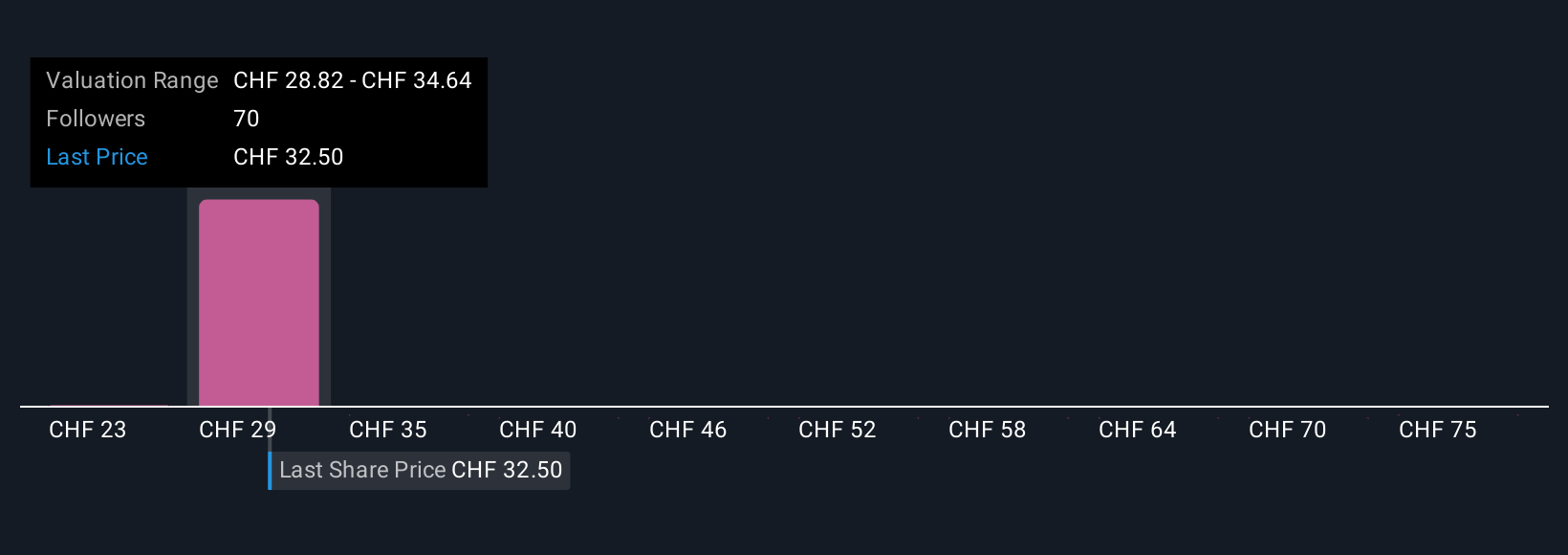

Uncover how UBS Group's forecasts yield a CHF33.35 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided six fair value estimates for UBS, ranging from CHF23.21 to CHF81.19 per share. Many are weighing these views against UBS’s ongoing integration efforts and execution risks, inviting you to explore a broad spectrum of perspectives for your own analysis.

Explore 6 other fair value estimates on UBS Group - why the stock might be worth 24% less than the current price!

Build Your Own UBS Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UBS Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UBS Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UBS Group's overall financial health at a glance.

No Opportunity In UBS Group?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives