- Switzerland

- /

- Machinery

- /

- SWX:INRN

At CHF2,955, Is It Time To Put Interroll Holding AG (VTX:INRN) On Your Watch List?

Interroll Holding AG (VTX:INRN), is not the largest company out there, but it received a lot of attention from a substantial price increase on the SWX over the last few months. The recent rally in share prices has nudged the company in the right direction, though it still falls short of its yearly peak. As a mid-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. However, could the stock still be trading at a relatively cheap price? Let’s take a look at Interroll Holding’s outlook and value based on the most recent financial data to see if the opportunity still exists.

See our latest analysis for Interroll Holding

What's The Opportunity In Interroll Holding?

The stock seems fairly valued at the moment according to our valuation model. It’s trading around 8.91% above our intrinsic value, which means if you buy Interroll Holding today, you’d be paying a relatively reasonable price for it. And if you believe that the stock is really worth CHF2713.37, there’s only an insignificant downside when the price falls to its real value. Is there another opportunity to buy low in the future? Since Interroll Holding’s share price is quite volatile, we could potentially see it sink lower (or rise higher) in the future, giving us another chance to buy. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

What kind of growth will Interroll Holding generate?

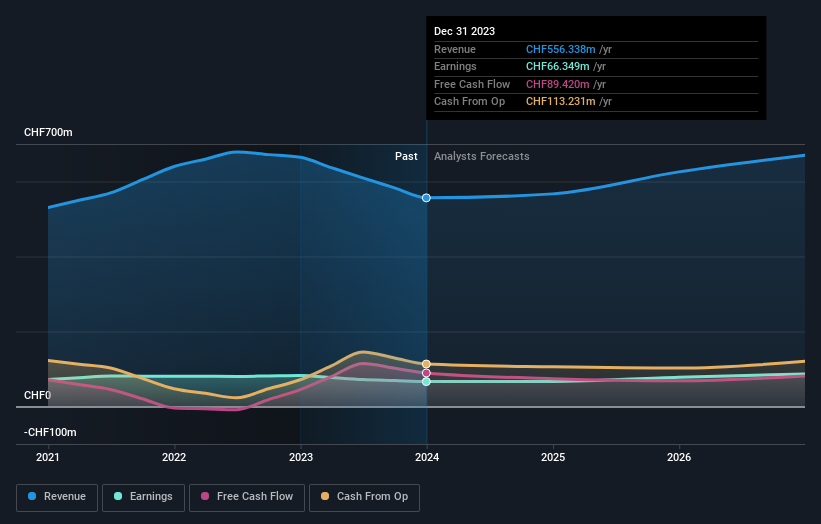

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. With profit expected to grow by 31% over the next couple of years, the future seems bright for Interroll Holding. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What This Means For You

Are you a shareholder? INRN’s optimistic future growth appears to have been factored into the current share price, with shares trading around its fair value. However, there are also other important factors which we haven’t considered today, such as the track record of its management team. Have these factors changed since the last time you looked at the stock? Will you have enough confidence to invest in the company should the price drop below its fair value?

Are you a potential investor? If you’ve been keeping an eye on INRN, now may not be the most advantageous time to buy, given it is trading around its fair value. However, the positive outlook is encouraging for the company, which means it’s worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

Since timing is quite important when it comes to individual stock picking, it's worth taking a look at what those latest analysts forecasts are. At Simply Wall St, we have the analysts estimates which you can view by clicking here.

If you are no longer interested in Interroll Holding, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:INRN

Interroll Holding

Provides material-handling solutions in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026