- Italy

- /

- Consumer Finance

- /

- BIT:MOL

3 European Growth Companies With Insider Ownership Up To 22%

Reviewed by Simply Wall St

Amid heightened global trade tensions and economic uncertainty, European markets have experienced significant declines, with the STOXX Europe 600 Index seeing its largest drop in five years. In such volatile conditions, companies with strong insider ownership can be appealing to investors as this often indicates confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Elicera Therapeutics (OM:ELIC) | 28.3% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Lokotech Group (OB:LOKO) | 13.9% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| CD Projekt (WSE:CDR) | 29.7% | 36.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Let's uncover some gems from our specialized screener.

Moltiply Group (BIT:MOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Moltiply Group S.p.A. is a holding company in the financial services industry with a market cap of €1.42 billion.

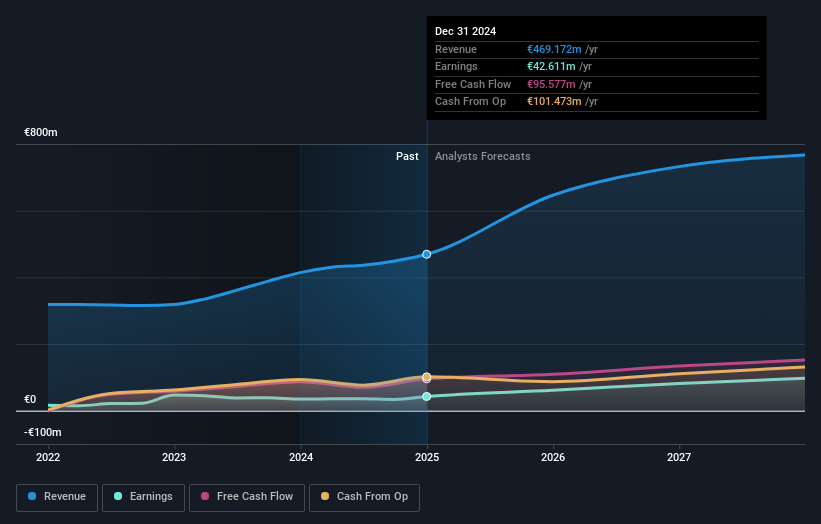

Operations: The company's revenue segments include €221.12 million from the Mavriq Division and €232.86 million from Moltiply BPO&Tech.

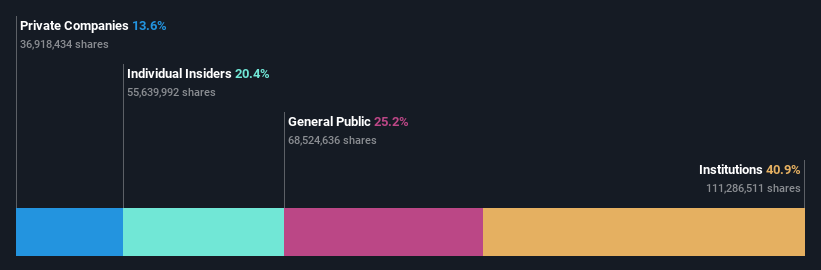

Insider Ownership: 22.9%

Moltiply Group S.p.A. demonstrates robust growth potential with earnings forecasted to rise significantly at 26.21% annually, outpacing the Italian market's 7.6%. Despite a high debt level, its revenue is projected to grow at 15% per year, surpassing the local market average of 4.1%. Recent financials show an increase in sales from €414.02 million to €469.17 million and net income from €34.69 million to €41.71 million for fiscal year-end 2024, highlighting solid performance momentum without recent insider trading activity influencing stock dynamics.

- Click here to discover the nuances of Moltiply Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Moltiply Group shares in the market.

Getinge (OM:GETI B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Getinge AB (publ) is a company that offers products and solutions for operating rooms, intensive-care units, and sterilization departments both in Sweden and globally, with a market cap of SEK52.98 billion.

Operations: Getinge's revenue segments comprise Life Science at SEK4.55 billion, Acute Care Therapies at SEK17.95 billion, and Surgical Workflows (excluding Life Science) at SEK12.26 billion.

Insider Ownership: 20.4%

Getinge shows potential as a growth company with significant insider ownership, despite challenges in profit margins, which decreased from 7.6% to 4.7%. The company's earnings are forecasted to grow significantly at 22.2% annually, outpacing the Swedish market's average of 9.4%. Recent innovations like the Neural Pressure Support for ICU ventilation and DPTE®-FLEX port enhance its product offerings. However, an unstable dividend track record and lower-than-expected return on equity remain concerns.

- Click to explore a detailed breakdown of our findings in Getinge's earnings growth report.

- Upon reviewing our latest valuation report, Getinge's share price might be too pessimistic.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VAT Group AG, along with its subsidiaries, specializes in the development, manufacturing, and sale of vacuum and gas inlet valves, multi-valve modules, motion components, and edge-welded metal bellows with a market capitalization of CHF8.05 billion.

Operations: The company's revenue is primarily generated from its Valves segment, which accounts for CHF842.76 million, followed by the Global Service segment at CHF167.53 million.

Insider Ownership: 10.2%

VAT Group demonstrates growth potential with substantial insider ownership. The company reported a rise in 2024 sales to CHF 942.2 million and net income of CHF 211.8 million, reflecting robust financial performance. Forecasts suggest earnings and revenue will grow faster than the Swiss market at 18.6% and 12.4% annually, respectively, though not significantly high by some standards. Despite volatile share prices recently, VAT trades below its estimated fair value with analyst consensus predicting a price increase of over 40%.

- Dive into the specifics of VAT Group here with our thorough growth forecast report.

- The analysis detailed in our VAT Group valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Navigate through the entire inventory of 228 Fast Growing European Companies With High Insider Ownership here.

- Curious About Other Options? Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Moltiply Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MOL

Moltiply Group

A holding company that operates in the financial services industry.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives