- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

European Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As European markets navigate the complexities of new trade tariffs and economic contractions, the pan-European STOXX Europe 600 Index has shown resilience with a modest increase, although recent tariff threats have tempered gains. In this environment, dividend stocks can offer stability and income potential, making them an attractive consideration for investors seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.52% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.17% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.69% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.90% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.55% | ★★★★★★ |

| ERG (BIT:ERG) | 5.44% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.10% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.65% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.53% | ★★★★★★ |

Click here to see the full list of 232 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

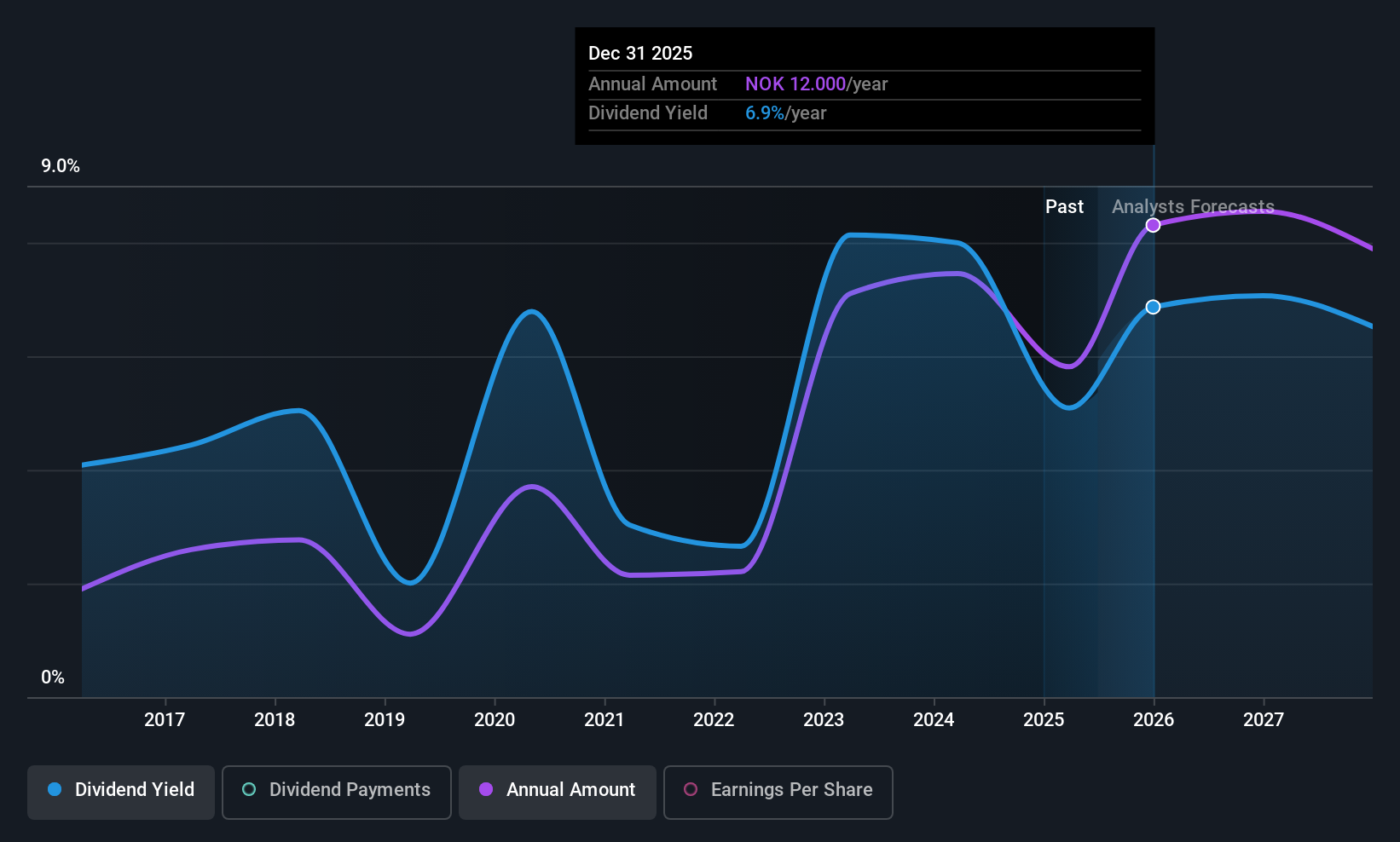

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpareBank 1 Helgeland offers a range of financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway, with a market cap of NOK4.77 billion.

Operations: SpareBank 1 Helgeland generates its revenue primarily from the Retail segment with NOK452 million and the Corporate Market segment contributing NOK304 million.

Dividend Yield: 4.7%

SpareBank 1 Helgeland's dividend payments are covered by earnings with a payout ratio of 51.2%, though the past decade has seen volatility and unreliability in its dividends. Despite this, dividends have increased over the last ten years and are forecasted to remain covered by earnings, reaching an 80% payout ratio in three years. The stock trades at a discount to its estimated fair value, but its dividend yield is lower than top-tier payers in Norway. Recent earnings show net income growth despite a drop in net interest income.

- Click here and access our complete dividend analysis report to understand the dynamics of SpareBank 1 Helgeland.

- Our comprehensive valuation report raises the possibility that SpareBank 1 Helgeland is priced lower than what may be justified by its financials.

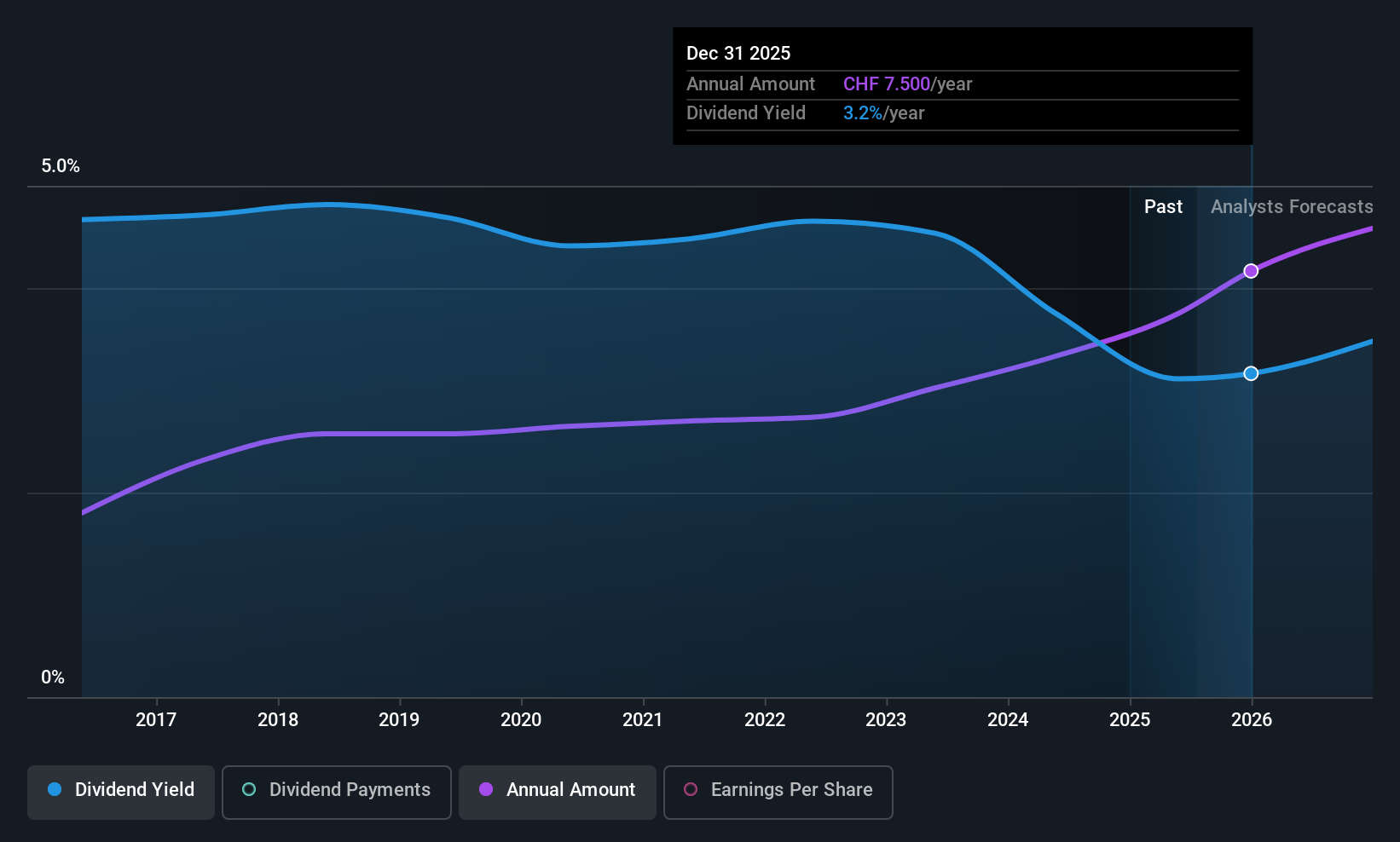

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market cap of CHF1.74 billion.

Operations: Compagnie Financière Tradition SA generates revenue from its operations across the Americas (CHF371.20 million), Asia-Pacific (CHF286.26 million), and Europe, Middle East, and Africa (CHF475.39 million).

Dividend Yield: 3%

Compagnie Financière Tradition offers a stable dividend profile, with payments reliably increasing over the past decade. The dividends are well-supported by earnings, evidenced by a payout ratio of 44.7%, and cash flows, with a cash payout ratio of 52%. Although its 3% yield is below the top quartile in Switzerland, it remains attractive due to stability and growth prospects. Trading slightly below estimated fair value enhances its appeal for income-focused investors.

- Get an in-depth perspective on Compagnie Financière Tradition's performance by reading our dividend report here.

- Our valuation report unveils the possibility Compagnie Financière Tradition's shares may be trading at a discount.

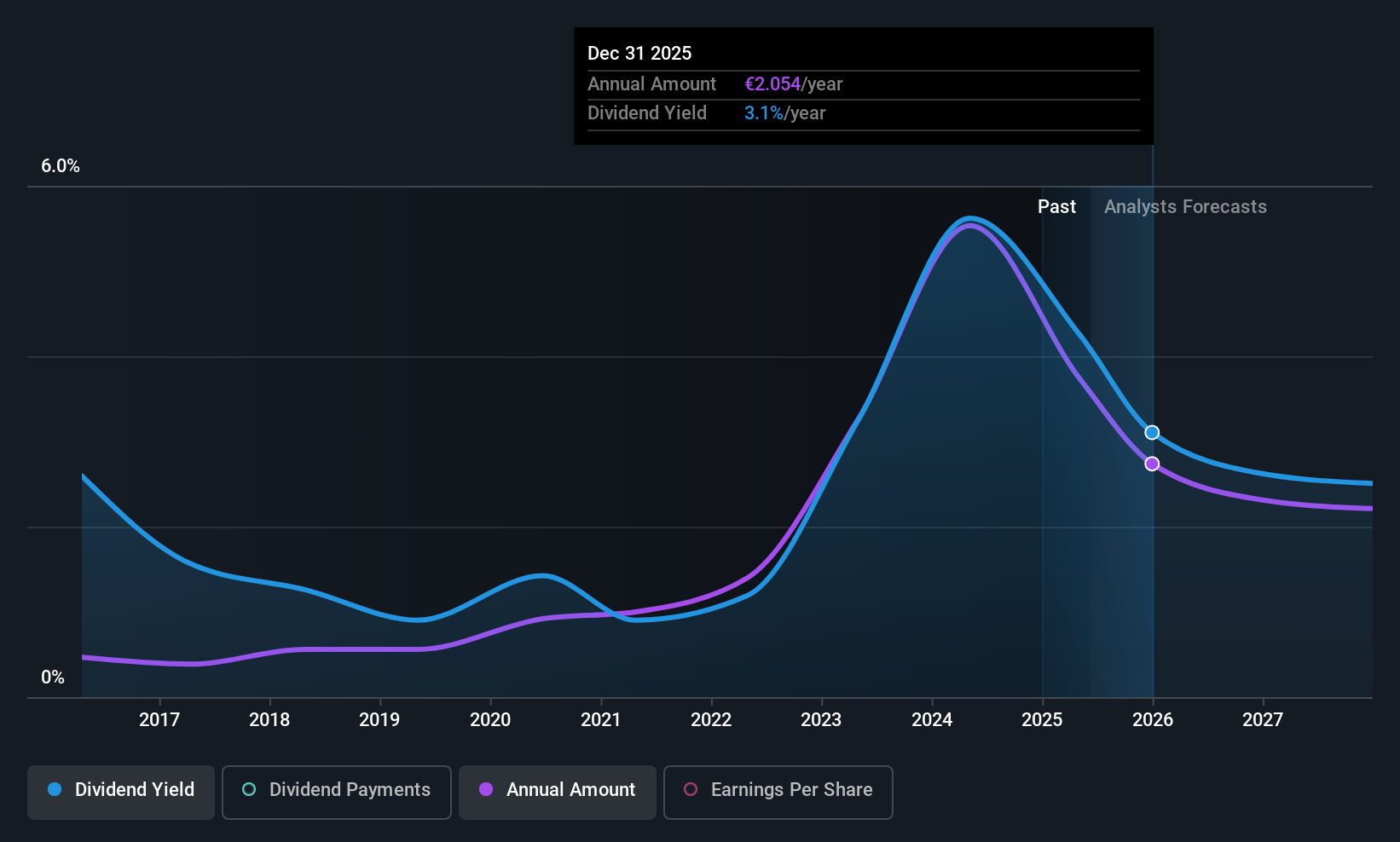

VERBUND (WBAG:VER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VERBUND AG, along with its subsidiaries, is involved in generating, trading, and selling electricity to various markets and customers, with a market cap of €22.62 billion.

Operations: VERBUND AG's revenue is primarily derived from its Sales segment at €6.96 billion, followed by Hydro at €3.36 billion, Grid at €1.59 billion, and New Renewables contributing €335.20 million.

Dividend Yield: 4.3%

VERBUND's dividend is supported by earnings and cash flows, with payout ratios of 55.1% and 56.3%, respectively, though its track record shows volatility over the past decade. The dividend yield of 4.3% falls short of Austria's top payers, but a price-to-earnings ratio of 12.8x suggests it may be undervalued relative to the market average. Recent earnings showed a decline in net income despite increased sales, potentially impacting future dividend stability.

- Dive into the specifics of VERBUND here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that VERBUND is trading beyond its estimated value.

Next Steps

- Take a closer look at our Top European Dividend Stocks list of 232 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives