- Switzerland

- /

- Insurance

- /

- SWX:VAHN

Uncovering Swiss Treasures Burkhalter Holding And 2 Other Hidden Small Caps

Reviewed by Simply Wall St

The Swiss market recently demonstrated resilience by recovering from early losses to close slightly higher, with the benchmark SMI posting a modest gain. In this fluctuating environment, identifying small-cap stocks that show potential for growth can be particularly rewarding, as these companies often possess unique characteristics and opportunities that larger firms may not offer.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

We'll examine a selection from our screener results.

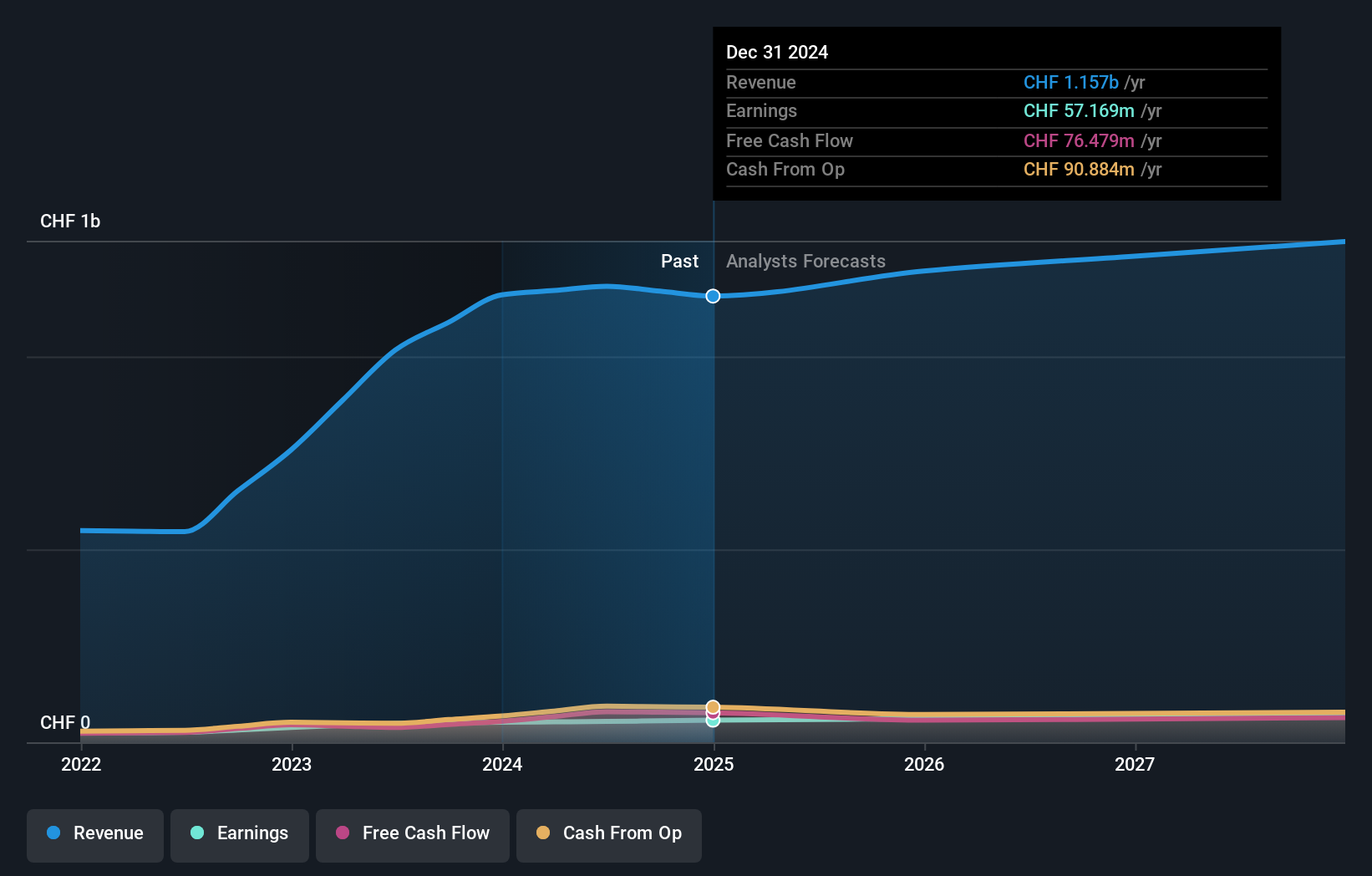

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Burkhalter Holding AG operates through its subsidiaries to offer electrical engineering services to the construction sector in Switzerland, with a market capitalization of CHF957.46 million.

Operations: Burkhalter Holding generates revenue primarily from electrical engineering services, amounting to CHF1.18 billion.

Burkhalter Holding, a Swiss player in the construction sector, reported impressive earnings growth of 10.3% over the past year, outpacing the industry average of 8.7%. Despite trading at 6.2% below its estimated fair value, Burkhalter's debt to equity ratio has surged from 17.4% to 89.5% over five years, indicating a high debt level with a net debt to equity ratio at 52.9%. Recent half-year results showed revenue climbing to CHF570 million and net income reaching CHF23 million, reflecting solid performance despite being dropped from the S&P Global BMI Index recently.

- Delve into the full analysis health report here for a deeper understanding of Burkhalter Holding.

Evaluate Burkhalter Holding's historical performance by accessing our past performance report.

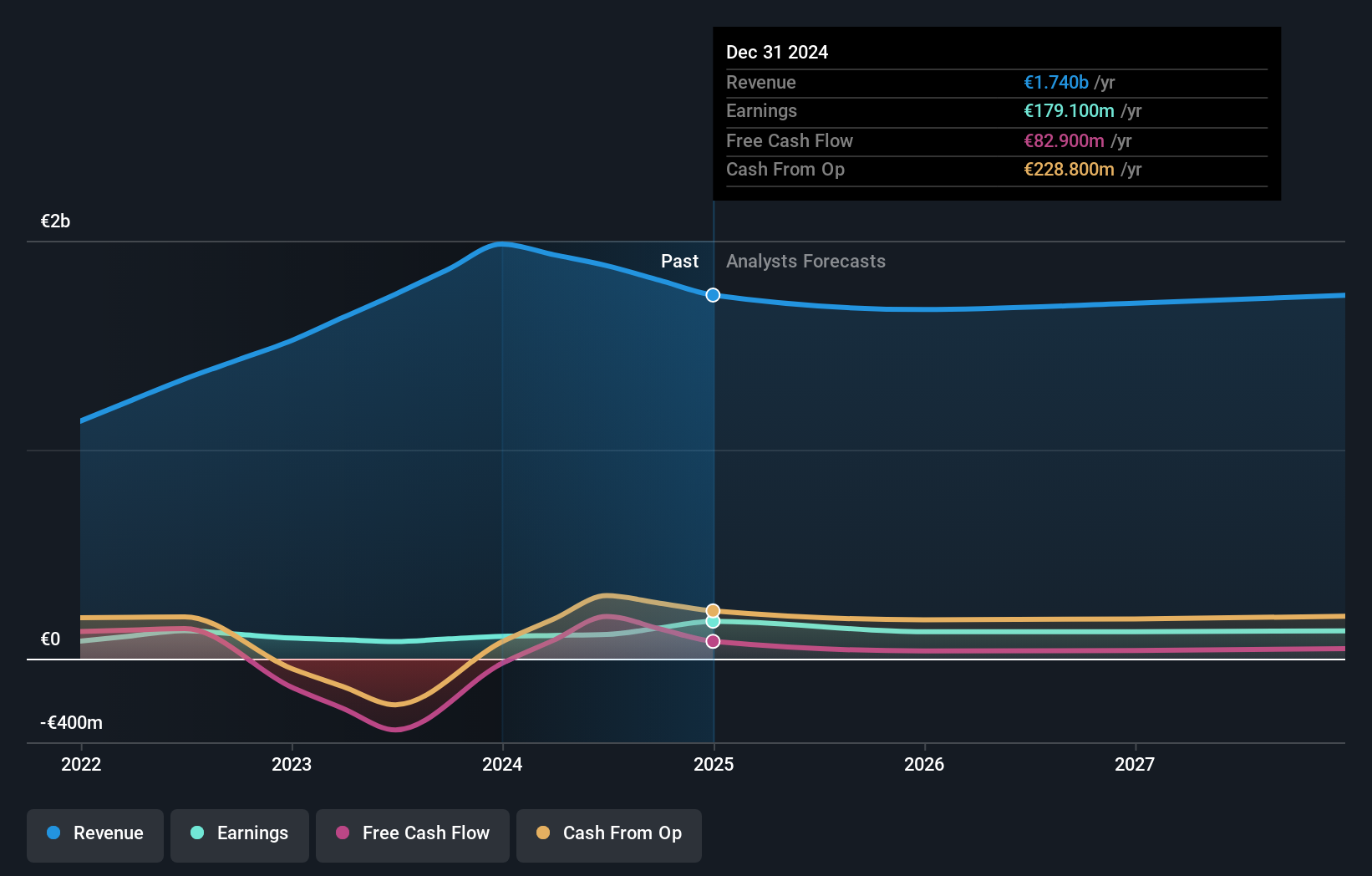

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.28 billion, operates through its subsidiaries to produce, distribute, and sell electricity under the naturenergie brand in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€1.15 billion) and Renewable Generation Infrastructure (€1.09 billion). The company also earns from System Relevant Infrastructure, contributing €403.50 million to its revenue streams.

With a price-to-earnings ratio of 11.7x, naturenergie holding stands out in the Swiss market where the average is 21.2x, indicating potential undervaluation. The company boasts high-quality earnings and has been debt-free for over five years, which likely contributes to its strong financial health. Recent half-year results show net income rising to €77.2 million from €68.5 million last year, despite sales dipping to €868.6 million from €972.5 million, suggesting efficiency improvements or cost management as key factors in profitability growth amidst revenue challenges.

- Unlock comprehensive insights into our analysis of naturenergie holding stock in this health report.

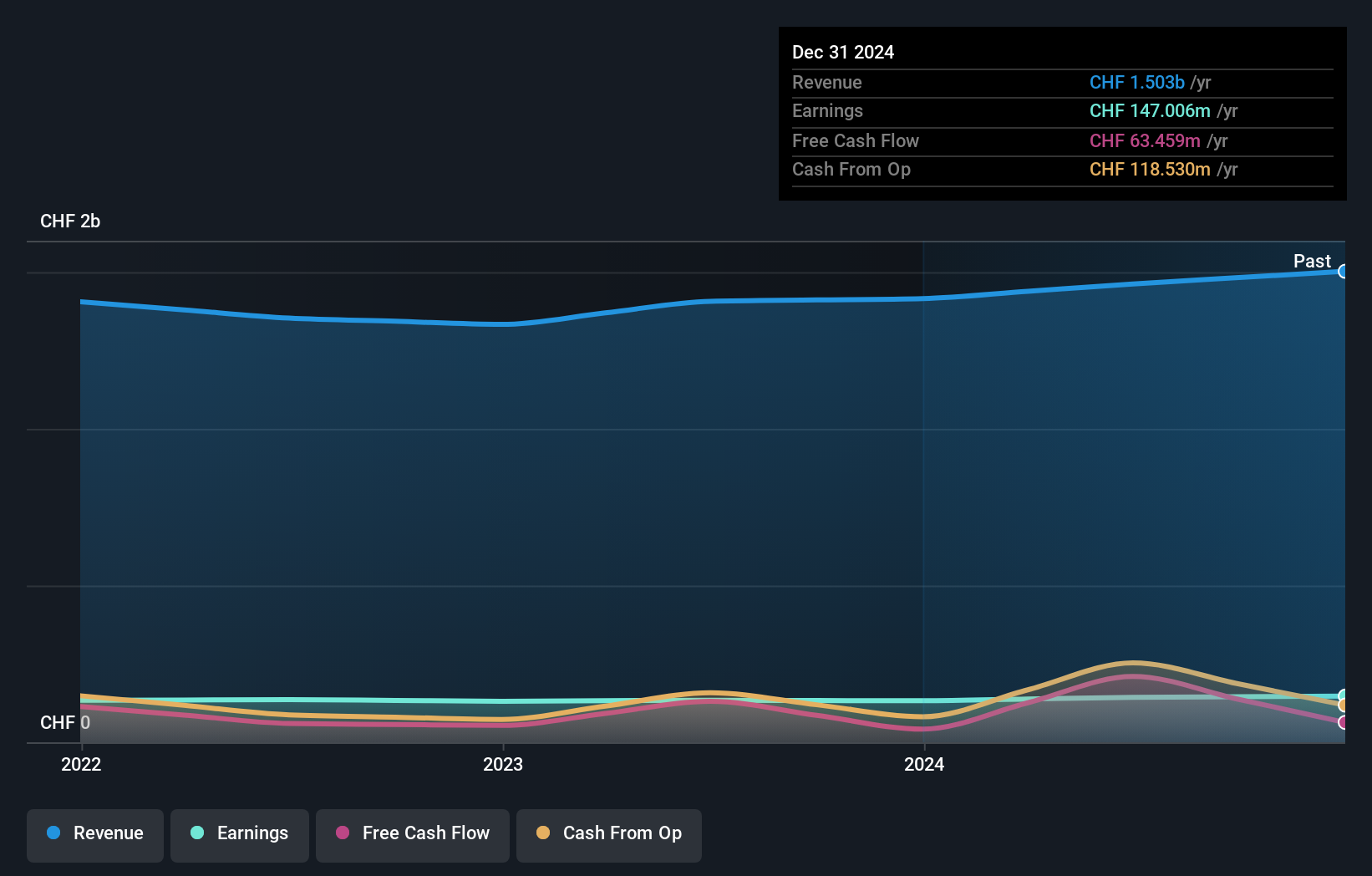

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland, with a market cap of CHF1.34 billion.

Operations: The company generates revenue primarily through insurance products and services in Switzerland. It has a market capitalization of CHF1.34 billion.

Vaudoise Assurances Holding, a notable player in the Swiss market, is trading at 65.1% below its estimated fair value, indicating potential undervaluation. The company reported earnings growth of 7.1% over the past year, surpassing the insurance industry's average of 6.7%. With no debt on its books for five years and high-quality earnings, Vaudoise demonstrates financial stability. Recent half-year net income reached CHF 81 million, up from CHF 70 million last year.

Taking Advantage

- Dive into all 18 of the SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VAHN

Vaudoise Assurances Holding

Provides insurance products and services primarily in Switzerland.

6 star dividend payer with solid track record.