- Switzerland

- /

- Trade Distributors

- /

- SWX:DKSH

3 Top Dividend Stocks On SIX Swiss Exchange Yielding Up To 5.6%

Reviewed by Simply Wall St

The Swiss market recently experienced a downturn, with the SMI index slipping due to concerns over geopolitical tensions and weak euro area economic data. Amidst this cautious environment, dividend stocks on the SIX Swiss Exchange offer a potential source of steady income, appealing to investors seeking stability and yield in uncertain times.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.21% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.71% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.59% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.74% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.48% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.05% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.97% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.73% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.44% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

CPH Group (SWX:CPHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CPH Group AG operates in the manufacture and sale of chemicals and packaging films across Switzerland, Europe, the Americas, Asia, and internationally with a market cap of CHF426.86 million.

Operations: CPH Group AG generates its revenue through three main segments: Chemistry (CHF128.62 million), Packaging (CHF219.70 million), and Spun-off divisions (Paper) (CHF245.37 million).

Dividend Yield: 5.6%

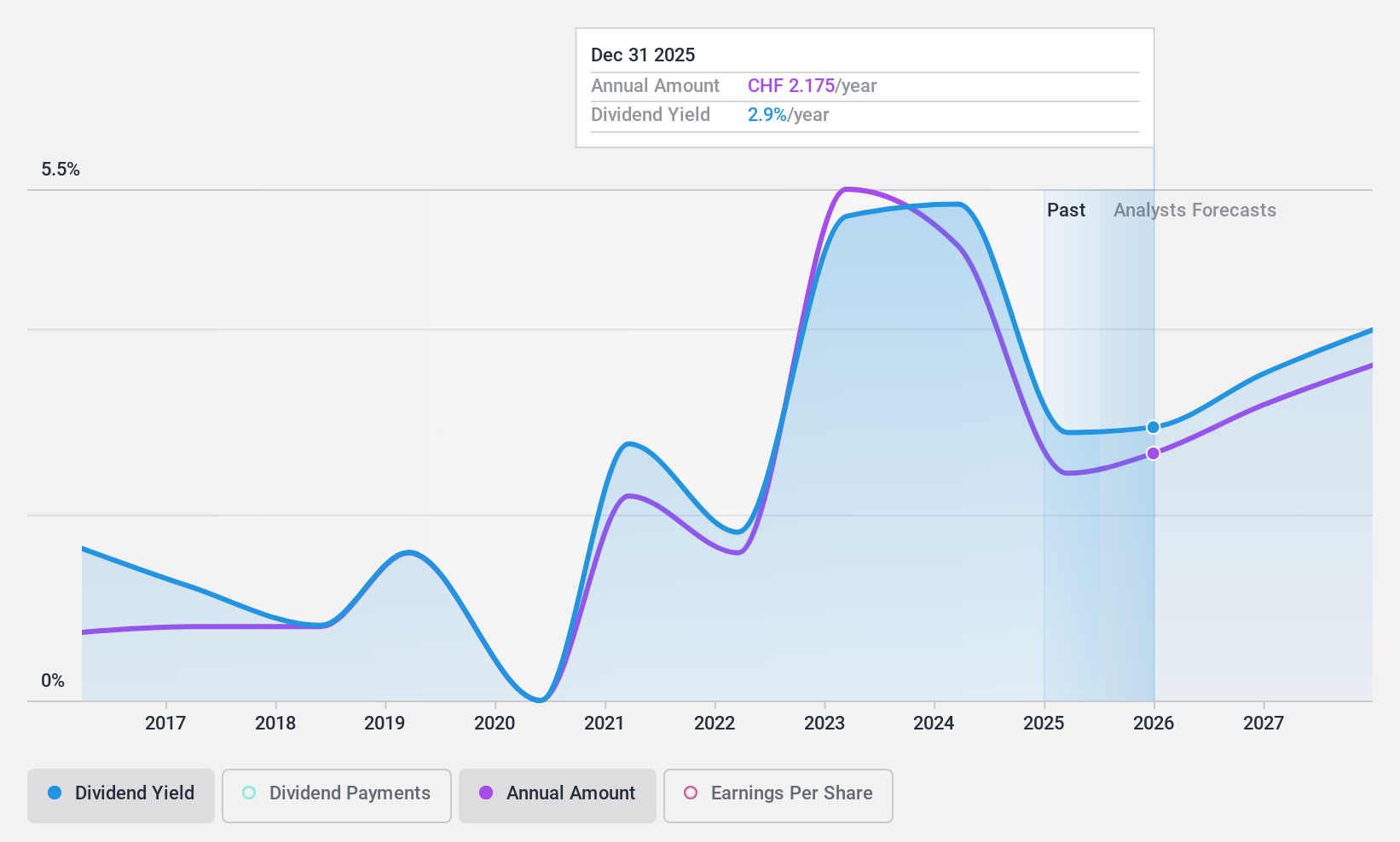

CPH Group's dividend yield of 5.62% ranks in the top 25% of Swiss dividend payers, yet its high payout ratio of 249.1% indicates dividends aren't well covered by earnings, though cash flow coverage is better at 47%. Recent financials show a net loss and declining profit margins, raising concerns about sustainability despite past increases in dividend payments. The company's dividends have been volatile over the last decade, reflecting potential unreliability for income-focused investors.

- Dive into the specifics of CPH Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that CPH Group is priced higher than what may be justified by its financials.

DKSH Holding (SWX:DKSH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DKSH Holding AG offers market expansion services across Thailand, Greater China, Malaysia, Singapore, the rest of the Asia Pacific, and internationally with a market cap of CHF4.25 billion.

Operations: DKSH Holding AG generates revenue from its segments as follows: Healthcare CHF5.55 billion, Consumer Goods CHF3.43 billion, Performance Materials CHF1.38 billion, and Technology CHF526.50 million.

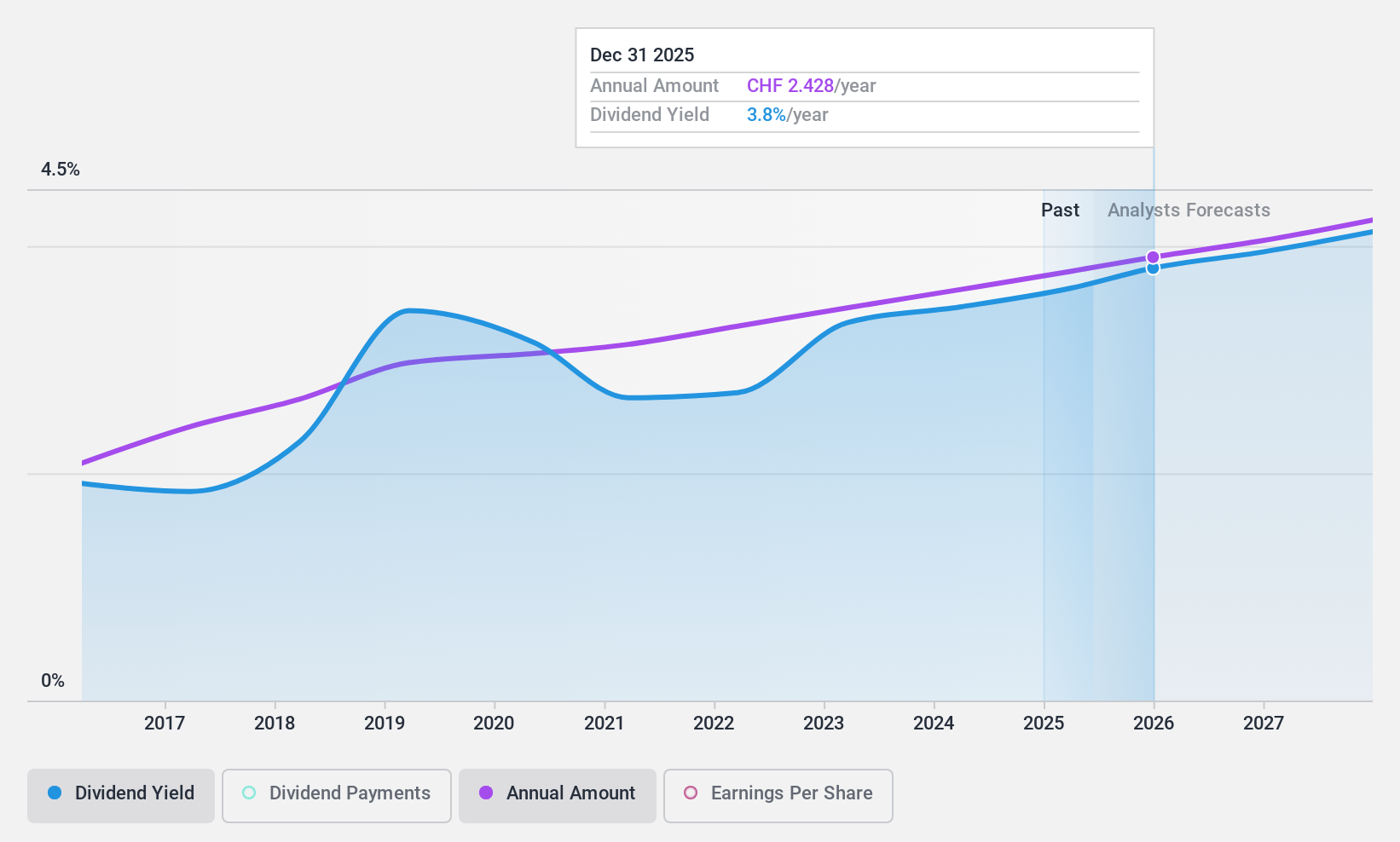

Dividend Yield: 3.4%

DKSH Holding offers a stable and growing dividend, with payments reliably increasing over the past decade. The company's dividends are well covered by earnings (payout ratio: 77%) and cash flows (cash payout ratio: 45.8%). Trading below its estimated fair value, DKSH's current yield of 3.44% is below the top tier in Switzerland but remains attractive for consistent income. Recent financials show improved net income at CHF 111.2 million despite slightly lower sales figures compared to last year.

- Delve into the full analysis dividend report here for a deeper understanding of DKSH Holding.

- The valuation report we've compiled suggests that DKSH Holding's current price could be inflated.

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG, along with its subsidiaries, offers private banking, wealth management, and asset management services and has a market capitalization of CHF3.51 billion.

Operations: EFG International's revenue segments include the Americas (CHF128.80 million), Asia Pacific (CHF176.70 million), United Kingdom (CHF193.30 million), Switzerland & Italy (CHF449.70 million), Global Markets & Treasury (CHF55.30 million), Investment and Wealth Solutions (CHF122.90 million), and Continental Europe & Middle East (CHF257.30 million).

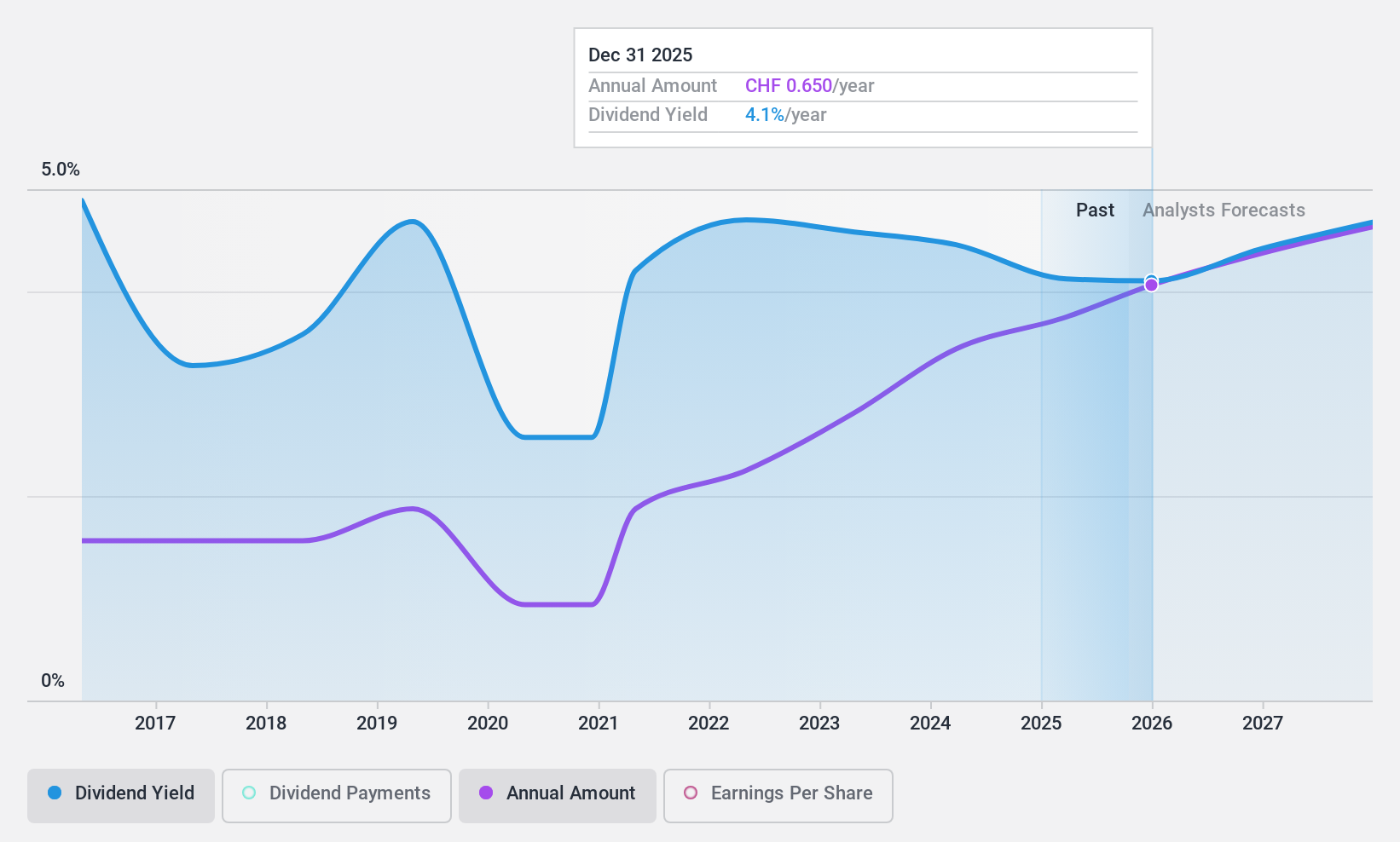

Dividend Yield: 4.7%

EFG International's dividend yield of 4.74% ranks in the top quartile in Switzerland, though its dividend history is unstable with past volatility. Despite this, dividends are well covered by earnings with a payout ratio of 55.2%, and future coverage is projected to remain sustainable. Recent earnings growth supports the company's financial health, reporting CHF 162.8 million net income for H1 2024, while trading below estimated fair value enhances its investment appeal despite high bad loans at 2.4%.

- Navigate through the intricacies of EFG International with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, EFG International's share price might be too pessimistic.

Summing It All Up

- Access the full spectrum of 26 Top SIX Swiss Exchange Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:DKSH

DKSH Holding

Provides various market expansion services in Thailand, Greater China, Malaysia, Singapore, rest of the Asia Pacific, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives