- Switzerland

- /

- Electrical

- /

- SWX:LECN

Risks Still Elevated At These Prices As Leclanché SA (VTX:LECN) Shares Dive 45%

To the annoyance of some shareholders, Leclanché SA ( VTX:LECN ) shares are down a considerable 45% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 78% loss during that time.

The primary reason for the dip in share price is that Leclanché shares fell below the free float threshold of the SIX Swiss Exchange, which dictates inclusion in the Swiss Performance Index (SPI). Now that Leclanché is no longer part of the index, passive index funds like UBS were required to liquidate their shares by October 25.

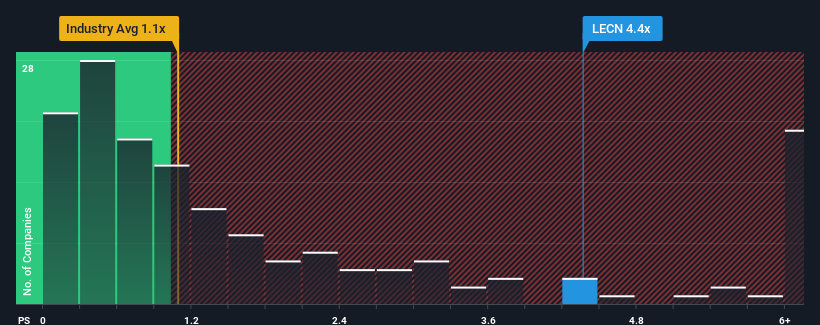

Even after such a large drop in price, when almost half of the companies in Switzerland's Electrical industry have price-to-sales ratios (or "P/S") below 2.4x, you may still consider Leclanché as a stock not worth researching with its 4.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Leclanché

What Does Leclanché's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Leclanché over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Leclanché, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Leclanché would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.3%. This means it has also seen a slide in revenue over the longer-term as revenue is down 21% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 6.4% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Leclanché's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Leclanché's P/S?

Leclanché's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Leclanché currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Leclanché is showing 5 warning signs in our investment analysis, and 3 of those are concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:LECN

Leclanché

Designs, develops, and manufactures customized turnkey energy storage solutions for electricity generation and transmission, mass transportation, heavy industrial machines, and specialty low voltage battery systems.

Low risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives