- Poland

- /

- Entertainment

- /

- WSE:CDR

3 Growth Companies With Insider Ownership Up To 29%

Reviewed by Simply Wall St

As global markets continue to navigate a landscape of geopolitical tensions and economic indicators, U.S. indexes are approaching record highs with broad-based gains, bolstered by strong labor market data and rising home sales. In this context of cautious optimism, growth companies with high insider ownership can be particularly appealing as they often reflect confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's take a closer look at a couple of our picks from the screened companies.

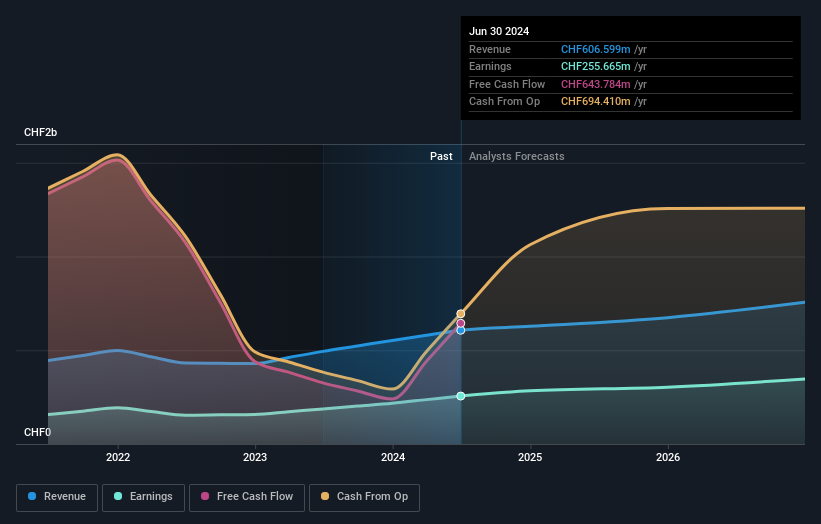

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swissquote Group Holding Ltd offers a range of online financial services to retail, affluent, and professional institutional investors globally, with a market cap of CHF5.01 billion.

Operations: The company's revenue is primarily derived from two segments: Leveraged Forex, contributing CHF93.28 million, and Securities Trading, which accounts for CHF488.98 million.

Insider Ownership: 11.4%

Swissquote Group Holding demonstrates potential as a growth company with high insider ownership, supported by its substantial earnings growth of 36.9% over the past year and forecasted revenue increase of 11.1% annually, outpacing the Swiss market's 4.2%. Although expected earnings growth at 12.7% is not significantly high, it surpasses the market average of 11.4%. The stock trades at a considerable discount to its estimated fair value, indicating possible undervaluation opportunities.

- Get an in-depth perspective on Swissquote Group Holding's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Swissquote Group Holding shares in the market.

ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ShenZhen Woer Heat-Shrinkable Material Co., Ltd. operates in the manufacturing sector, focusing on heat-shrinkable materials, with a market cap of CN¥21.79 billion.

Operations: ShenZhen Woer Heat-Shrinkable Material Co., Ltd. generates its revenue primarily from the production and sale of heat-shrinkable materials, contributing significantly to its market presence in the manufacturing sector.

Insider Ownership: 19.1%

ShenZhen Woer Heat-Shrinkable Material Ltd. exhibits strong growth potential, with revenue forecasted to increase by 21.8% annually, surpassing the Chinese market average of 13.8%. Recent earnings showed significant improvement, with sales reaching CNY 4.82 billion and net income rising to CNY 655.1 million for the first nine months of 2024. Despite high share price volatility and an unstable dividend history, its Price-To-Earnings ratio suggests it is trading at good value compared to industry peers.

- Dive into the specifics of ShenZhen Woer Heat-Shrinkable MaterialLtd here with our thorough growth forecast report.

- The valuation report we've compiled suggests that ShenZhen Woer Heat-Shrinkable MaterialLtd's current price could be quite moderate.

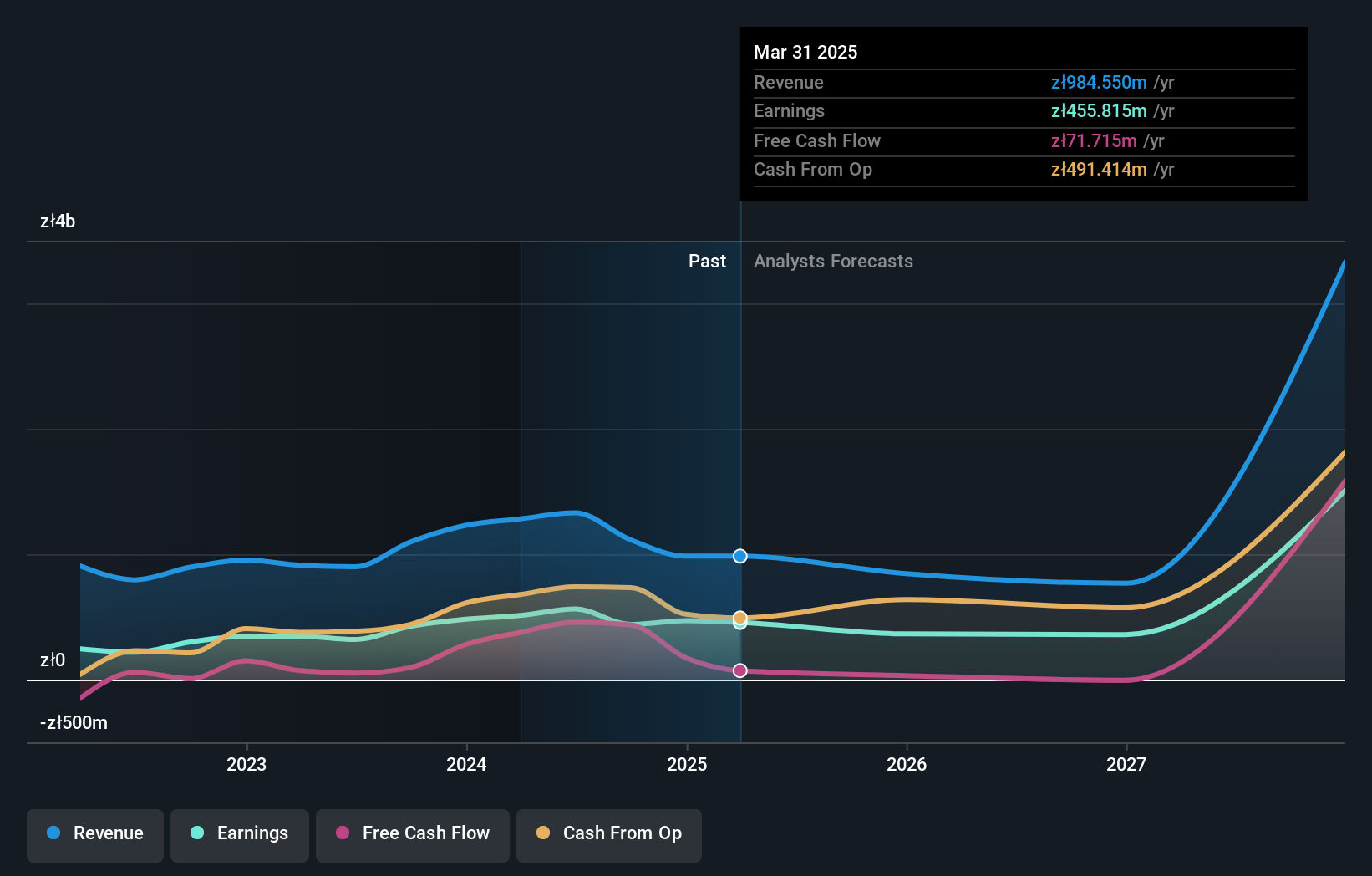

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CD Projekt S.A., along with its subsidiaries, focuses on the development, publishing, and digital distribution of video games for personal computers and consoles in Poland, with a market cap of PLN16.07 billion.

Operations: The company's revenue segments include GOG.Com, generating PLN238.12 million, and CD PROJEKT RED, contributing PLN1.14 billion.

Insider Ownership: 29.7%

CD Projekt demonstrates robust growth potential with earnings forecasted to grow 17.47% annually, outpacing the Polish market's 15.3%. Recent earnings for H1 2024 showed revenue at PLN 424.81 million and net income at PLN 170.01 million, reflecting substantial year-on-year increases. Despite no recent insider trading activity, the company's high return on equity forecast (29.1%) indicates strong financial health, supporting its position among growth companies with significant insider ownership influence.

- Take a closer look at CD Projekt's potential here in our earnings growth report.

- Our expertly prepared valuation report CD Projekt implies its share price may be too high.

Make It Happen

- Get an in-depth perspective on all 1527 Fast Growing Companies With High Insider Ownership by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CDR

CD Projekt

Together its subsidiaries, engages in the development, publishing, and digital distribution of video games for personal computers and video game consoles in Poland.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives