- Switzerland

- /

- Machinery

- /

- SWX:BUCN

Bucher Industries (VTX:BUCN) Will Pay A Larger Dividend Than Last Year At CHF13.50

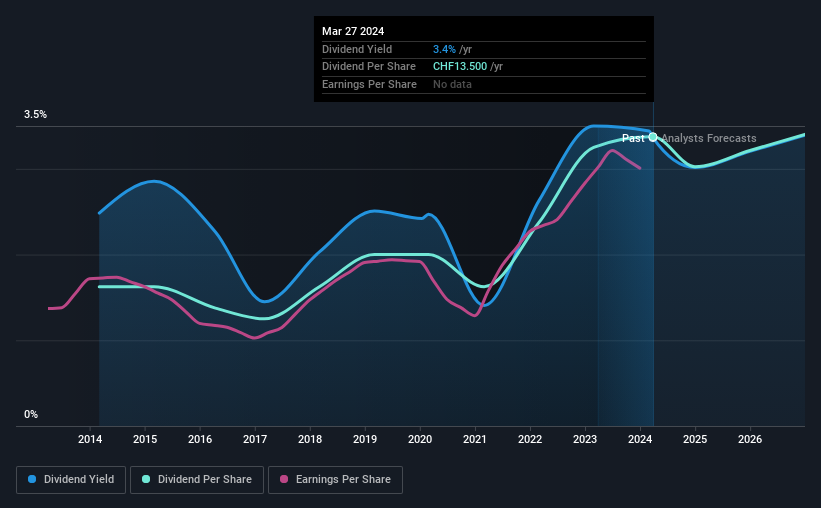

The board of Bucher Industries AG (VTX:BUCN) has announced that it will be paying its dividend of CHF13.50 on the 24th of April, an increased payment from last year's comparable dividend. This takes the dividend yield to 3.4%, which shareholders will be pleased with.

See our latest analysis for Bucher Industries

Bucher Industries' Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, Bucher Industries was paying a whopping 127% as a dividend, but this only made up 39% of its overall earnings. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

Looking forward, earnings per share is forecast to fall by 18.9% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 52%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Bucher Industries Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2014, the dividend has gone from CHF6.50 total annually to CHF13.50. This works out to be a compound annual growth rate (CAGR) of approximately 7.6% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

The Dividend Has Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Bucher Industries has seen EPS rising for the last five years, at 9.5% per annum. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Bucher Industries will make a great income stock. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Bucher Industries (of which 1 doesn't sit too well with us!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Bucher Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:BUCN

Bucher Industries

Engages in the manufacture and sale of machinery, systems, and hydraulic components for harvesting, producing and packaging food products, and keeping roads and public spaces clean and safe in Asia, the United States, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives