- Switzerland

- /

- Machinery

- /

- SWX:KOMN

March 2025's European Stocks That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the European markets face challenges from U.S. trade tariffs and monetary policy uncertainties, investors are closely watching economic developments across the continent. In this environment, identifying stocks that may be trading below their estimated value could present opportunities for those looking to navigate these complex market conditions effectively.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Romsdal Sparebank (OB:ROMSB) | NOK130.30 | NOK260.00 | 49.9% |

| Somec (BIT:SOM) | €10.35 | €20.55 | 49.6% |

| Wienerberger (WBAG:WIE) | €35.12 | €69.28 | 49.3% |

| Comet Holding (SWX:COTN) | CHF236.00 | CHF464.97 | 49.2% |

| JOST Werke (XTRA:JST) | €50.40 | €98.53 | 48.8% |

| Net Insight (OM:NETI B) | SEK4.825 | SEK9.58 | 49.6% |

| MEMSCAP (ENXTPA:MEMS) | €3.95 | €7.69 | 48.6% |

| dormakaba Holding (SWX:DOKA) | CHF685.00 | CHF1356.53 | 49.5% |

| MilDef Group (OM:MILDEF) | SEK207.00 | SEK404.07 | 48.8% |

| Entech (ENXTPA:ALESE) | €8.16 | €16.30 | 50% |

Below we spotlight a couple of our favorites from our exclusive screener.

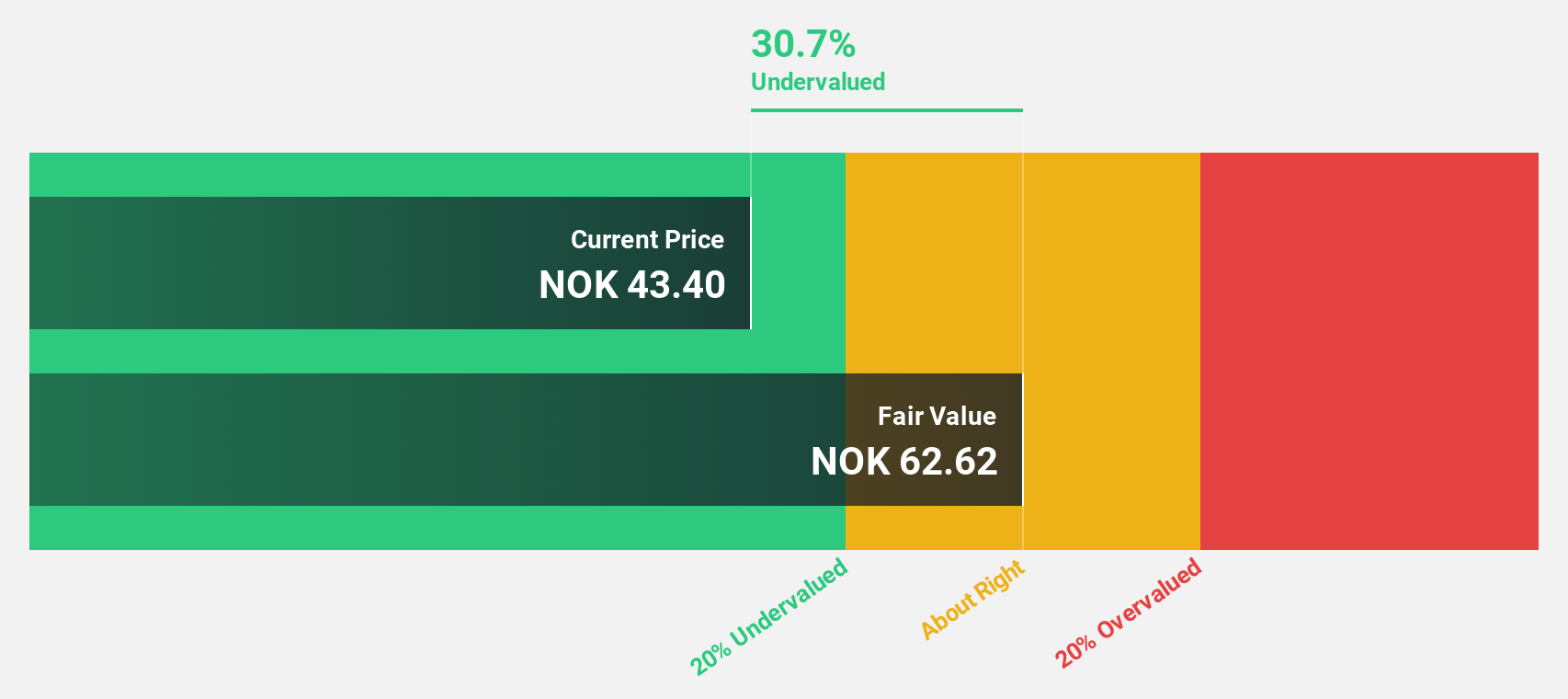

Norconsult (OB:NORCO)

Overview: Norconsult ASA is a consultancy firm specializing in community planning, engineering design, and architecture services in the Nordics and internationally, with a market capitalization of NOK13.87 billion.

Operations: The company generates revenue from several segments, including NOK1.81 billion from Sweden, NOK864 million from Denmark, NOK2.83 billion from Norway Regions, NOK918 million in Renewable Energy, NOK3.04 billion at the Norway Head Office, and NOK1.19 billion through Digital and Techno-Garden services.

Estimated Discount To Fair Value: 37.3%

Norconsult ASA appears undervalued, trading at NOK 46, significantly below its estimated fair value of NOK 73.4. Despite a modest revenue growth forecast of 2.4% annually, earnings are expected to grow by 15.1% per year, surpassing the Norwegian market average. Recent financial results show strong quarterly performance with net income rising to NOK 202 million from NOK 74 million a year ago, although full-year net income slightly declined to NOK 496 million from NOK 516 million.

- Our comprehensive growth report raises the possibility that Norconsult is poised for substantial financial growth.

- Get an in-depth perspective on Norconsult's balance sheet by reading our health report here.

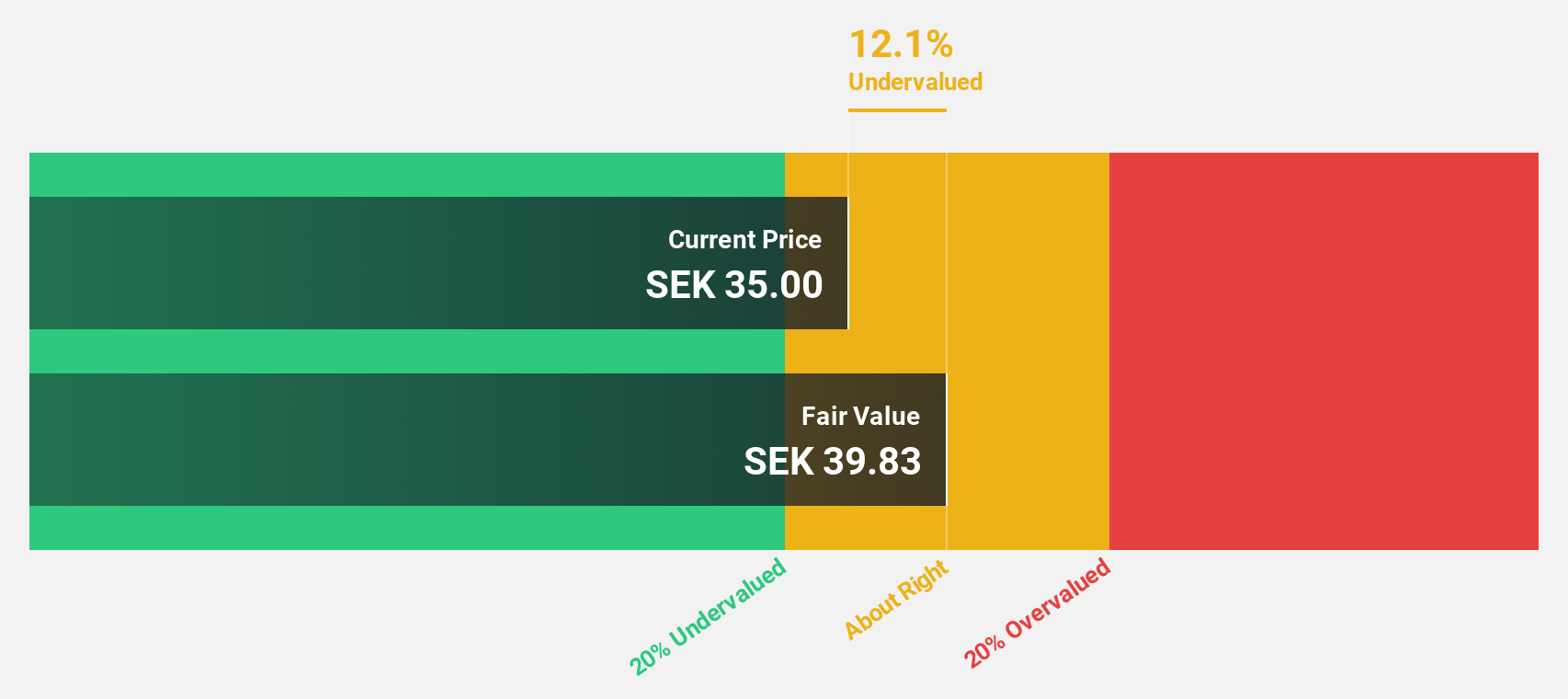

Ratos (OM:RATO B)

Overview: Ratos AB (publ) is a private equity firm focused on buyouts, turnarounds, add-on acquisitions, and middle market transactions with a market cap of SEK11.81 billion.

Operations: The company's revenue is segmented into Consumer (SEK5.34 billion), Construction (SEK12.07 billion), Product Solutions (SEK5.10 billion), Industrial Services (SEK5.36 billion), and Critical Infrastructure (SEK4.31 billion).

Estimated Discount To Fair Value: 25.2%

Ratos AB is trading at SEK 35.76, well below its estimated fair value of SEK 47.78, making it undervalued based on cash flows. Despite a challenging year with net income dropping to SEK 249 million from SEK 1,218 million and profit margins decreasing to 0.8%, earnings are forecasted to grow significantly at 36% annually over the next three years, outpacing the Swedish market average of 9.2%.

- Our expertly prepared growth report on Ratos implies its future financial outlook may be stronger than recent results.

- Take a closer look at Ratos' balance sheet health here in our report.

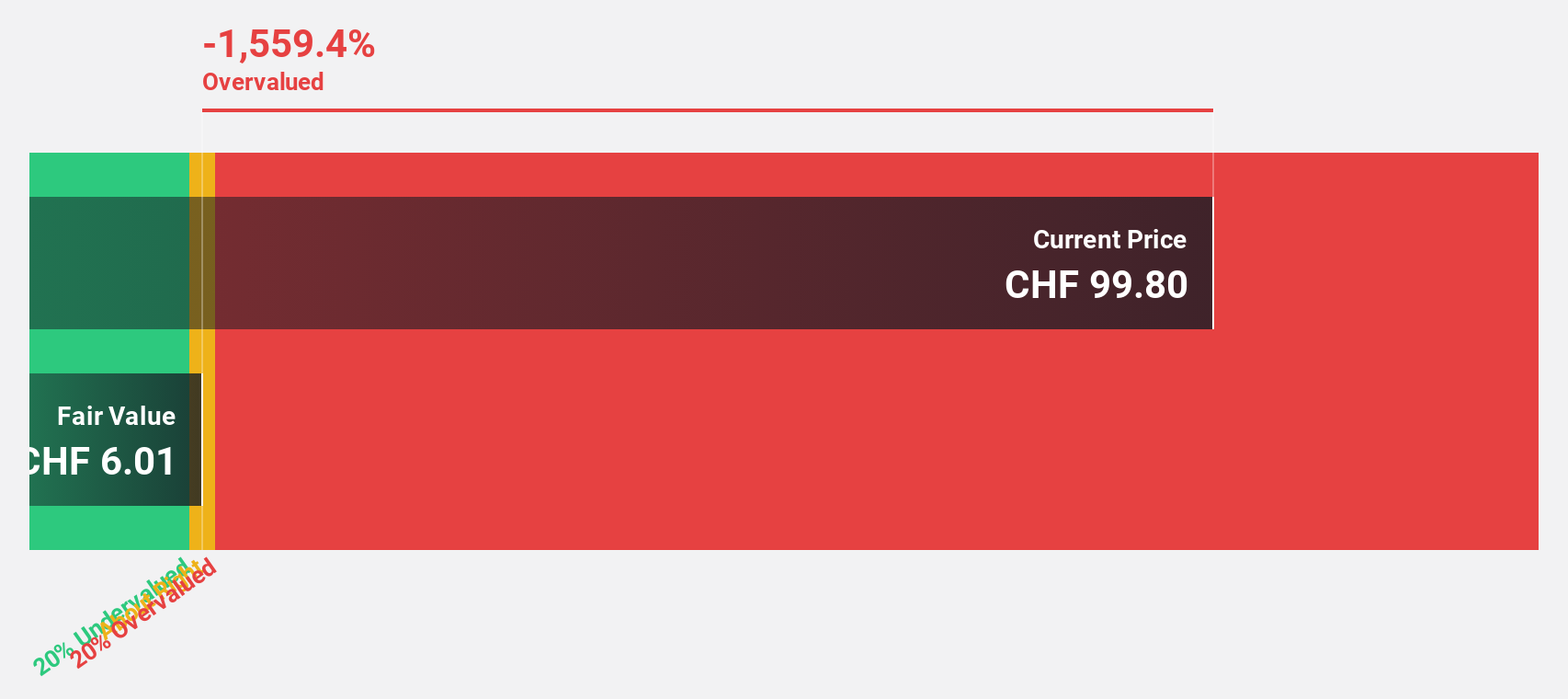

Komax Holding (SWX:KOMN)

Overview: Komax Holding AG, with a market cap of CHF587.18 million, operates in the automated wire processing industry through its subsidiaries.

Operations: The company's revenue is primarily generated from its Wire Processing segment, amounting to CHF623.39 million.

Estimated Discount To Fair Value: 14.0%

Komax Holding AG, trading at CHF 114.6, is undervalued relative to its estimated fair value of CHF 133.32. Despite a challenging fiscal year with a net loss of CHF 3.22 million and declining revenues, the company is expected to achieve profitability within three years and grow earnings by 59% annually, surpassing market averages. Analysts anticipate a stock price rise of over 50%, although recent share price volatility may concern some investors.

- In light of our recent growth report, it seems possible that Komax Holding's financial performance will exceed current levels.

- Dive into the specifics of Komax Holding here with our thorough financial health report.

Key Takeaways

- Delve into our full catalog of 206 Undervalued European Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komax Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:KOMN

Excellent balance sheet and good value.