- Germany

- /

- Medical Equipment

- /

- XTRA:SBS

European Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As the European market experiences a mixed economic landscape, with the pan-European STOXX Europe 600 Index showing resilience amidst global uncertainties, investors are increasingly focusing on growth companies with strong insider ownership. In such an environment, stocks that combine robust growth potential with significant insider investment can offer a compelling proposition, as they often signal confidence from those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| TF Bank (OM:TFBANK) | 15.6% | 20% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| Vow (OB:VOW) | 12.9% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.1% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 89.9% |

| Ortoma (OM:ORT B) | 27.7% | 73.4% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 114.3% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Here's a peek at a few of the choices from the screener.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG, with a market cap of CHF10.77 billion, develops and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across Switzerland and globally.

Operations: Revenue Segments (in millions of CHF):#start# Semiconductor: 1,021.45; Display & Solar: 312.78; General Vacuum: 205.32 #end# VAT Group AG generates revenue through its Semiconductor segment with CHF1.02 billion, Display & Solar segment at CHF312.78 million, and General Vacuum segment contributing CHF205.32 million.

Insider Ownership: 10.2%

VAT Group exhibits strong growth potential with earnings projected to increase significantly at 20.6% annually, outpacing the Swiss market. Recent results show a rise in net income to CHF 211.8 million for 2024, supported by sales growth to CHF 942.2 million. Despite high share price volatility, insider ownership remains stable with no recent substantial trading activity. Revenue is expected to grow at 12.4% annually, and return on equity is forecasted to be very high in three years.

- Take a closer look at VAT Group's potential here in our earnings growth report.

- Our valuation report here indicates VAT Group may be overvalued.

Circus (XTRA:CA1)

Simply Wall St Growth Rating: ★★★★★★

Overview: Circus SE, with a market cap of €400.37 million, is an AI robotics company specializing in developing robotics and software technologies for autonomous food service operations.

Operations: The company's revenue segment includes Industrial Automation & Controls, generating €0.27 million.

Insider Ownership: 26%

Circus SE is poised for significant growth, with revenue and earnings expected to exceed 41% and 51% annually, respectively, outpacing the German market. Despite recent share price volatility, insider ownership remains stable. The company has completed industrialization of its CA-1 robot for high-volume production starting May 2025. Strategic appointments like Hajo Riesenbeck and Claus Holst-Gydesen bolster its global expansion efforts in AI-powered food robotics, addressing a substantial pre-order backlog of over 8,400 units.

- Dive into the specifics of Circus here with our thorough growth forecast report.

- Our expertly prepared valuation report Circus implies its share price may be too high.

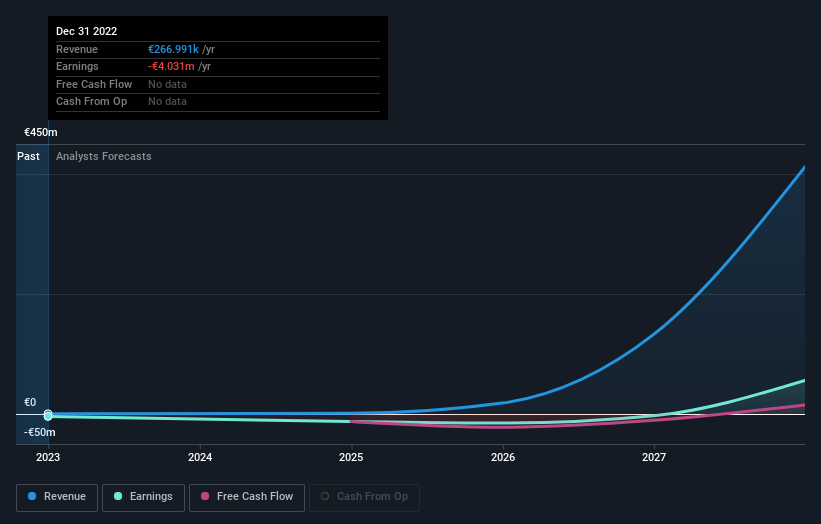

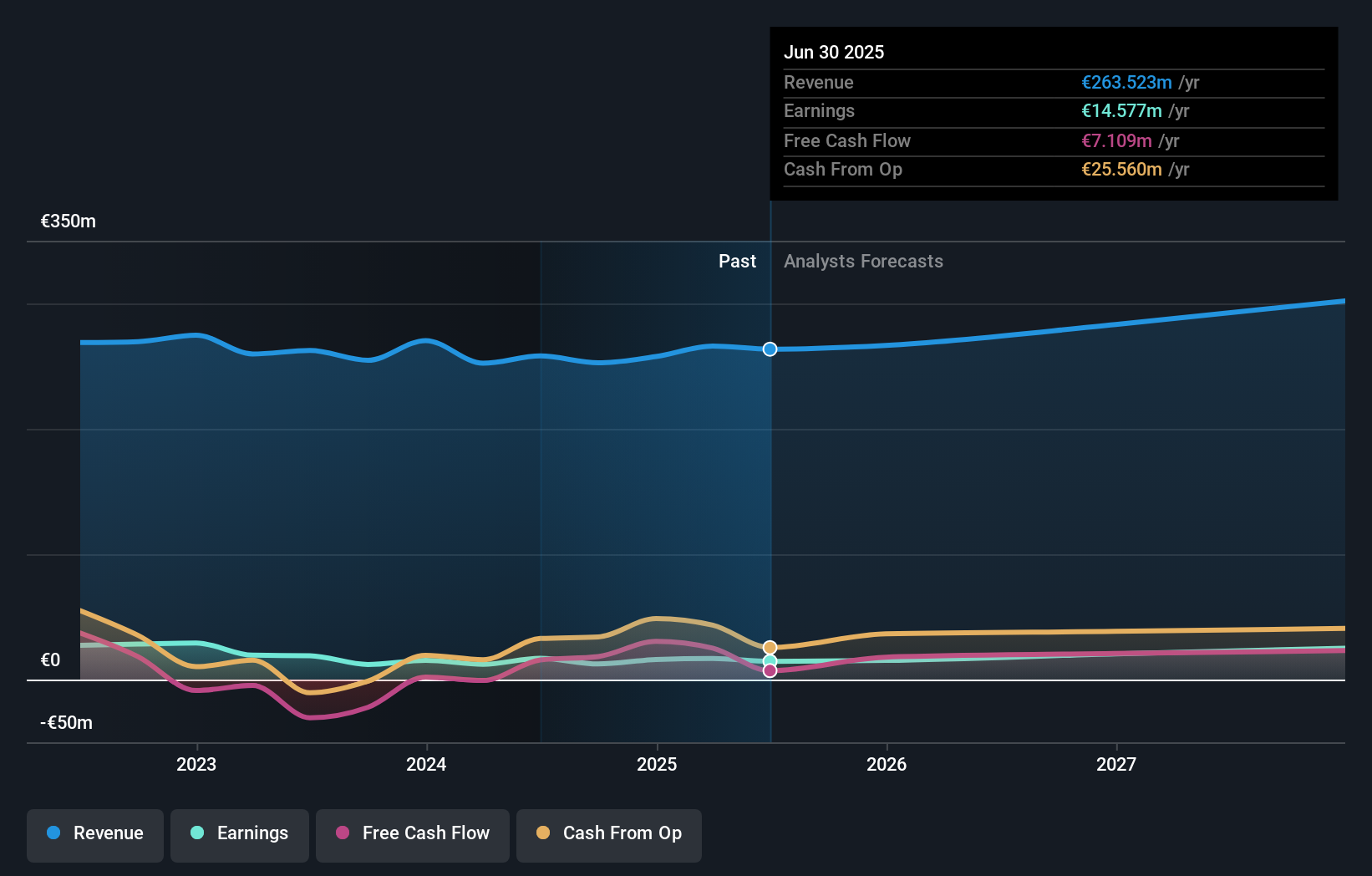

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stratec SE, with a market cap of €339.15 million, designs and manufactures automation and instrumentation solutions for in-vitro diagnostics and life sciences in Germany, the European Union, and internationally.

Operations: The company's revenue primarily comes from its Automation Solutions for Highly Regulated Laboratory segment, which generated €250.54 million.

Insider Ownership: 30.9%

Stratec SE is positioned for strong earnings growth, with forecasts indicating a 25.09% annual increase, surpassing the German market's 16.7%. Despite its high debt level and volatile share price, the stock trades at a significant discount to its estimated fair value. Revenue growth of 6.1% per year slightly outpaces the market average of 5.8%. Recent presentations at major conferences highlight ongoing engagement with investors and industry stakeholders, although insider trading activity remains minimal over recent months.

- Get an in-depth perspective on Stratec's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Stratec's share price might be on the cheaper side.

Summing It All Up

- Unlock more gems! Our Fast Growing European Companies With High Insider Ownership screener has unearthed 221 more companies for you to explore.Click here to unveil our expertly curated list of 224 Fast Growing European Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SBS

Stratec

Designs and manufactures automation and instrumentation solutions in the fields of in-vitro diagnostics and life sciences in Germany, European Union, and internationally.

Reasonable growth potential with adequate balance sheet.