- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

European Dividend Stocks To Watch In March 2025

Reviewed by Simply Wall St

As European markets navigate a complex landscape of trade-related uncertainties and inflation concerns, the pan-European STOXX Europe 600 Index managed to end the week higher, buoyed by hopes of increased government spending. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking to balance growth headwinds with reliable returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.48% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.17% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.60% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.85% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.37% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.03% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 5.80% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.75% | ★★★★★★ |

| VERBUND (WBAG:VER) | 6.27% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

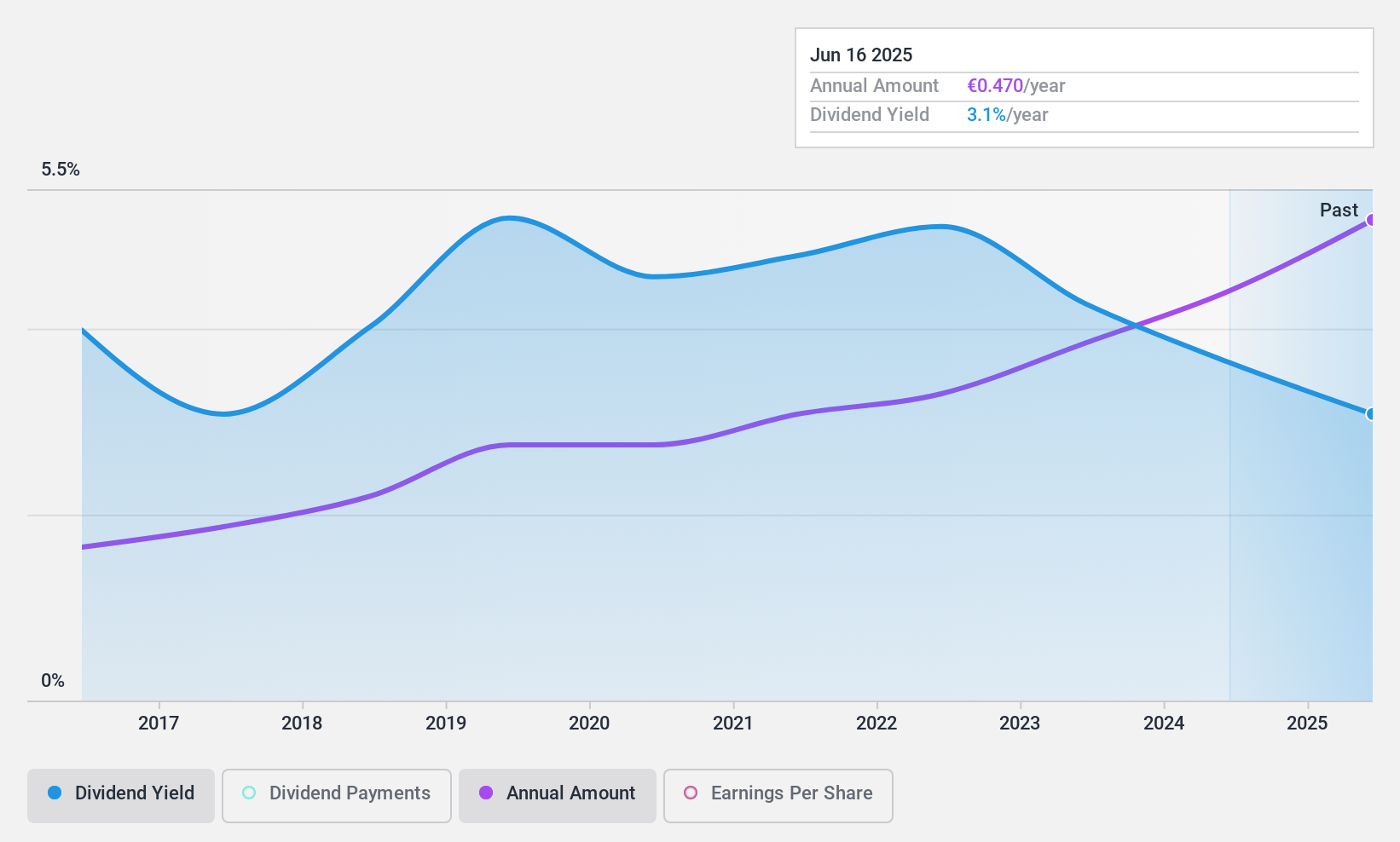

B&C Speakers (BIT:BEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B&C Speakers S.p.A. produces and markets professional loudspeakers under the B&C brand in Italy and internationally, with a market cap of €174.63 million.

Operations: B&C Speakers S.p.A. generates its revenue primarily from the Acoustic Transducers segment, which accounted for €99.40 million.

Dividend Yield: 4.4%

B&C Speakers offers a mixed dividend profile. Its 4.4% yield is lower than the top Italian payers, and dividends have been volatile over the past decade despite recent increases. However, dividends are well covered by earnings (44.1% payout ratio) and free cash flow (50.8% cash payout ratio), suggesting sustainability. The stock trades at a good value compared to peers and below estimated fair value, with analysts projecting a price rise of 32.3%.

- Click to explore a detailed breakdown of our findings in B&C Speakers' dividend report.

- According our valuation report, there's an indication that B&C Speakers' share price might be on the cheaper side.

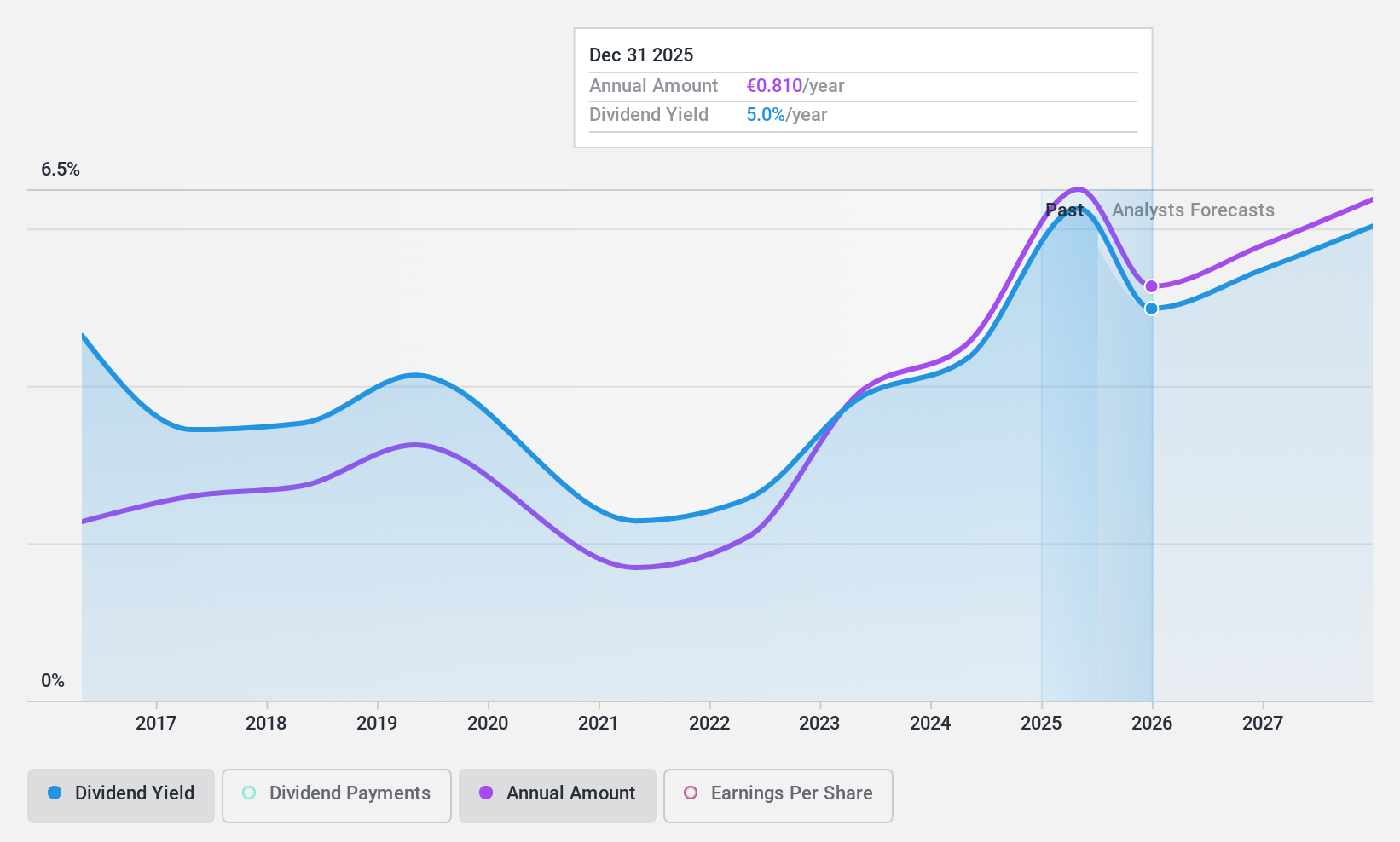

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across various regions including Europe and the Asia-Pacific, with a market cap of €771.46 million.

Operations: VIEL & Cie société anonyme generates its revenue primarily from Professional Intermediation (€1.05 billion) and Stock Exchange Online services (€71.02 million), with additional contributions from Holdings (€3.63 million).

Dividend Yield: 3.3%

VIEL & Cie société anonyme provides a stable dividend profile with consistent payments over the past decade. The 3.27% yield is modest compared to top French payers, but dividends are well-covered by earnings (22.4% payout ratio) and cash flows (22.1% cash payout ratio), indicating sustainability. Earnings grew significantly by 36.3% last year, supporting potential future increases in dividends, while the stock trades at a 27.5% discount to its estimated fair value.

- Navigate through the intricacies of VIEL & Cie société anonyme with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that VIEL & Cie société anonyme is priced lower than what may be justified by its financials.

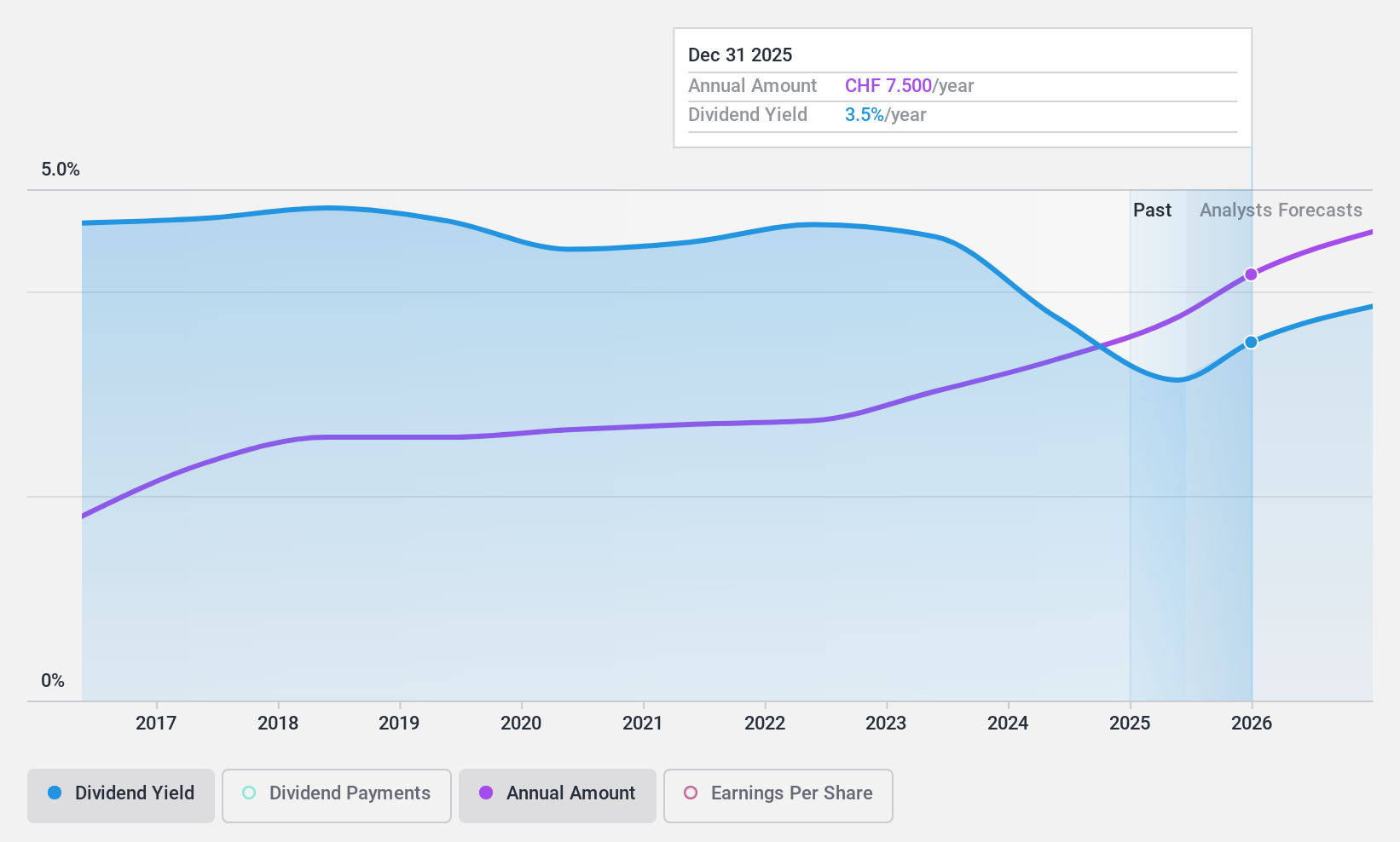

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as a global interdealer broker of financial and non-financial products, with a market cap of CHF1.57 billion.

Operations: Compagnie Financière Tradition SA generates revenue from its role as an intermediary in the trading of both financial and non-financial products across global markets.

Dividend Yield: 3.3%

Compagnie Financière Tradition offers a stable dividend profile with reliable payments over the past decade. Its 3.34% yield is modest compared to top Swiss payers but dividends are well-covered by earnings (44.7% payout ratio) and cash flows (68.4% cash payout ratio), ensuring sustainability. Earnings rose by 22.4%, supporting dividend stability, while the stock trades at a 21% discount to its estimated fair value, presenting potential for capital appreciation alongside income generation.

- Get an in-depth perspective on Compagnie Financière Tradition's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Compagnie Financière Tradition's share price might be too pessimistic.

Key Takeaways

- Take a closer look at our Top European Dividend Stocks list of 237 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives