- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

Assessing UBS After Credit Suisse Integration Amid 2025 Market Swings

Reviewed by Bailey Pemberton

Trying to figure out what to do with UBS Group stock? You’re not alone. Whether you’re pondering a first investment or reconsidering your current position, recent share price swings have plenty of investors pausing to re-examine their next move. Over the past week, UBS shares inched up by 0.4%. Zoom out to the last month and they’re actually down 8.4%. Despite this, the stock is sitting on gains of 6.8% for the year to date. Looking at the last three years, UBS has risen over 100%. The five-year chart is even more impressive, with shares up 235%, reflecting a long-term turnaround that few financials can match.

What is fueling these moves? The big headline is UBS’s integration of Credit Suisse, a process that has drawn both optimism and scrutiny from investors worldwide. There is still work ahead, especially in harmonizing operations, and many see the merger as a powerful move to consolidate UBS’s dominance in European banking and wealth management. There have also been regulatory updates this summer clarifying capital requirements, which steadily reduced perceived risk levels among analysts. These factors, combined with UBS’s navigation of global market uncertainty, have shaped both recent volatility and the stock’s longer-term gains.

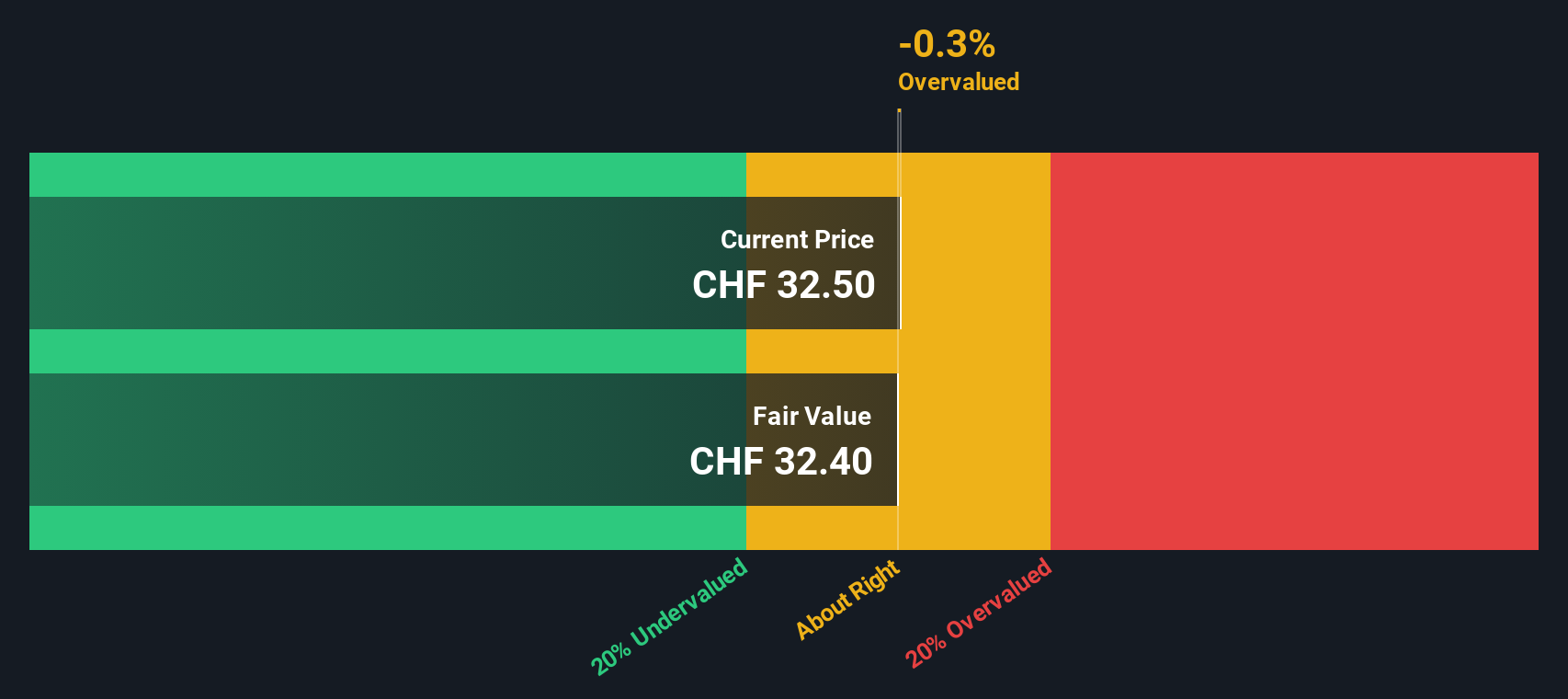

But here is the big question: is UBS actually undervalued, or is the share price already factoring in all the good news? According to our valuation framework, the company scores a solid 3 out of 6 on our undervaluation checklist, hinting at some room for upside but not a strong buy just yet. Next, let’s unpack what that score really means and take a closer look at the classic ways analysts value shares, before revealing a more dynamic approach to understanding UBS’s real price potential.

Approach 1: UBS Group Excess Returns Analysis

The Excess Returns valuation model estimates a company’s intrinsic value by analyzing how much profit it generates above its cost of equity. This approach focuses on UBS Group’s ability to deliver a superior return on invested capital over time. Rather than relying solely on company earnings or cash flows, this method zeroes in on the extra value created for shareholders when profits outpace the required rate of return.

For UBS Group, analysts expect a stable book value of CHF32.33 per share and stable earnings per share of CHF3.53, based on projected future returns on equity from six analysts. The company’s cost of equity is estimated at CHF2.87 per share, resulting in an annual excess return of CHF0.66 per share. This is supported by an average return on equity of 10.91%, indicating UBS is consistently generating profits well in excess of its funding costs and adding value with each franc of equity.

The model projects an intrinsic value of CHF31.94 per share, about 4.8% higher than the current trading price. This modest discount signals that UBS stock is priced just slightly below its intrinsic value according to the Excess Returns methodology.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out UBS Group's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: UBS Group Price vs Earnings

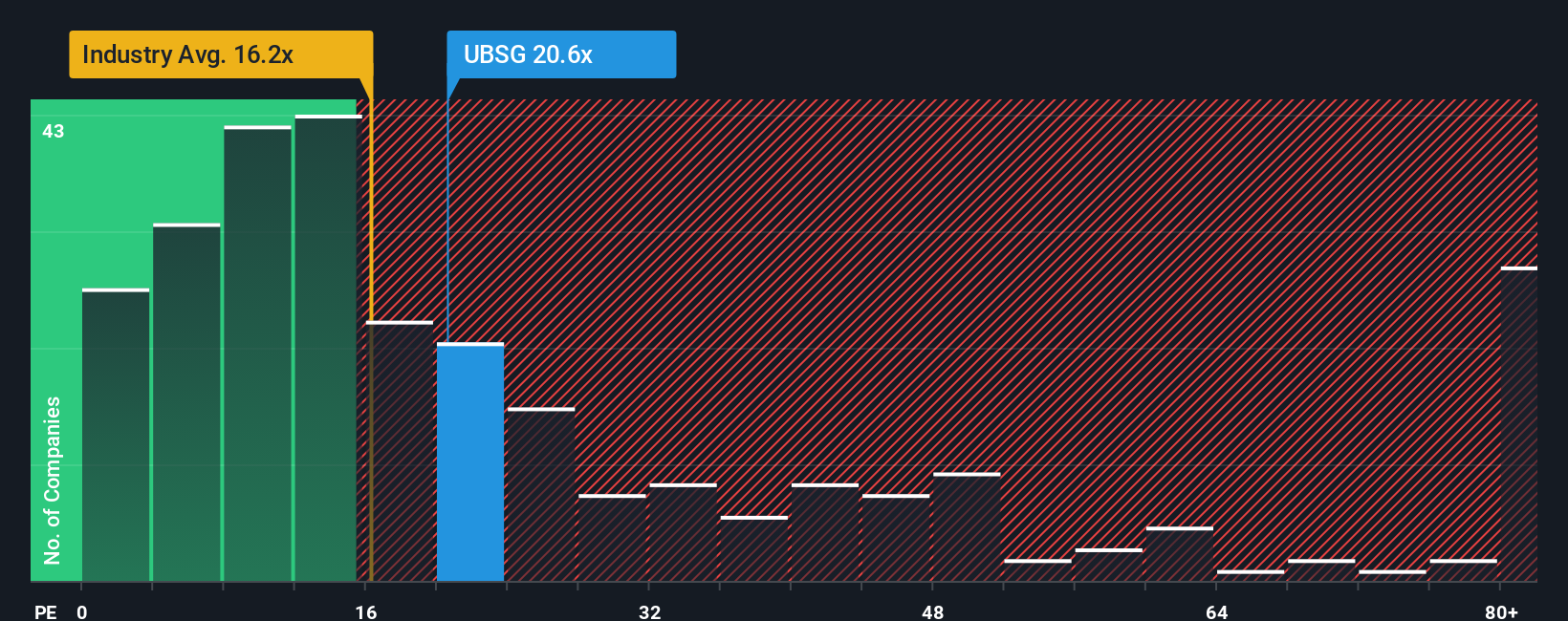

The price-to-earnings (PE) ratio is a standard benchmark for valuing profitable companies like UBS Group. It directly compares the market price of a share to its earnings. Investors typically use the PE ratio as a quick way to gauge how much they are paying for each franc of earnings and to compare valuations across similar companies.

Growth expectations and company-specific risks play a big role in shaping what is considered a “normal” or “fair” PE ratio. Faster-growing companies or those with lower risk profiles tend to earn higher PE multiples, while slower growth or elevated risks usually mean a lower PE is justified. Therefore, in assessing UBS, it is important to consider not just its own recent results but also the wider industry context and future prospects.

Currently, UBS Group trades at a PE ratio of 19.28x. This is just above the Capital Markets industry average PE of 18.91x but below the peer average of 21.34x. To provide a more tailored view, Simply Wall St’s proprietary “Fair Ratio” model estimates a fair PE for UBS at 26.33x. This calculation is based on factors including the company’s expected earnings growth, profit margin, market cap, and unique risk profile. The Fair Ratio gives a more accurate snapshot than simply comparing with peers or the sector average because it adjusts for UBS’s specific strengths and weaknesses.

With the actual PE ratio (19.28x) below the Fair Ratio (26.33x), UBS shares currently appear undervalued by this measure. This suggests the market might not be fully factoring in its growth potential and profitability.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UBS Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives allow you to capture your personal story and outlook on UBS Group by combining your perspective on its future, such as your forecasts for revenue, profit margins, or fair value, with easy-to-use financial models in one dynamic view.

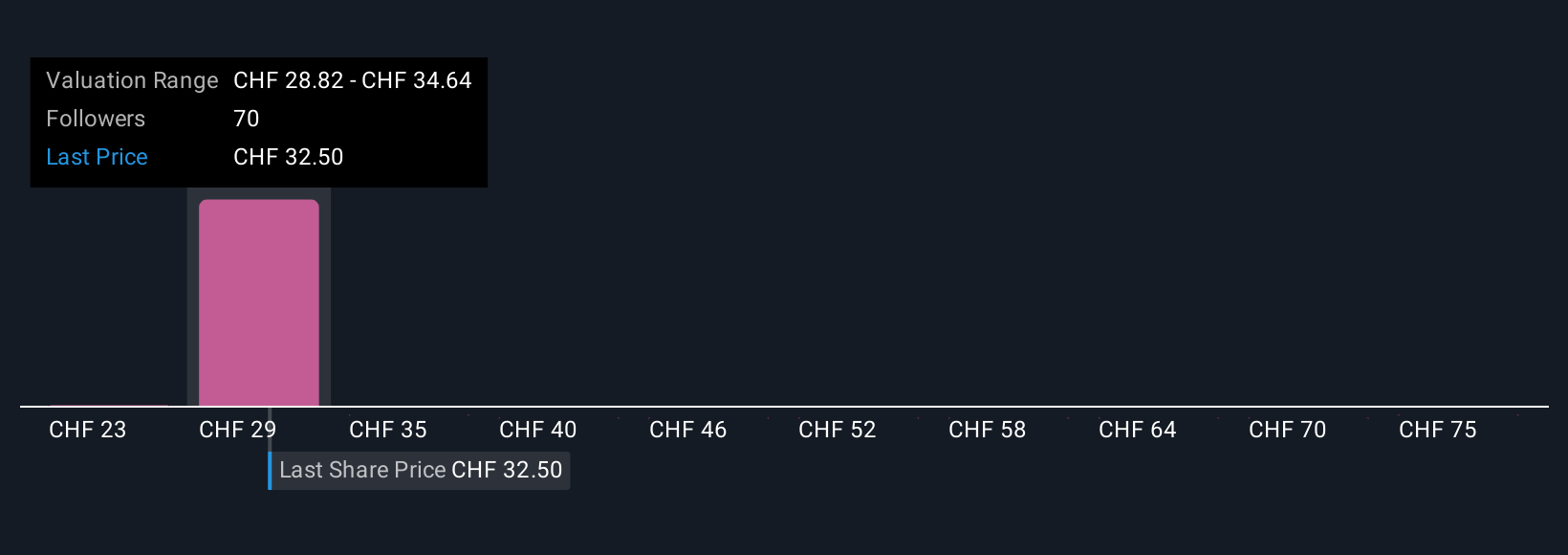

A Narrative essentially links your beliefs about what is driving UBS’s business, your expectations for its future financial performance, and how those all come together in a fair value estimate. With Simply Wall St’s Narratives, available to millions of investors in the Community page, you can easily experiment with “what-if” scenarios and quickly see if the current price represents an opportunity or a risk according to your view, not just analysts’ consensus or static models.

These Narratives are updated automatically when new results, news, or regulatory changes arrive, so your view stays relevant as the facts change. For example, right now the highest UBS Group Narrative values the stock at CHF39.50, driven by optimism about global banking integration and digital transformation. The lowest Narrative sits at CHF21.00, based on concerns about regulatory risks and margin pressure. By comparing different narratives and their price targets, you gain the clarity to decide if UBS shares are a buy, hold, or sell for your own strategy.

Do you think there's more to the story for UBS Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives