As global markets continue to navigate geopolitical tensions and economic uncertainties, U.S. indexes have shown resilience by approaching record highs, buoyed by broad-based gains and positive labor market indicators. In such a climate, identifying undervalued stocks becomes crucial for investors seeking potential opportunities amidst the prevailing optimism and evolving macroeconomic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$279.50 | NT$555.22 | 49.7% |

| Gaming Realms (AIM:GMR) | £0.3665 | £0.73 | 49.6% |

| Kehua Data (SZSE:002335) | CN¥22.98 | CN¥45.54 | 49.5% |

| S-Pool (TSE:2471) | ¥339.00 | ¥676.60 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1474.00 | ¥2936.95 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$49.21 | US$98.42 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.85 | 49.8% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €7.88 | €15.63 | 49.6% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.45 | HK$54.36 | 49.5% |

| ASMPT (SEHK:522) | HK$73.00 | HK$145.81 | 49.9% |

Let's dive into some prime choices out of the screener.

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, with a market cap of CHF2.20 billion, offers X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and other international markets through its subsidiaries.

Operations: The company's revenue is derived from three main segments: X-Ray Systems (IXS) at CHF115.34 million, Industrial X-Ray Modules (IXM) at CHF95.90 million, and Plasma Control Technologies (PCT) at CHF180.62 million.

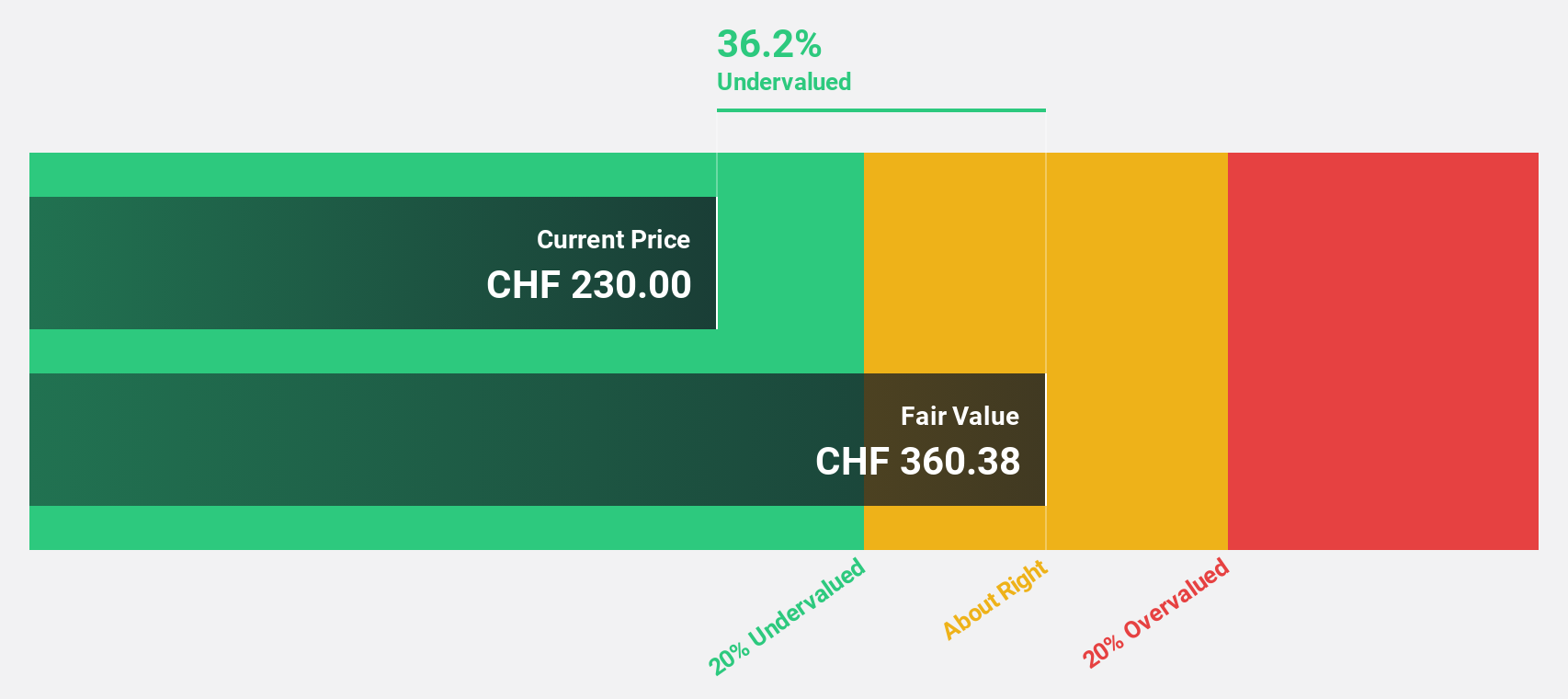

Estimated Discount To Fair Value: 28.1%

Comet Holding is trading at CHF283, significantly below its estimated fair value of CHF393.37, highlighting its undervaluation based on discounted cash flow analysis. Despite recent volatility in share price and a drop in profit margins from 10.8% to 4.6%, Comet's earnings are forecast to grow at a robust 48.6% annually, outpacing the Swiss market's growth rate of 11.4%, with revenue expected to rise by over 20% per year.

- Our expertly prepared growth report on Comet Holding implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Comet Holding with our comprehensive financial health report here.

Dätwyler Holding (SWX:DAE)

Overview: Dätwyler Holding AG produces and sells elastomer components for various industries including health care, mobility, connectors, general, and food and beverage across Europe, North America, South America, Australia, and Asia with a market cap of CHF2.36 billion.

Operations: The company's revenue is derived from Healthcare Solutions, which generated CHF445.90 million, and Industrial Solutions, which contributed CHF679.80 million.

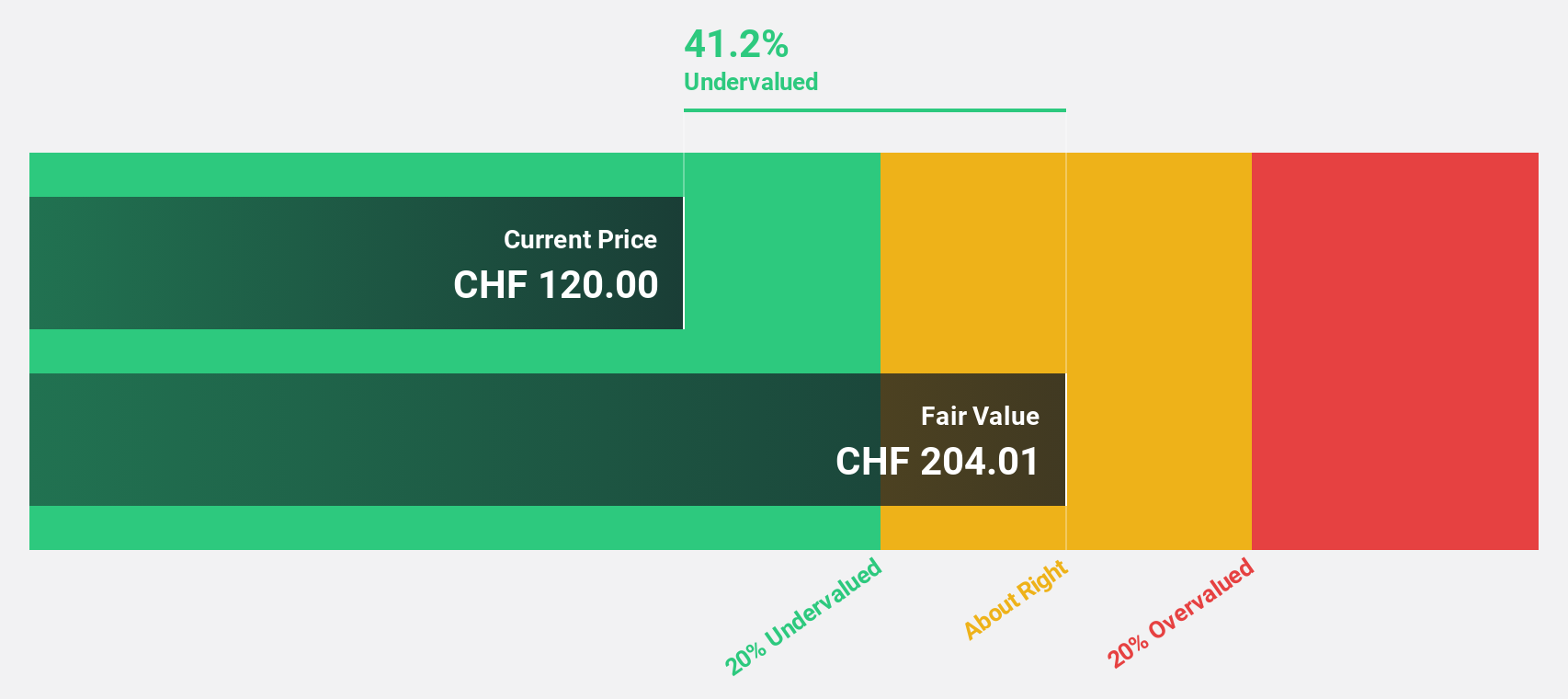

Estimated Discount To Fair Value: 40.6%

Dätwyler Holding is trading at CHF138.8, well below its estimated fair value of CHF233.66, suggesting significant undervaluation based on discounted cash flow analysis. Although the company carries a high level of debt and has an unstable dividend track record, its earnings are expected to grow significantly at 25.3% annually over the next three years, surpassing the Swiss market's growth rate of 11.4%, with revenue forecasted to increase by 5.5% per year.

- Our growth report here indicates Dätwyler Holding may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Dätwyler Holding stock in this financial health report.

Swissquote Group Holding (SWX:SQN)

Overview: Swissquote Group Holding Ltd offers a range of online financial services to retail, affluent, and professional institutional customers globally, with a market cap of CHF4.98 billion.

Operations: The company's revenue is primarily derived from Leveraged Forex, contributing CHF93.28 million, and Securities Trading, which accounts for CHF488.98 million.

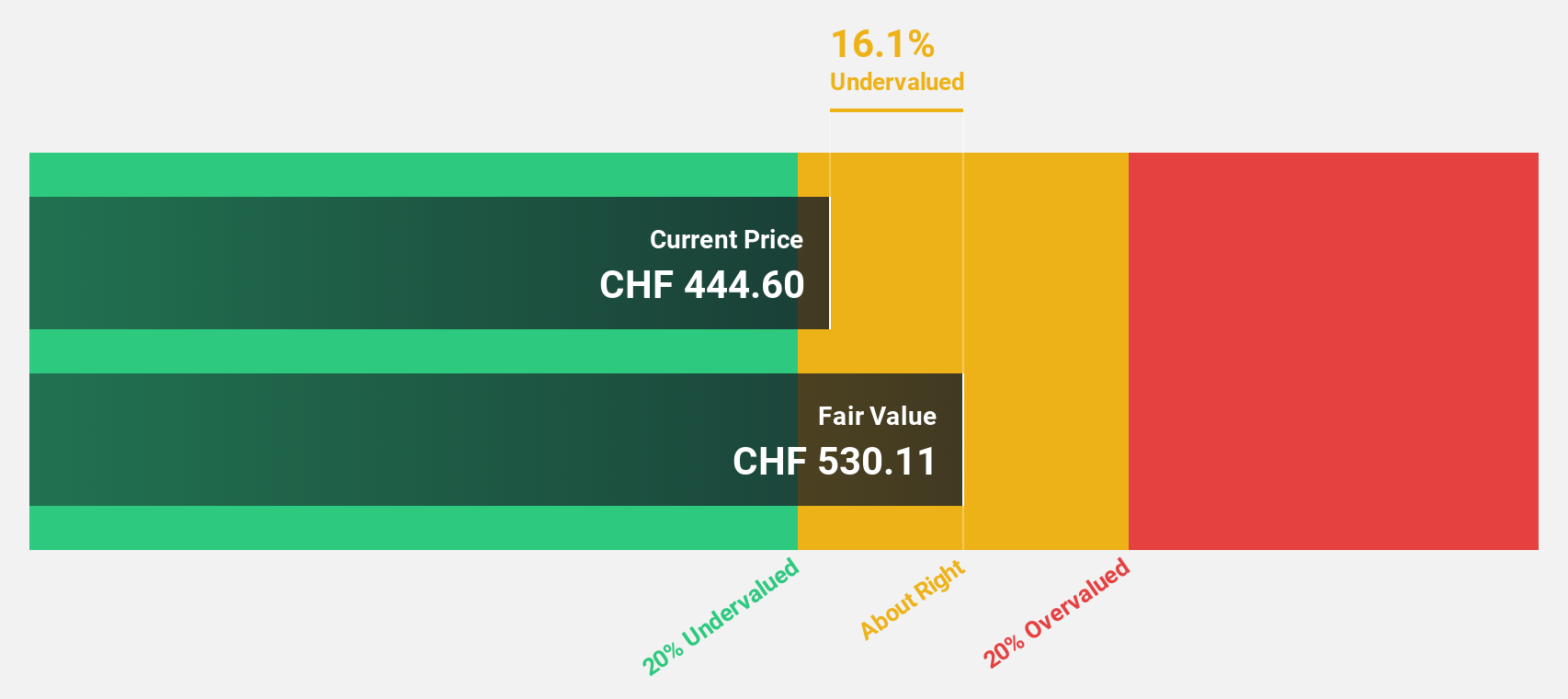

Estimated Discount To Fair Value: 40.2%

Swissquote Group Holding is trading at CHF335, significantly below its estimated fair value of CHF560.15, indicating substantial undervaluation based on discounted cash flow analysis. Its earnings are forecast to grow 12.7% annually, outpacing the Swiss market's 11.4%, while revenue is expected to increase by 11.1% per year, faster than the market's 4.2%. Despite not reaching significant growth levels, Swissquote's financial outlook remains robust with a high future return on equity of 25.6%.

- According our earnings growth report, there's an indication that Swissquote Group Holding might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Swissquote Group Holding.

Next Steps

- Investigate our full lineup of 923 Undervalued Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:COTN

Comet Holding

Provides X-ray and radio frequency (RF) power technology solutions in Europe, North America, Asia, and internationally.

Exceptional growth potential with flawless balance sheet.