- Switzerland

- /

- Capital Markets

- /

- SWX:BAER

Assessing Julius Baer (SWX:BAER) Valuation as Investors Revisit Shares in a Quiet Market

Reviewed by Kshitija Bhandaru

Julius Bär Gruppe (SWX:BAER) is back in the spotlight after its shares caught the attention of investors this week. There was no headline-generating event or earnings shock to explain the market’s latest move; sometimes the lack of obvious news can be just as telling. Whether you are already holding Julius Bär or scanning for hidden opportunities, moments like these often invite a closer look at what the market might be signaling under the surface.

Over the year, Julius Bär Gruppe’s share price has delivered a respectable 20% total return. This momentum stands out, especially when set against a recent dip in the past month, following gains over the previous quarter. The company continues to post steady annual revenue and net income growth, suggesting a business that is adapting and potentially thriving even without major headlines grabbing attention. Compared to its longer-term returns, the current performance may signal shifting sentiment or a recalibration of growth prospects among investors.

With the market moving quietly, is there an opportunity to buy Julius Bär Gruppe while others look elsewhere, or is the share price already reflecting everything investors need to know about future growth?

Most Popular Narrative: 8.9% Undervalued

The most widely followed narrative suggests Julius Bär Gruppe is undervalued by nearly 9 percent, pointing to growth expectations that could support a higher share price.

Strong growth in net new money and significant year-on-year increases in underlying net profit signal that Julius Bär is capturing rising global wealth and intergenerational transfers. This is expected to directly support future revenue and fee-based income expansion. Progress in cost efficiency, as shown by the lower cost-income ratio and ahead-of-plan CHF 130 million cost savings target, indicates sustained improvement in operational margins and profitability going forward.

Curious about the recipe for Julius Bär Gruppe's bullish valuation? The narrative centers on ambitious profit and revenue goals as well as estimates that could surprise many investors. Are these financial projections robust enough to justify a share price uplift? The full narrative offers a rare peek into the big numbers driving this target. Dare to take a closer look.

Result: Fair Value of CHF60.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing credit risks and uncertainty around share buybacks could present challenges to the optimistic outlook and may affect Julius Bär Gruppe’s future returns.

Find out about the key risks to this Julius Bär Gruppe narrative.Another View: SWS DCF Model Sends a Stronger Signal

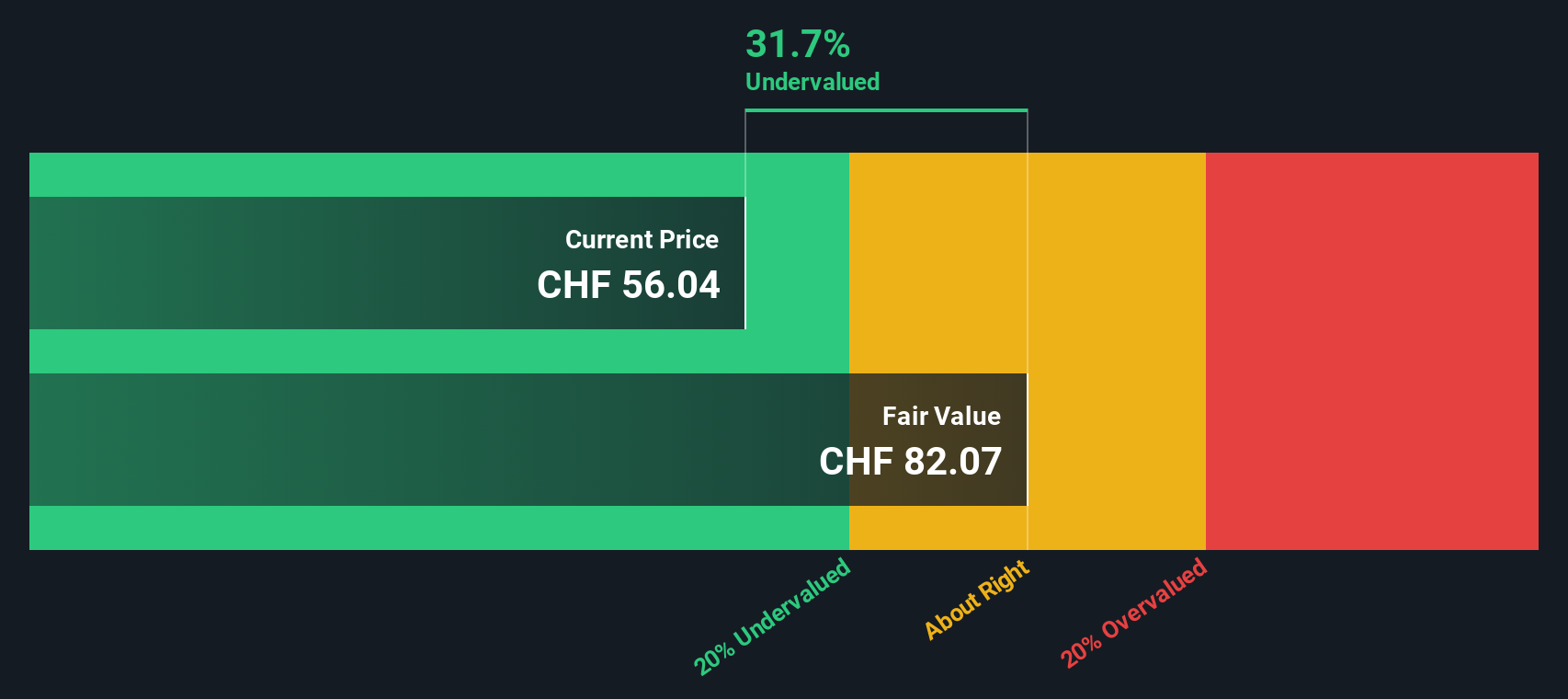

Looking beyond analyst price targets, our DCF model indicates Julius Bär Gruppe is undervalued by a far wider margin. This approach weighs the company’s future cash flows and draws a sharper distinction from consensus opinions. Could this difference point to overlooked potential, or is there a reason for the gap?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Julius Bär Gruppe Narrative

If you have a different perspective or would rather dive into the numbers yourself, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Julius Bär Gruppe research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Supercharge your investment strategy by targeting market opportunities that others overlook. Let Simply Wall Street’s powerful screener point you toward sectors where growth, resilience, and innovation are key.

- Tap into market-beating yield by searching companies offering reliable income backed by strong financials using our dividend stocks with yields > 3%.

- Spot tomorrow’s tech winners and get ahead of the crowd by following the leaders in transformative AI innovation via AI penny stocks.

- Capitalize on pricing missteps and uncover hidden value through our filter for undervalued stocks based on cash flows before Wall Street catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BAER

Julius Bär Gruppe

Provides wealth management solutions in Switzerland, Europe, the Americas, Asia, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives