As the European stock market navigates through uncertainties surrounding U.S. trade policies and economic forecasts, the recent rate cut by the European Central Bank highlights ongoing efforts to stimulate growth amid modest inflation. In this context, identifying stocks that appear undervalued can be a strategic approach for investors looking to capitalize on potential discrepancies between current market prices and intrinsic value, particularly in sectors poised to benefit from increased spending on infrastructure and defense.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.80 | €107.22 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK258.00 | SEK510.61 | 49.5% |

| Vimi Fasteners (BIT:VIM) | €0.97 | €1.90 | 49% |

| CTT Systems (OM:CTT) | SEK226.00 | SEK444.87 | 49.2% |

| Wienerberger (WBAG:WIE) | €34.86 | €68.58 | 49.2% |

| Comet Holding (SWX:COTN) | CHF235.50 | CHF461.22 | 48.9% |

| TF Bank (OM:TFBANK) | SEK369.00 | SEK719.63 | 48.7% |

| Storytel (OM:STORY B) | SEK89.70 | SEK177.35 | 49.4% |

| Star7 (BIT:STAR7) | €6.25 | €12.33 | 49.3% |

| W5 Solutions (OM:W5) | SEK73.40 | SEK143.13 | 48.7% |

Let's explore several standout options from the results in the screener.

Bouvet (OB:BOUV)

Overview: Bouvet ASA is an IT and digital communication consultancy firm serving public and private sectors in Norway, Sweden, and internationally, with a market cap of NOK7.57 billion.

Operations: The company's revenue is primarily derived from IT consultancy services, amounting to NOK3.92 billion.

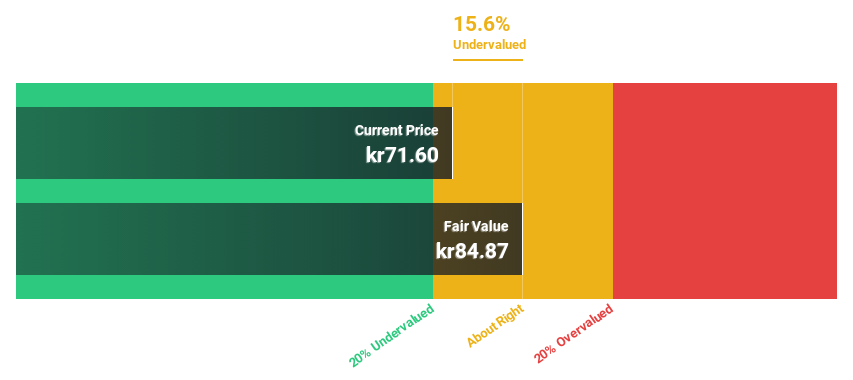

Estimated Discount To Fair Value: 13.7%

Bouvet ASA is trading at NOK 73.2, below its estimated fair value of NOK 84.87, indicating potential undervaluation based on cash flows. The company's earnings and revenue are forecast to grow faster than the Norwegian market, with earnings expected to increase by 8.6% annually. Recent announcements include a share repurchase program worth NOK 90 million and a proposed dividend of NOK 3 per share for the financial year 2024, reflecting strong cash flow management despite moderate growth expectations.

- In light of our recent growth report, it seems possible that Bouvet's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Bouvet.

Dätwyler Holding (SWX:DAE)

Overview: Dätwyler Holding AG produces and sells elastomer components for various industries including healthcare, mobility, connectors, general, and food and beverage sectors across Europe, North America, South America, Australia, and Asia with a market cap of CHF2.17 billion.

Operations: The company's revenue is derived from two primary segments: Healthcare Solutions, contributing CHF446 million, and Industrial Solutions, generating CHF664.80 million.

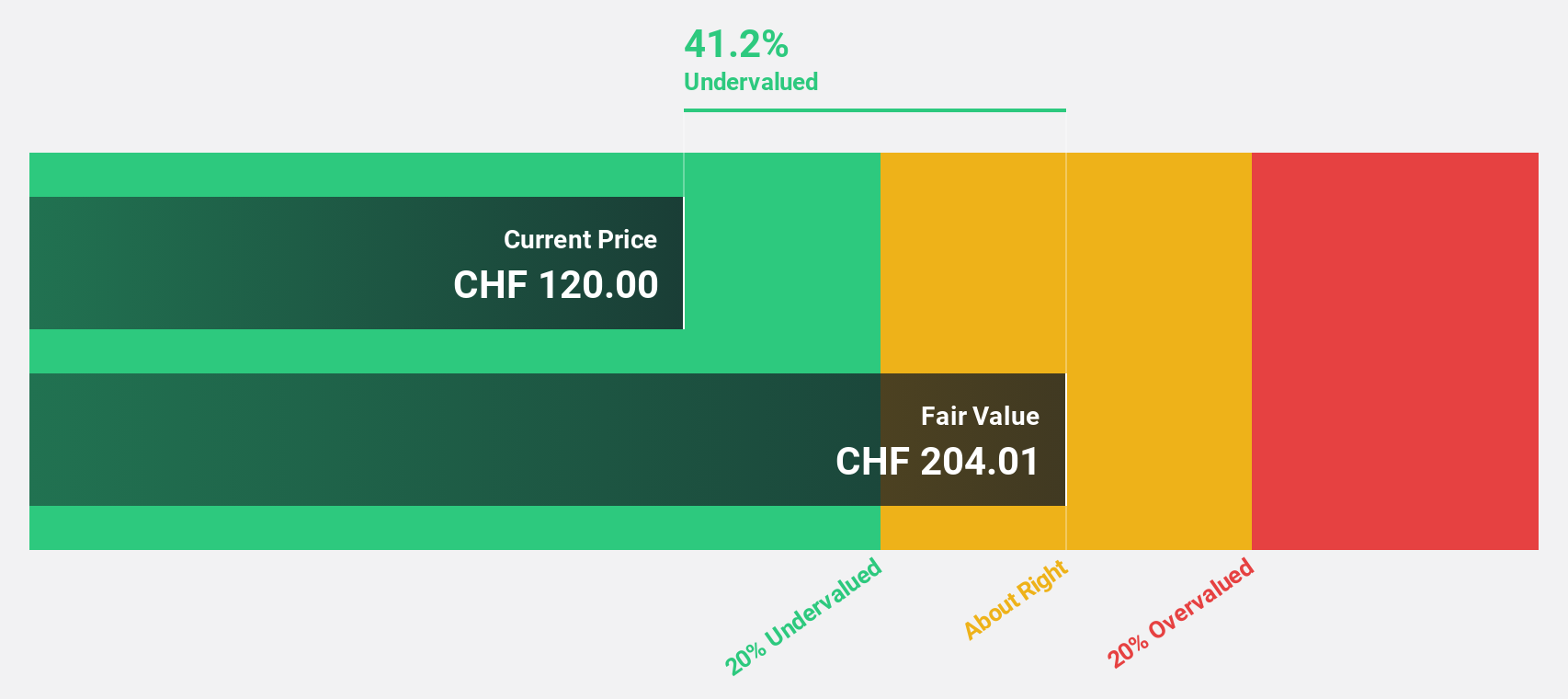

Estimated Discount To Fair Value: 39.5%

Dätwyler Holding is trading at CHF 127.6, significantly below its estimated fair value of CHF 211.06, highlighting potential undervaluation based on cash flows. Although the company faces challenges with a high level of debt and declining profit margins, earnings are expected to grow significantly by 35% annually over the next three years, outpacing the Swiss market's growth rate. Recent earnings showed a decline in net income to CHF 31.1 million from CHF 66.8 million last year.

- The growth report we've compiled suggests that Dätwyler Holding's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Dätwyler Holding.

Verbio (XTRA:VBK)

Overview: Verbio SE is involved in the production and distribution of fuels and finished products across Germany, Europe, North America, and internationally, with a market cap of €618.40 million.

Operations: The company's revenue segments include Biodiesel at €856.58 million and Bioethanol (including Biomethane) at €636.48 million.

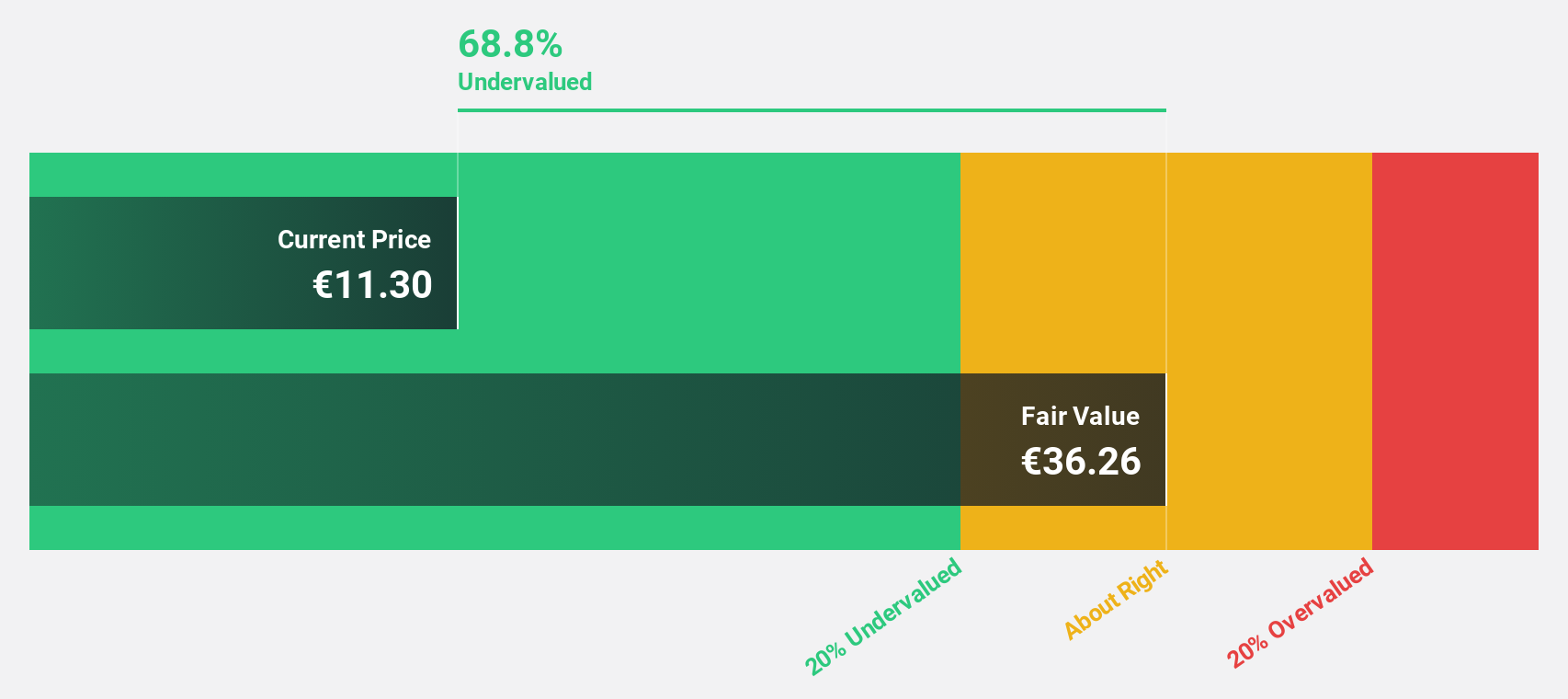

Estimated Discount To Fair Value: 34.3%

Verbio SE is trading at €9.71, well below its estimated fair value of €14.77, suggesting significant undervaluation based on cash flows. Despite recent earnings showing a net loss of €26.49 million for the first half of 2025, Verbio's revenue is forecast to grow faster than the German market at 7% annually. The company’s production figures have increased across biodiesel, bioethanol, and biomethane compared to last year, indicating operational resilience amidst financial challenges.

- Our earnings growth report unveils the potential for significant increases in Verbio's future results.

- Dive into the specifics of Verbio here with our thorough financial health report.

Turning Ideas Into Actions

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 201 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bouvet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BOUV

Bouvet

Provides IT and digital communication consultancy services for public and private sector companies in Norway, Sweden, and internationally.

Flawless balance sheet with solid track record and pays a dividend.