- Switzerland

- /

- Luxury

- /

- SWX:CALN

CALIDA Holding (VTX:CALN) Will Pay A Larger Dividend Than Last Year At CHF1.15

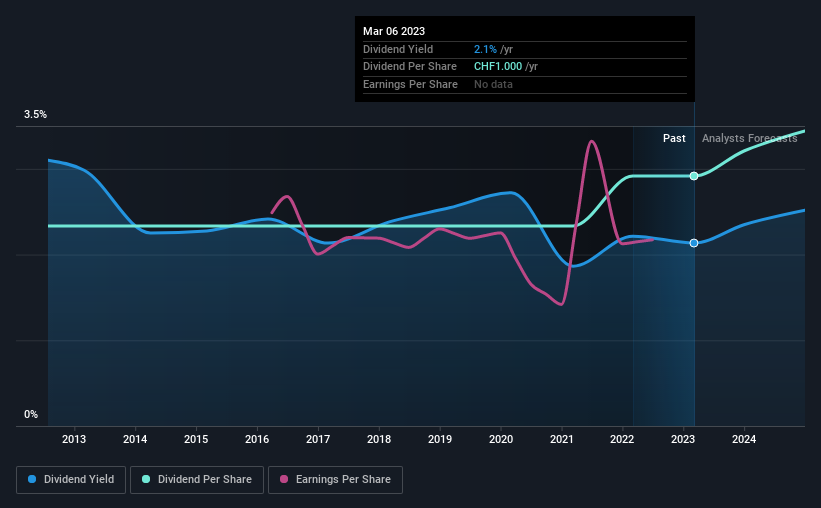

The board of CALIDA Holding AG (VTX:CALN) has announced that the dividend on 27th of April will be increased to CHF1.15, which will be 15% higher than last year's payment of CHF1.00 which covered the same period. This will take the annual payment to 2.1% of the stock price, which is above what most companies in the industry pay.

Check out our latest analysis for CALIDA Holding

CALIDA Holding's Earnings Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, CALIDA Holding's earnings easily covered the dividend, but free cash flows were negative. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

Over the next year, EPS is forecast to expand by 57.8%. Assuming the dividend continues along recent trends, we think the payout ratio could be 40% by next year, which is in a pretty sustainable range.

CALIDA Holding Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2013, the annual payment back then was CHF0.80, compared to the most recent full-year payment of CHF1.00. This implies that the company grew its distributions at a yearly rate of about 2.3% over that duration. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

CALIDA Holding May Find It Hard To Grow The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. However, initial appearances might be deceiving. However, CALIDA Holding's EPS was effectively flat over the past five years, which could stop the company from paying more every year.

Our Thoughts On CALIDA Holding's Dividend

Overall, we always like to see the dividend being raised, but we don't think CALIDA Holding will make a great income stock. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 3 warning signs for CALIDA Holding that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:CALN

CALIDA Holding

Engages in the apparel business in Switzerland, France, Germany, rest of Europe, Asia, the United States, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion