- Switzerland

- /

- Building

- /

- SWX:DOKA

European Stocks Possibly Undervalued In March 2025

Reviewed by Simply Wall St

Amidst ongoing uncertainty over U.S. trade tariffs and European monetary policy, the pan-European STOXX Europe 600 Index recently ended lower, reflecting broader concerns about economic growth in the region. Despite these challenges, there may be opportunities to identify stocks that are potentially undervalued based on current market conditions and economic factors, offering investors a chance to explore value investments in Europe's diverse markets.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Absolent Air Care Group (OM:ABSO) | SEK258.00 | SEK511.18 | 49.5% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.46 | SEK164.57 | 49.3% |

| Gesco (XTRA:GSC1) | €16.10 | €31.37 | 48.7% |

| JOST Werke (XTRA:JST) | €51.00 | €98.68 | 48.3% |

| Storytel (OM:STORY B) | SEK91.45 | SEK179.85 | 49.2% |

| Star7 (BIT:STAR7) | €6.30 | €12.40 | 49.2% |

| dormakaba Holding (SWX:DOKA) | CHF691.00 | CHF1359.06 | 49.2% |

| Neosperience (BIT:NSP) | €0.538 | €1.06 | 49.2% |

| Cint Group (OM:CINT) | SEK6.635 | SEK12.90 | 48.6% |

| MilDef Group (OM:MILDEF) | SEK207.50 | SEK404.50 | 48.7% |

Let's uncover some gems from our specialized screener.

Nordic Semiconductor (OB:NOD)

Overview: Nordic Semiconductor ASA is a fabless semiconductor company that designs, sells, and delivers integrated circuits and related products for wireless applications globally, with a market cap of NOK25.52 billion.

Operations: The company's revenue is primarily generated from the design and sale of integrated circuits and related solutions, amounting to $511.42 million.

Estimated Discount To Fair Value: 44.4%

Nordic Semiconductor, trading at NOK133.3, is significantly undervalued relative to its estimated fair value of NOK239.85, with a 44.4% discount based on discounted cash flow analysis. Despite recent volatility and a net loss of US$38.5 million in 2024, earnings are projected to grow by over 50% annually as the company aims for profitability within three years. A share repurchase program worth NOK240 million further underscores management's confidence in future cash flows and valuation recovery potential.

- According our earnings growth report, there's an indication that Nordic Semiconductor might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Nordic Semiconductor.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Overview: Telefonaktiebolaget LM Ericsson (publ) and its subsidiaries offer mobile connectivity solutions to communications service providers, enterprises, and the public sector, with a market cap of approximately SEK278.13 billion.

Operations: Ericsson's revenue segments include Networks at SEK158.21 billion, Enterprise at SEK24.86 billion, and Cloud Software and Services at SEK62.64 billion.

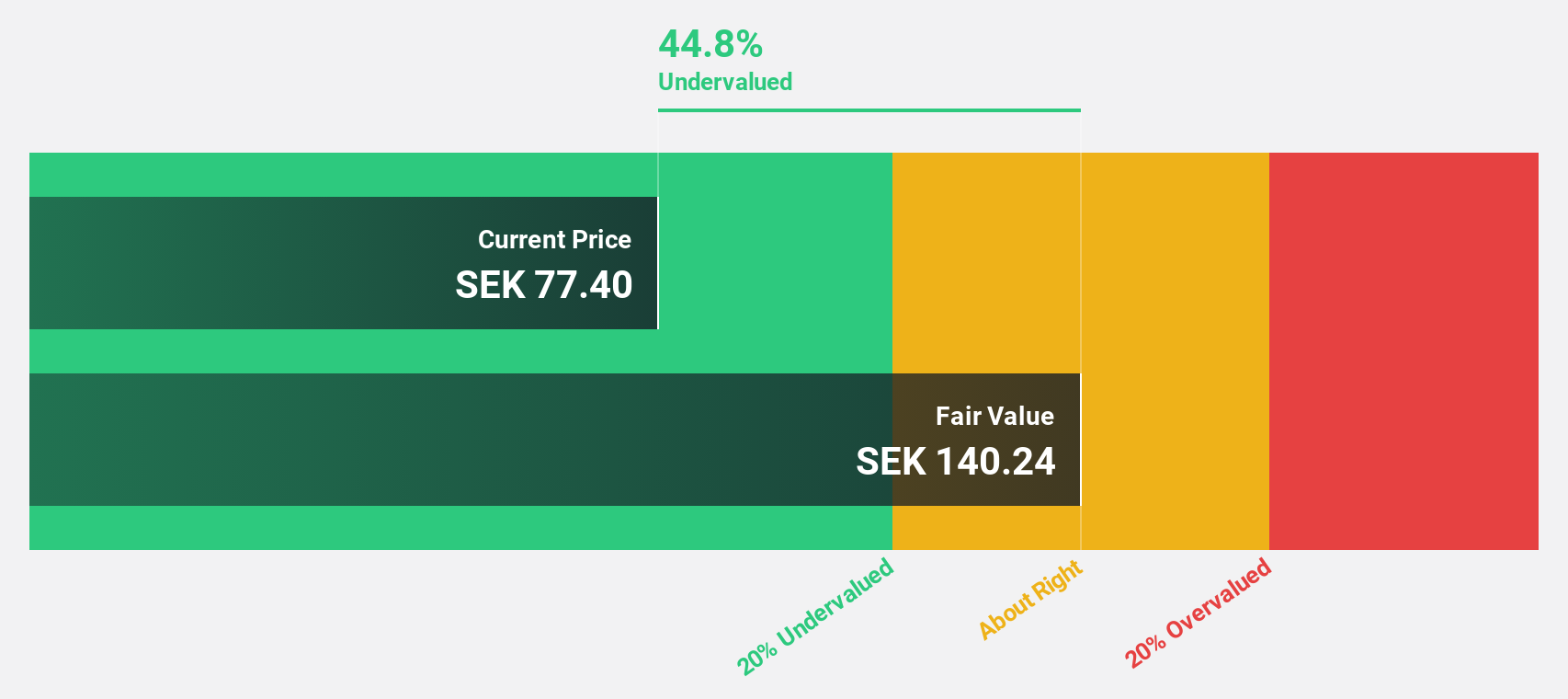

Estimated Discount To Fair Value: 49.3%

Telefonaktiebolaget LM Ericsson, trading at SEK83.46, is significantly undervalued with a fair value estimate of SEK164.57 based on discounted cash flow analysis. Recent strategic alliances, such as the partnership with Volvo and Bharti Airtel for 5G and XR technologies, highlight potential growth avenues despite large one-off items impacting financial results. Earnings are forecast to grow significantly faster than the Swedish market at 47% annually, although revenue growth remains modest at 1.9% per year.

- In light of our recent growth report, it seems possible that Telefonaktiebolaget LM Ericsson's financial performance will exceed current levels.

- Get an in-depth perspective on Telefonaktiebolaget LM Ericsson's balance sheet by reading our health report here.

dormakaba Holding (SWX:DOKA)

Overview: dormakaba Holding AG is a global provider of access and security solutions, with a market capitalization of CHF2.90 billion.

Operations: The company's revenue segments include Access Solutions, generating CHF2.44 billion, and Key & Wall Solutions and OEM, contributing CHF496.40 million.

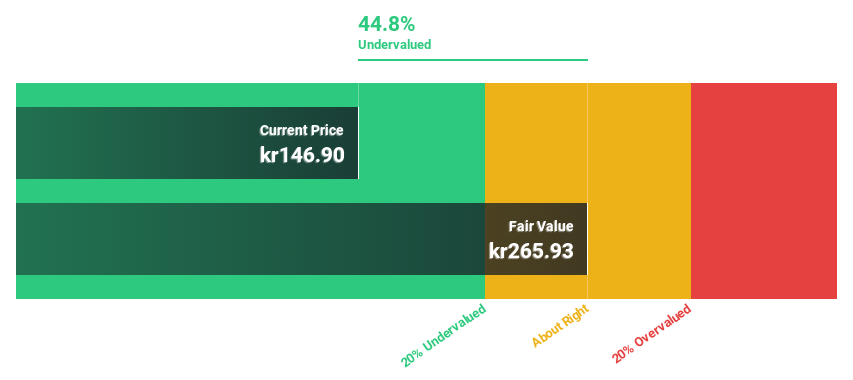

Estimated Discount To Fair Value: 49.2%

dormakaba Holding, trading at CHF691, is significantly undervalued with a fair value estimate of CHF1359.06 based on discounted cash flow analysis. Despite high debt levels, the company has shown robust earnings growth, with net income rising to CHF50.4 million for H1 2025 from CHF24.9 million a year ago. Strategic alliances and innovative solutions in critical infrastructure sectors bolster its potential for profit growth, forecasted to outpace the Swiss market at 27% annually.

- The analysis detailed in our dormakaba Holding growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in dormakaba Holding's balance sheet health report.

Where To Now?

- Navigate through the entire inventory of 204 Undervalued European Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:DOKA

Excellent balance sheet with reasonable growth potential.