- Switzerland

- /

- Machinery

- /

- SWX:BCHN

With Burckhardt Compression Holding AG (VTX:BCHN) It Looks Like You'll Get What You Pay For

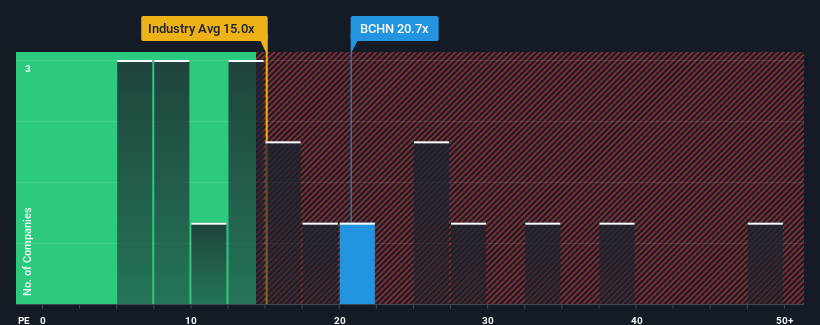

With a price-to-earnings (or "P/E") ratio of 20.7x Burckhardt Compression Holding AG (VTX:BCHN) may be sending bearish signals at the moment, given that almost half of all companies in Switzerland have P/E ratios under 18x and even P/E's lower than 12x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Burckhardt Compression Holding certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Burckhardt Compression Holding

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Burckhardt Compression Holding's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 37% last year. The latest three year period has also seen an excellent 89% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the four analysts watching the company. With the market only predicted to deliver 8.4% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Burckhardt Compression Holding's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Burckhardt Compression Holding's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Burckhardt Compression Holding maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Burckhardt Compression Holding that you need to be mindful of.

If you're unsure about the strength of Burckhardt Compression Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Burckhardt Compression Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:BCHN

Burckhardt Compression Holding

Manufactures and sells reciprocating compressor technologies worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)