- Switzerland

- /

- Machinery

- /

- SWX:BUCN

How Should Investors Feel About Bucher Industries AG's (VTX:BUCN) CEO Pay?

In 2016 Jacques Sanche was appointed CEO of Bucher Industries AG (VTX:BUCN). First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for Bucher Industries

How Does Jacques Sanche's Compensation Compare With Similar Sized Companies?

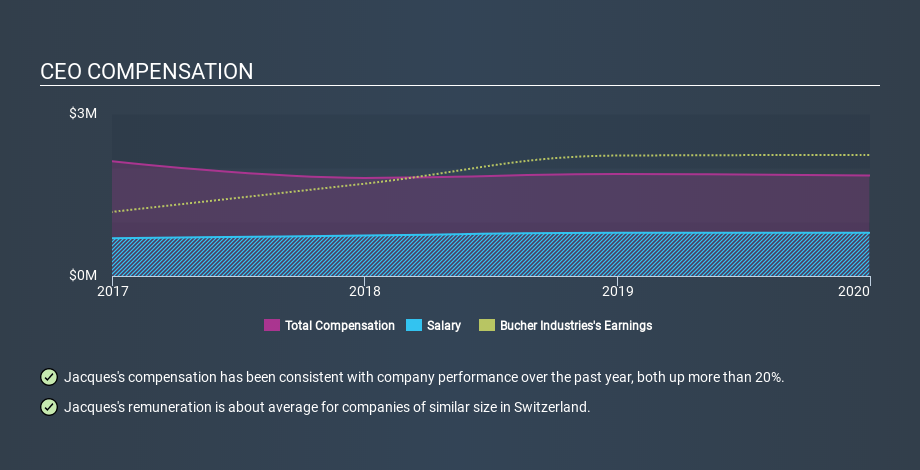

According to our data, Bucher Industries AG has a market capitalization of CHF2.8b, and paid its CEO total annual compensation worth CHF1.9m over the year to December 2019. That's below the compensation, last year. While we always look at total compensation first, we note that the salary component is less, at CHF800k. We looked at a group of companies with market capitalizations from CHF1.9b to CHF6.1b, and the median CEO total compensation was CHF1.8m.

That means Jacques Sanche receives fairly typical remuneration for the CEO of a company that size. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance.

You can see a visual representation of the CEO compensation at Bucher Industries, below.

Is Bucher Industries AG Growing?

Over the last three years Bucher Industries AG has grown its earnings per share (EPS) by an average of 21% per year (using a line of best fit). In the last year, its revenue is up 1.4%.

This demonstrates that the company has been improving recently. A good result. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Shareholders might be interested in this free visualization of analyst forecasts.

Has Bucher Industries AG Been A Good Investment?

Bucher Industries AG has not done too badly by shareholders, with a total return of 3.7%, over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Jacques Sanche is paid around the same as most CEOs of similar size companies.

We would wish for better returns (whether dividends or capital gains) but we do admire the solid EPS growth on show here. So upon reflection one could argue that the CEO pay is quite reasonable. Taking a breather from CEO compensation, we've spotted 3 warning signs for Bucher Industries (of which 1 is concerning!) you should know about in order to have a holistic understanding of the stock.

If you want to buy a stock that is better than Bucher Industries, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SWX:BUCN

Bucher Industries

Engages in the manufacture and sale of machinery, systems, and hydraulic components for harvesting, producing and packaging food products, and keeping roads and public spaces clean and safe in Asia, the United States, Europe, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026