Stock Analysis

- Switzerland

- /

- Software

- /

- SWX:TEMN

Exploring Value Opportunities On SIX Swiss Exchange With 3 Stocks Estimated To Be Trading At Discounts Between 28.9% And 44.3%

Reviewed by Simply Wall St

The Switzerland stock market recently experienced a downturn, reflecting broader European trends driven by concerns over global economic growth and disappointing earnings reports from key players in the US and Europe. With the benchmark SMI index showing a decline, this environment may present opportunities to identify stocks that are potentially undervalued, offering attractive prospects for investors attentive to valuation metrics in challenging times.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF132.40 | CHF220.91 | 40.1% |

| COLTENE Holding (SWX:CLTN) | CHF45.60 | CHF74.04 | 38.4% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF610.00 | CHF857.01 | 28.8% |

| Georg Fischer (SWX:GF) | CHF65.00 | CHF100.24 | 35.2% |

| Julius Bär Gruppe (SWX:BAER) | CHF51.96 | CHF93.29 | 44.3% |

| Sonova Holding (SWX:SOON) | CHF264.80 | CHF468.39 | 43.5% |

| Temenos (SWX:TEMN) | CHF61.00 | CHF94.98 | 35.8% |

| SGS (SWX:SGSN) | CHF92.10 | CHF129.51 | 28.9% |

| Comet Holding (SWX:COTN) | CHF349.00 | CHF590.65 | 40.9% |

| Medartis Holding (SWX:MED) | CHF73.80 | CHF131.71 | 44% |

Here we highlight a subset of our preferred stocks from the screener.

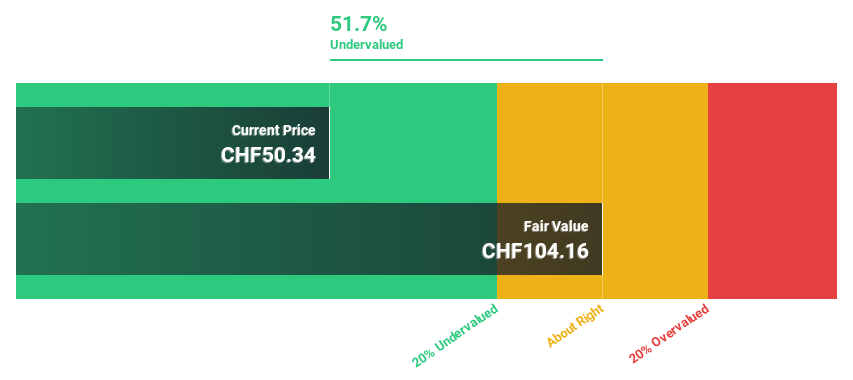

Julius Bär Gruppe (SWX:BAER)

Overview: Julius Bär Gruppe AG is a global wealth management firm operating in Switzerland, Europe, the Americas, and Asia, with a market capitalization of CHF 10.64 billion.

Operations: The firm generates CHF 3.24 billion from its private banking segment.

Estimated Discount To Fair Value: 44.3%

Julius Bär Gruppe, priced at CHF51.96, appears undervalued based on a discounted cash flow (DCF) valuation indicating a fair value of CHF93.29. Despite slower expected revenue growth at 9.4% annually compared to the market's 20%, its earnings are projected to increase significantly by 21.6% per year, outpacing the Swiss market's 8.3%. However, current profit margins have decreased from last year’s 24.6% to 14%, and its dividend coverage is uncertain, reflecting potential financial management challenges under new leadership initiatives and strategic expansions in Asia.

- The growth report we've compiled suggests that Julius Bär Gruppe's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Julius Bär Gruppe.

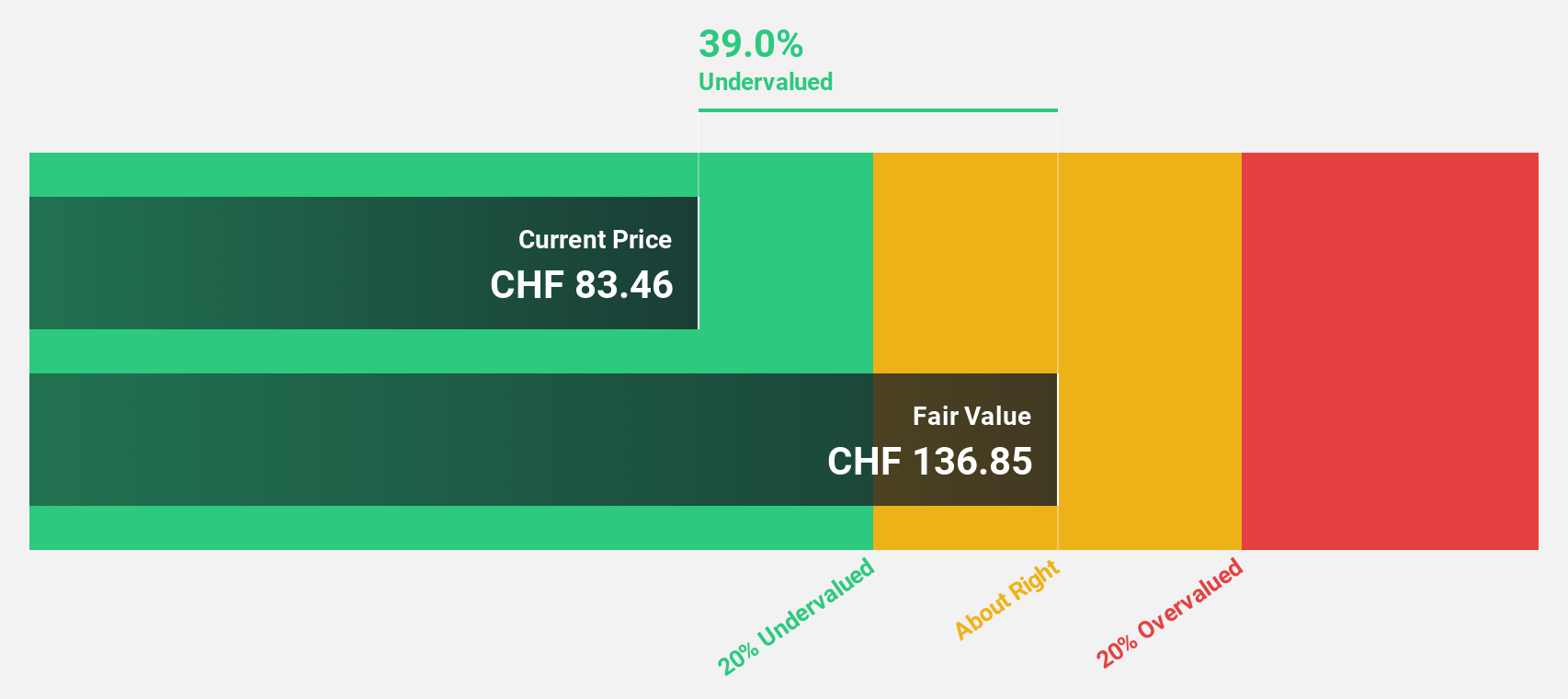

SGS (SWX:SGSN)

Overview: SGS SA is a global company headquartered in Switzerland, offering inspection, testing, and verification services across various regions including Europe, Africa, the Middle East, the Americas, and Asia Pacific, with a market capitalization of CHF 17.43 billion.

Operations: The company's revenue is derived from its Business Assurance segment, which generated CHF 0.76 billion.

Estimated Discount To Fair Value: 28.9%

SGS SA, with a recent share price of CHF92.1, is trading 28.9% below its estimated fair value of CHF129.51, signaling potential undervaluation based on cash flows. Despite a high debt level and dividends not well covered by earnings, the company's revenue and earnings growth are forecasted to outpace the Swiss market at 5.5% and 11.91% per year respectively. Recent financials show slight declines in net income and EPS but confirm mid to high single-digit organic growth for 2024.

- The analysis detailed in our SGS growth report hints at robust future financial performance.

- Click here to discover the nuances of SGS with our detailed financial health report.

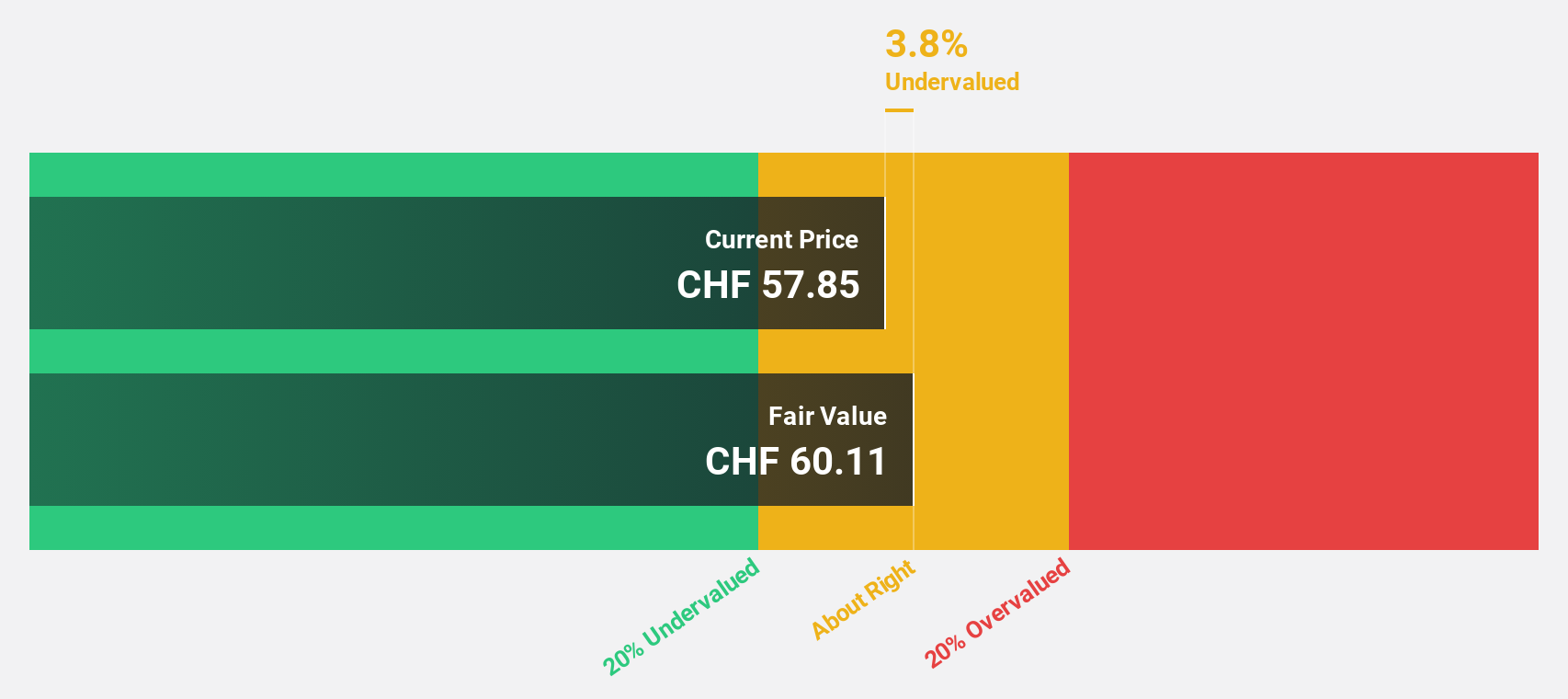

Temenos (SWX:TEMN)

Overview: Temenos AG is a global provider of integrated banking software systems, serving banks and financial institutions, with a market capitalization of approximately CHF 4.42 billion.

Operations: The firm's revenue is derived from the sale of integrated banking software systems to financial institutions globally.

Estimated Discount To Fair Value: 35.8%

Temenos, priced at CHF61, is valued 35.8% below its fair value of CHF94.98, suggesting undervaluation based on cash flows. While the company's earnings growth is expected at 13.9% annually, surpassing the Swiss market forecast of 8.3%, revenue growth projections are modest at 7.6% per year. Recent strategic executive hires aim to boost its SaaS and U.S market presence, potentially enhancing future performance despite a high debt level and a revenue growth rate that doesn't reach the high-growth threshold of 20%.

- Our expertly prepared growth report on Temenos implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Temenos here with our thorough financial health report.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener has unearthed 13 more companies for you to explore.Click here to unveil our expertly curated list of 16 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Temenos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TEMN

Temenos

Develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide.

Reasonable growth potential with proven track record and pays a dividend.