- Sweden

- /

- Commercial Services

- /

- OM:ITAB

European Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the European market continues to navigate a complex landscape marked by trade tensions and economic policy shifts, the pan-European STOXX Europe 600 Index has managed to rise for a fourth consecutive week. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business, potentially offering resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Yubico (OM:YUBICO) | 36.5% | 27% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.4% | 66.1% |

| Vow (OB:VOW) | 13.1% | 81% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 52.2% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 51.9% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

Underneath we present a selection of stocks filtered out by our screen.

Idun Industrier (OM:IDUN B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Idun Industrier AB (publ) is an investment holding company that manufactures and sells glass fiber reinforced fat- and oil separators in Sweden, with a market cap of SEK4.31 billion.

Operations: Idun Industrier generates revenue through its Manufacturing segment, which contributes SEK1.35 billion, and its Service & Maintenance segment, which adds SEK863.34 million.

Insider Ownership: 13.3%

Idun Industrier AB demonstrates strong growth potential with earnings forecasted to increase significantly at 23.9% annually, outpacing the Swedish market's 16.4%. Recent Q1 results showed net income rising to SEK 10.65 million from SEK 3.47 million, reflecting robust financial performance despite interest payments not being well covered by earnings. The company trades slightly below its estimated fair value and maintains a steady revenue growth rate of 10.5%, surpassing the broader market's pace.

- Delve into the full analysis future growth report here for a deeper understanding of Idun Industrier.

- The valuation report we've compiled suggests that Idun Industrier's current price could be inflated.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) specializes in providing store design solutions, customized fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores, with a market cap of SEK6.47 billion.

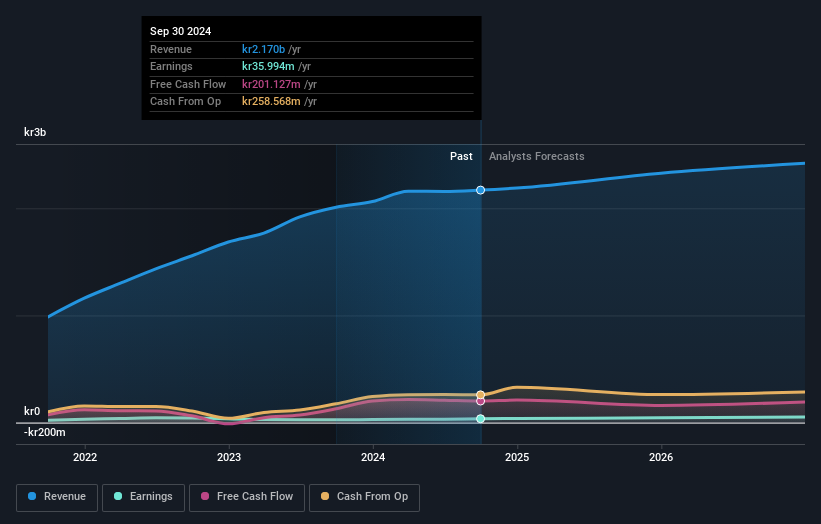

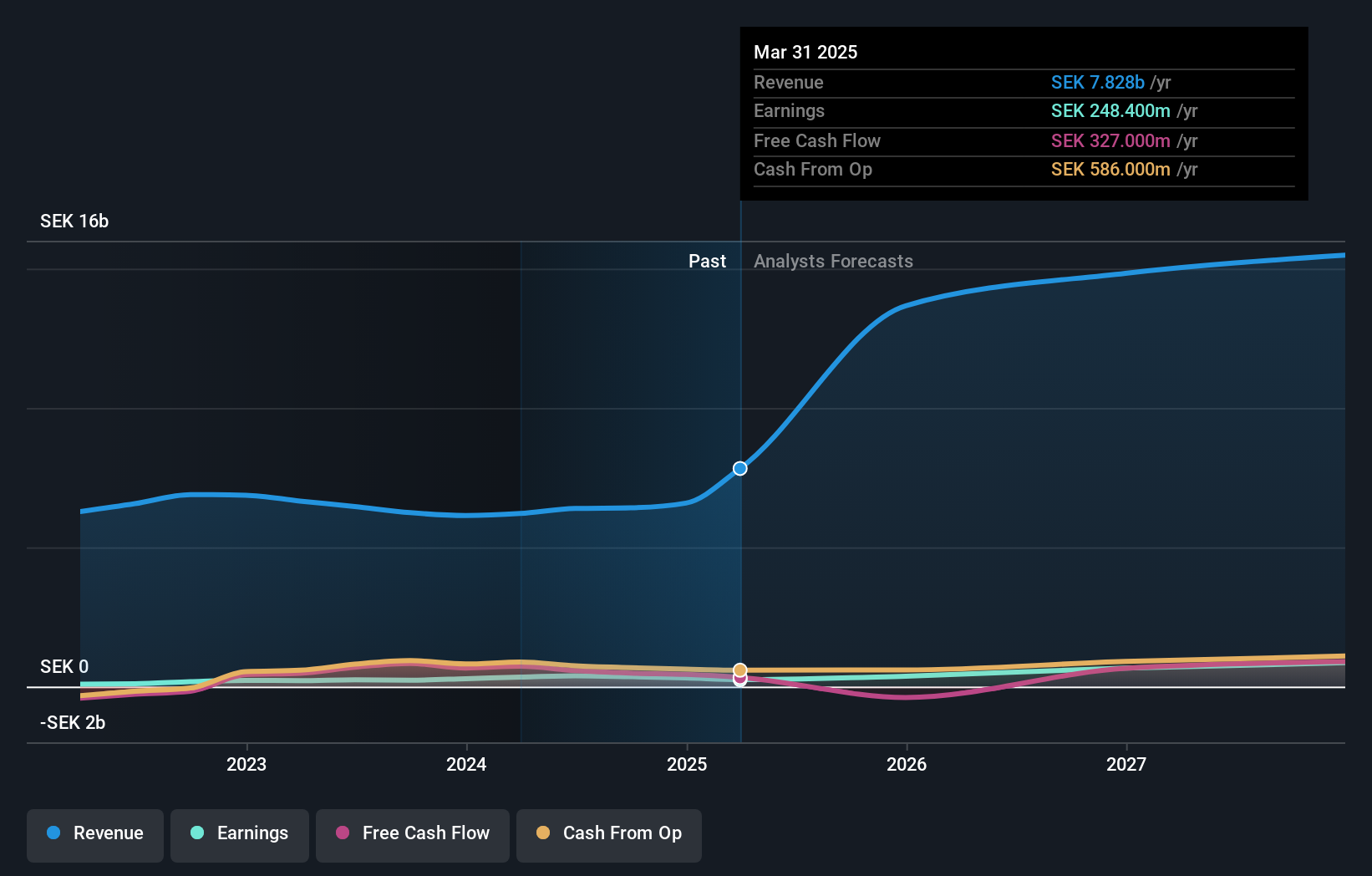

Operations: The company's revenue is primarily derived from its Furniture & Fixtures segment, amounting to SEK7.83 billion.

Insider Ownership: 18.8%

ITAB Shop Concept shows promising growth potential with earnings expected to grow significantly at 43.1% annually, surpassing the Swedish market's rate. Despite recent dilution and a decrease in profit margins from 5.5% to 3.2%, ITAB trades well below its fair value estimate. Recent agreements with major European retailers like ASDA and a large DIY chain highlight strategic expansion efforts, although net income dropped to SEK 37 million compared to SEK 100 million last year.

- Take a closer look at ITAB Shop Concept's potential here in our earnings growth report.

- Our expertly prepared valuation report ITAB Shop Concept implies its share price may be lower than expected.

Rieter Holding (SWX:RIEN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rieter Holding AG, along with its subsidiaries, provides systems for manufacturing yarn from staple fibers in spinning mills both in Switzerland and internationally, with a market cap of CHF369.32 million.

Operations: The company's revenue is derived from three main segments: Components (CHF303 million), After Sales (CHF186.60 million), and Machines & Systems (CHF424.90 million).

Insider Ownership: 35.1%

Rieter Holding is forecasted to achieve robust earnings growth of 47.8% annually, outpacing the Swiss market's 10.9%. Despite a recent decline in sales to CHF 859.1 million and net income to CHF 10.5 million, analysts expect a substantial stock price increase of 48.9%. However, profit margins have decreased from last year, and interest payments are inadequately covered by earnings, while insider trading activity remains minimal over the past three months.

- Navigate through the intricacies of Rieter Holding with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Rieter Holding's shares may be trading at a premium.

Make It Happen

- Embark on your investment journey to our 209 Fast Growing European Companies With High Insider Ownership selection here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 30 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ITAB

ITAB Shop Concept

Provides solution and store design, customized concept fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for the physical stores.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives