- Switzerland

- /

- Machinery

- /

- SWX:RIEN

Rieter Holding AG (VTX:RIEN) Shares Fly 26% But Investors Aren't Buying For Growth

Rieter Holding AG (VTX:RIEN) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

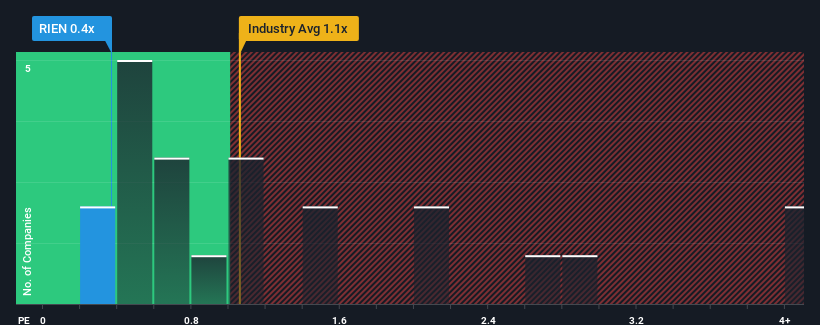

Although its price has surged higher, it would still be understandable if you think Rieter Holding is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Switzerland's Machinery industry have P/S ratios above 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Rieter Holding

How Rieter Holding Has Been Performing

Rieter Holding has been struggling lately as its revenue has declined faster than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Rieter Holding will help you uncover what's on the horizon.How Is Rieter Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Rieter Holding's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.1%. Even so, admirably revenue has lifted 148% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 27% as estimated by the three analysts watching the company. That's not great when the rest of the industry is expected to grow by 2.2%.

With this in consideration, we find it intriguing that Rieter Holding's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Rieter Holding's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Rieter Holding's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 5 warning signs for Rieter Holding (1 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:RIEN

Rieter Holding

Supplies systems for manufacturing yarn from staple fibers in spinning mills in Switzerland and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives